Crude Oil eases slightly ahead of OPEC monthly report

- Crude Oil resides near the low for this year after being unable to significantly bounce higher on Monday.

- Markets gear up for the monthly OPEC report, with expectations that it will disappoint markets.

- The US Dollar Index trades above 101.50, easing a touch after Monday’s rally.

Crude Oil steadies near $68.00 on Tuesday ahead of the publication of the monthly OPEC report, a key market-moving event for Oil prices. Taking into consideration the recent comments from commodity leading experts and analysts, the report should bear either a very bullish outlook or set forth some additional interventions by the OPEC cartel to prevent any further downturn in prices. The risk is that the report does not hold any measures or comments on the matter, triggering another leg down for Oil prices.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against a basket of currencies, is easing a touch on Tuesday ahead of a very light US calendar. The main event will be after US markets have closed, with the first and possibly only debate between former US President Donald Trump and Vice President Kamala Harris in their race to the White House.

At the time of writing, Crude Oil (WTI) trades at $67.94 and Brent Crude at $71.46.

Oil news and market movers: China imports could drop further

The OPEC monthly Market Report is expected to be published at 12:00 GMT.

- Bloomberg reports that Tropical Storm Francine, which is moving towards the Gulf of Mexico, is gaining strength. Oil drillers in the area are evacuating crews and halting offshore crude production.

- Hungarian energy company Mol Group will take over the Russian oil flow at the Belarusian-Ukrainian border in order to guarantee maintenance and safe flow into Hungary, running over Ukrainian land. The company was forced to do so after Ukraine sanctioned Russian company Lukoil, which was initially responsible for the maintenance and securing the transition on Ukrainian soil, Reuters reports.

- Bloomberg reports that Liao Na, the chief consultant of energy and chemicals at Mysteel OilChem, said that China’s crude imports could drop another 1.2% year over year.

- The American Petroleum Institute (API) is due to release its weekly numbers on the US Crude stockpile changes. In the previous week, there was a drawdown of over 7.8 million barrels. No forecast is available for this week’s number, which is expected at 20:30 GMT.

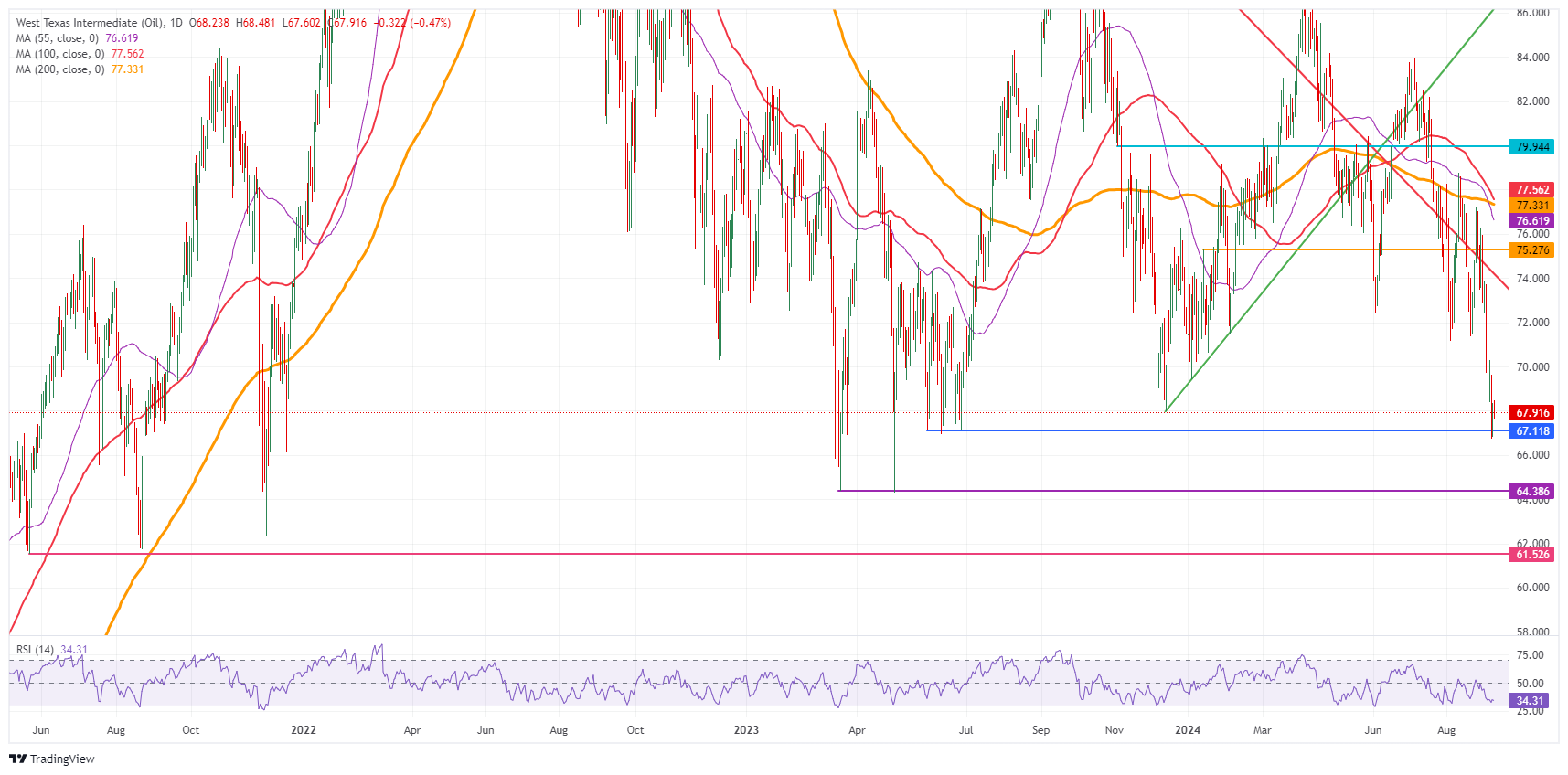

Oil Technical Analysis: Just be done with it

Crude Oil could get a final blow which might see prices drop further towards $65.00 or even $60.00, depending on how markets interpret the upcoming monthly OPEC report. OPEC is the only market player that could impact prices very quickly. The unofficial central bank of Oil could easily bring prices back up to $70.00 if it commits to more production cuts, although the ununified group appears not able to act decisively to support Oil prices.

On the upside, the $75.27 will be the first level to head back to. Next, the $77.43 level aligns with both a descending trendline and the 200-day Simple Moving Average (SMA). In case bulls can break above it, the 100-day SMA at $77.71 could trigger a rejection.

On Friday, the $67.11 key level broke very briefly. For now, the current range between $67.11 and the $68.00 big figure is to be watched. Next level further down the line is $64.38, the low from March and May 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.