Gold skyrockets as Fed cuts 25 bps, eyes further easing

- The Federal Reserve cut rates 0.25% as expected.

- The FOMC projects additional 50 bps of easing towards the year end.

- Fed Governor Stephen Miran voted for 50 bps cut as expected.

Gold price trades volatile at around $3,650 - $3,700 after the Federal Open Market Committee (FOMC) decided to cut rates by 25 basis points, signaling that further easing is coming towards the years end.

Statement by the Federal Reserve

In its statement, the Fed revealed that downside risks to employment have risen and that although the unemployment rate is lower, it has edged up. The decision was not unanimous as Fed Governor Stephen Miran opted for a 50-bps cut as expected by analysts.

Regarding inflation, the central bank said that it has moved up, remaining “somewhat elevated.” The Fed noted that economic growth has moderated over the first half of 2025.

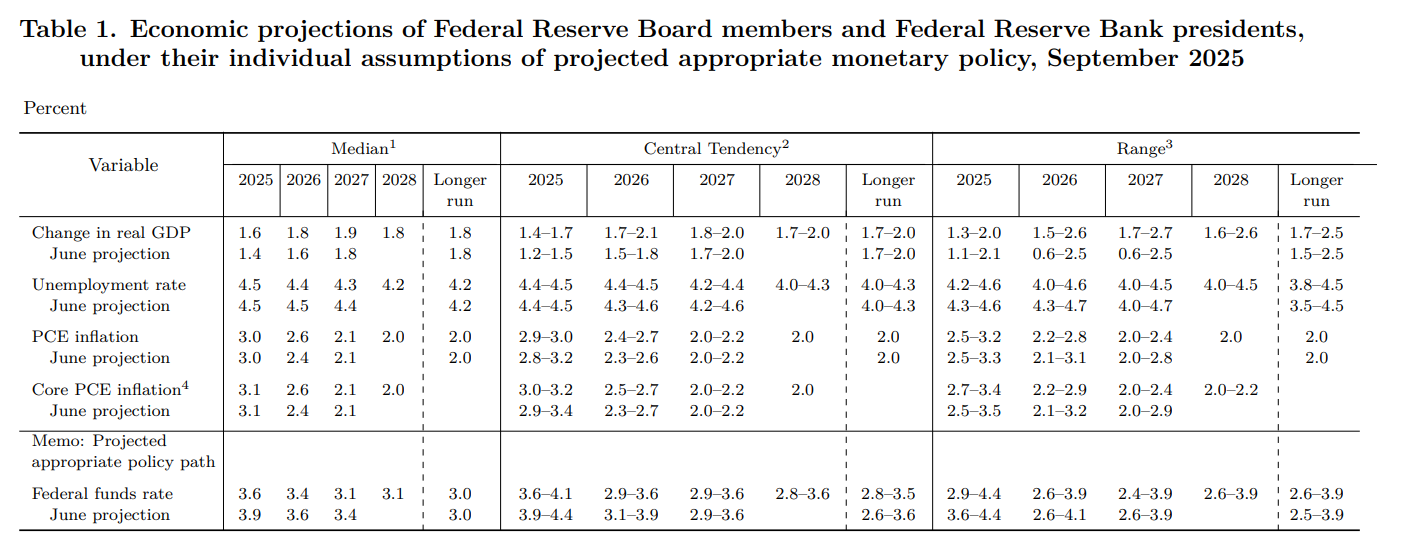

Meanwhile, the Summary of Economic Projections (SEP) revealed that 50 bps of cuts are expected towards the years end.

Gold’s reaction

XAU/USD fell to daily lows of $3,650 before reversing its course and now is eyeing a test of $3,700. A dovish tilt by Fed Chair Powell, could send Gold prices higher.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.