EUR/USD jumps on cautiously dovish Fed

- EUR/USD lurched into intraday highs near 1.1670 after the Fed delivered a widely anticipated interest rate cut.

- Dovish sentiment remains a sticking point, but markets are hopeful for further rate cuts in 2026.

EUR/USD caught a volatile bullish swing on Wednesday after the Federal Reserve (Fed) delivered a third straight interest rate cut. The Fiber pair is testing its highest intraday bids in nearly a week as markets tilt toward more interest rate cuts to come further down the road, as well as signs that the Fed is gearing up to open the spigots on Quantitative Easing (QE) programs.

The Federal Open Market Committee (FOMC) voted nine-to-three to deliver another quarter-point interest rate cut, with one policymaker preferring a 50 basis-point trim and two voters opting for no cuts at all.

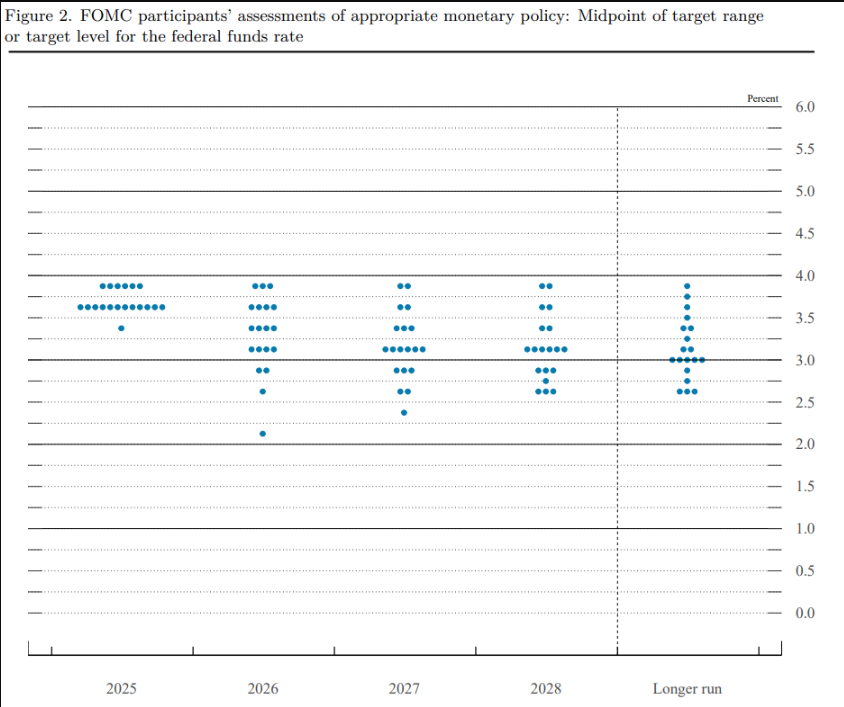

The range of FOMC policy outlooks has widened heading into the end of the year, but markets are latching onto a notable hawkish tilt in the Fed's 2026 economic outlook in the latest update to the Summary of Economic Projections (SEP). The dot plot of FOMC interest rate expectations also widened, but investors are focused on a growing number of Fed policymakers who see room for two or more interst rate cuts next year.

More to come....

EUR/USD 5-minute chart

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed Dec 10, 2025 19:00

Frequency: Irregular

Actual: 3.75%

Consensus: 3.75%

Previous: 4%

Source: Federal Reserve

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.