Canada CPI set to remain below target in May despite inflation uncertainty from US tariffs

- Canadian inflation is expected to consolidate in May.

- The headline Consumer Price Index is seen rising 1.7% from a year earlier.

- In the last few days, the selling pressure on the Canadian Dollar has intensified.

This Tuesday, Statistics Canada will release the Consumer Price Index (CPI) for May. This will get the market's attention because it will provide new information about inflation trends that the Bank of Canada (BoC) uses to make decisions about interest rates. Economists think that headline inflation will match April’s annual increase of 1.7%. But on a monthly basis, inflation may have gone up by 0.5%, which is much more than the 0.1% drop in April.

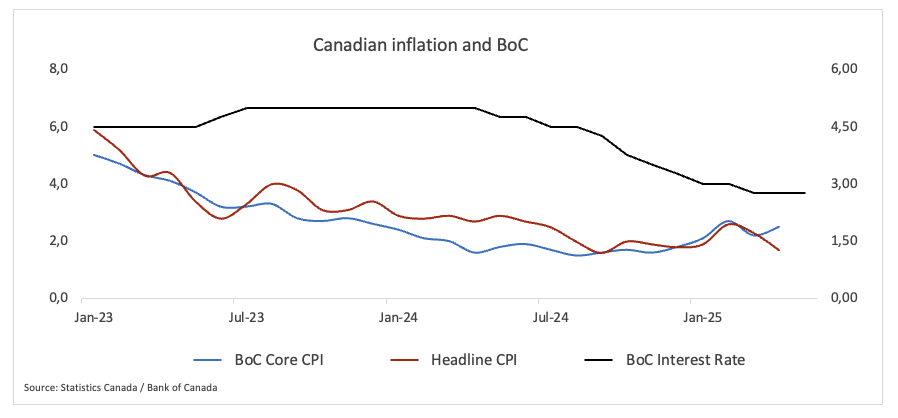

The Bank of Canada will also release its core inflation measures, which leave out unstable price swings to show the underlying momentum. These main indicators went up 2.6% from the same month last year in April.

Analysts remain on high alert regarding the potential pass-through of domestic inflation from the impact of US tariffs, even though there are signs that price pressure is easing. Because the inflation outlook is now less certain, both investors and policymakers are expected to be careful in the coming weeks.

What can we expect from Canada’s inflation rate?

The Bank of Canada maintained its benchmark rate at 2.75% earlier this month, a decision that was largely expected. The central bank has chosen to evaluate the complete effects of US tariffs before considering additional stimulus measures. Since June 2024, the central bank has reduced borrowing costs by 225 basis points. However, Governor Tiff Macklem has indicated that further cuts may be necessary if trade-related challenges intensify.

Market participants now assign a roughly 45% probability to a July rate cut, with overnight index swaps implying about 36 basis points of easing by year-end.

At his post-meeting press conference, Governor Macklem acknowledged the challenge of isolating tariff effects in headline CPI figures, noting the bank’s growing reliance on business surveys and soft data, which already point to rising input costs.

When is the Canada CPI data due, and how could it affect USD/CAD?

Canada’s April inflation data is due out on Tuesday at 12:30 GMT, and markets are bracing for a potential pickup of inflationary pressure.

If inflation exceeds expectations, it could confirm the belief that tariff-induced price pressure is beginning to manifest, leading the Bank of Canada to adopt a more cautious approach, potentially strengthening the Canadian Dollar (CAD), and possibly bolstering expectations for additional rate cuts, thereby exerting some pressure on the Loonie.

That said, an unexpected jump in inflation isn’t necessarily positive news either. A sharp increase in inflation could potentially raise concerns about the health of the Canadian economy, and paradoxically, such a surprise could also negatively impact the currency. In short, markets are watching closely — not just for the headline number but for the broader message it sends about where policy and growth are headed.

Senior Analyst Pablo Piovano from FXStreet pointed out that the Canadian Dollar has surrendered part of its recent gains, lifting USD/CAD from levels last seen in early October 2024 near 1.3540 to the boundaries of 1.3800, the figure at the beginning of the week or fresh four-week highs.

“The resurgence of the bearish tone could motivate USD/CAD to revisit its 2025 bottom at 1.3538, marked on June 16,” Piovano said. “That would be followed by the September 2024 trough of 1.3418 and the weekly base of 1.3358 reached on January 31, 2024.”

“A firmer conviction from bulls could push spot to its provisional barrier at the 55-day SMA at 1.3827, prior to the weekly top of 1.3860 set on May 29 and then its May peak at 1.4015 hit on May 12,” he added.

“Looking at the broader picture, further losses in the pair are likely below its key 200-day SMA at 1.4030,” Piovano added.

“Furthermore, USD/CAD is currently showing some marked recovery, as the Relative Strength Index (RSI) approaches the 56 mark, while the Average Directional Index (ADX) is easing toward 26, indicating some loss of impetus in the current trend.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Jun 04, 2025 13:45

Frequency: Irregular

Actual: 2.75%

Consensus: 2.75%

Previous: 2.75%

Source: Bank of Canada

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Jun 24, 2025 12:30

Frequency: Monthly

Consensus: -

Previous: 2.5%

Source: Statistics Canada