Crypto Today: BTC price stalls at $103K with $120B inflows skewed towards ETH, SOL and DOGE

- The cryptocurrency market cap surged above $3.2 billion on Friday, rising 3.7% with an approximate $120 billion increase.

- Despite an additional $117 million in inflows toward Bitcoin ETFs, BTC's rally stalls below $103,000, with gains capped at 3.6%.

- Dogecoin, Ethereum and Solana all posted double-digit gains on the 24-hour price chart.

Cryptocurrency market cap rose by 4% on Friday, with over $120 billion increase in the last 24 hours. Rising institutional demand, expectation of hawkish monetary policy and BTC adoption in regional US states have added to the bullish market momentum in this week.

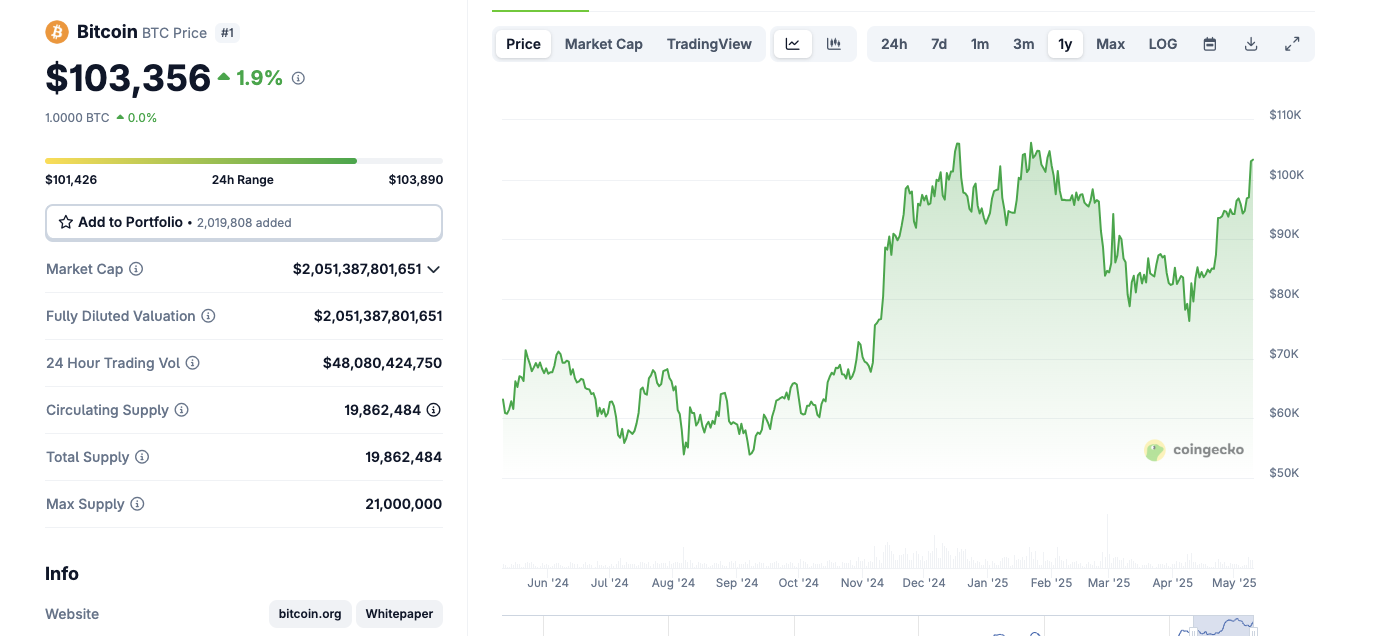

Bitcoin market update

- Bitcoin price rose as high as $104,361 on Friday before facing a major sell-off as investors began to rotate profits towards altcoins.

Bitcoin price action, May 9, 2025 | Coingecko

At press time, BTC price gains remain subdued at 0.04%, while top altcoins like Ethereum and Solana have each secured solid gains on the day.

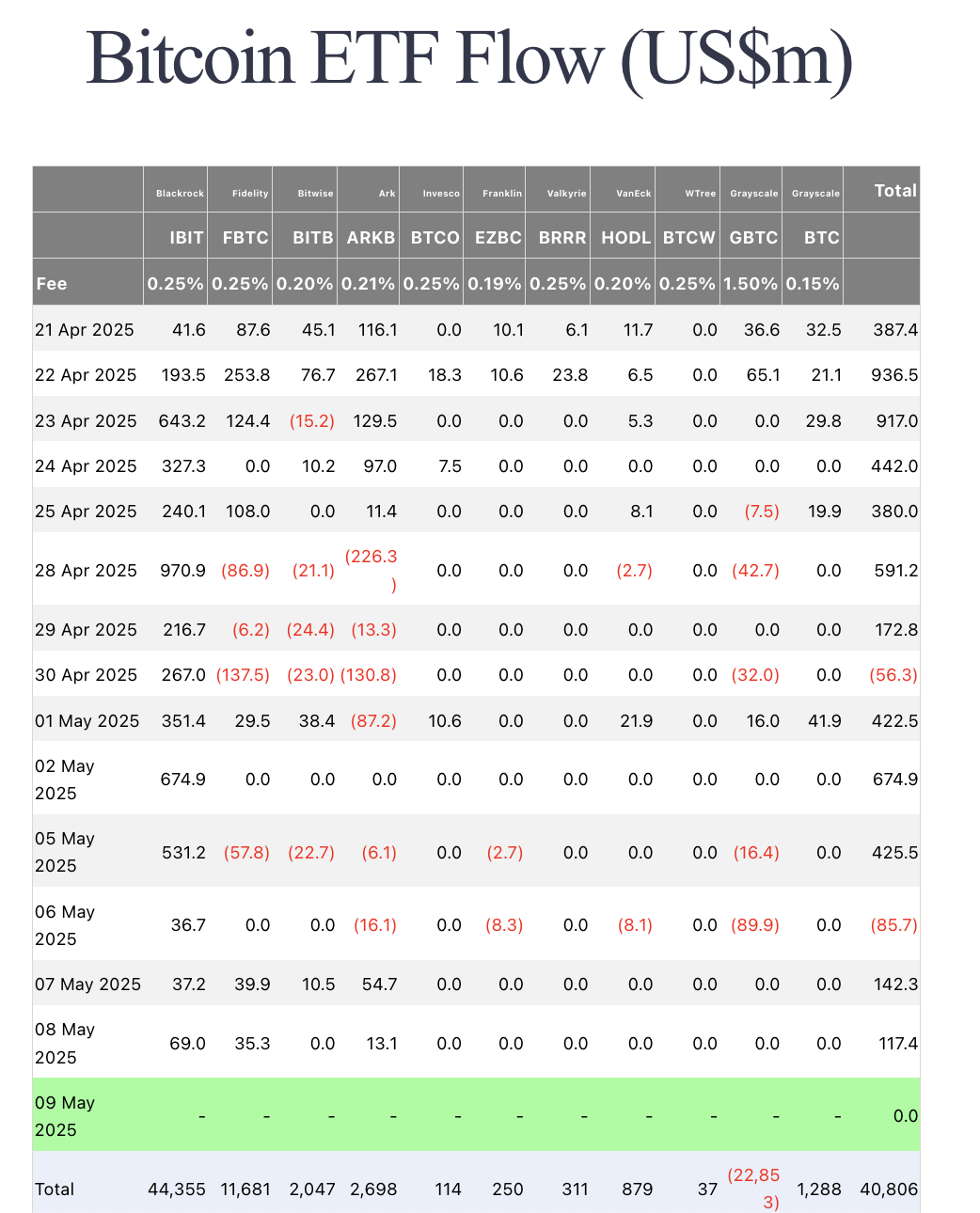

Chart of the Day: BTC stalls at Institutional demand dips

As market sentiment improves, investors appear to be rotating funds out from BTC markets towards altcoins with higher short-term growth potential. The rotation trend also appears among institutional investors. On Thursday, Bitcoin ETFs recorded another $117 million in inflows. Farside data shows that this represents the lowest single-day inflows in the last 14 days of trading.

Bitcoin ETF Flows, May 9, 2025 | Source: Farside

This shows that while corporate investors continue to lean bullish, investors are beginning to allocate lower amounts of funds towards BTC, in a bid to profit from the upside potential of alternative crypto assets.

Altcoin market updates: Dogecoin, Ethereum, and Solana lead Friday rally as BTC gains dip

The global cryptocurrency market cap stands at $3.37 trillion on Friday, marking a 1.4% increase over the past 24 hours. Major altcoins like Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE) stole the spotlight with double-digit weekly surges.

- Ethereum (ETH) hits $2,490, up 6% in 24 Hours

Ethereum led the large-cap altcoin rally with a 6% daily gain and a staggering 25.6% rise over the past week. Backed by strong inflows into Lido Staked Ether (STETH) and increased DeFi activity, ETH is rapidly closing in on a $300 billion market cap. Its liquid staking derivatives STETH and WSTETH , mirrored its performance, both up around 12% in the past 24 hours.

- Solana (SOL) climbs to $176.15, gaining 19.6% this week

Solana continued its strong upward trajectory, adding 4.7% in the past day and 19.6% over the week. With daily on-chain activity surging and memecoins like Fartcoin and Moo Deng driving retail speculation, SOL remains one of the most active Layer-1 ecosystems. Its 24-hour volume of $9.45 billion signals growing market demand.

- Dogecoin (DOGE) rallies to $0.2145, up 7.7% in 24 hours

Dogecoin rejoined the altcoin spotlight with a 7.7% jump on Friday and 19.91% in weekly gains. The meme coin’s resurgence has been tied to renewed speculative interest and broader retail-driven momentum. Its $3.05 billion in daily trading volume signals a sharp uptick in demand, outperforming major altcoins like Cardano and Tron.

With BTC dominance slightly retracing, capital rotation into altcoins appears underway. Ethereum and its staking derivatives (STETH, WSTETH, WEETH) are surging, while riskier assets like DOGE and SHIB also post strong double-digit weekly returns.

Notably, Pepe (PEPE) emerged as the top weekly performer among the top ten-ranked memecoins, soaring 40.4% over the past seven days.

If the current risk-on sentiment continues, the altcoin market could outpace Bitcoin in near-term performance.

Crypto news updates:

Metaplanet raises $21 million through zero-interest bonds to fund Bitcoin purchases

Metaplanet has issued its 14th series of ordinary bonds, securing $21.25 million in funding through a private allocation to EVO FUND. The zero-interest bonds are scheduled for redemption in November 2025, aligning with the company’s previously disclosed plans regarding financial strategy and stock acquisition rights.

According to the official statement, the proceeds will be used to purchase Bitcoin and to secure sufficient capital for bond redemption at maturity. This move reinforces Metaplanet’s ongoing strategy of integrating digital assets into its financial reserves.

German authorities seize $38 million in crypto from eXch exchange ahead of shutdown

German prosecutors have confiscated €34 million ($38.2 million) worth of crypto assets from the anonymous swapping platform eXch, one day before its closure. The seizure, announced by the Frankfurt Prosecutor General's Office, included Bitcoin, Ether, Litecoin, and Dash, along with 8 terabytes of data and the platform’s server infrastructure in Germany.

Authorities allege that eXch operated as a criminal trading platform since 2014, facilitating anonymous transactions without anti-money laundering or KYC measures. Investigators say the platform processed around $1.9 billion in crypto, including funds linked to the North Korean hacker group Lazarus and the $1.4 billion Bybit theft. Prosecutors suspect the operators of commercial money laundering and criminal platform operations.