Crypto Today: BTC price reaches 70-day peak, propelled by Michael Saylor and 21Shares

- Cryptocurrencies’ total market cap rises above the $3.1 trillion market on Friday, its highest since early March.

- Bitcoin price hits a 70-day peak of $97,431 on Friday.

- Michael Saylor-led Strategy announces plans to raise another $21 billion to fund BTC purchases in Q2.

- SUI attracted significant search interest on Coingecko after 21 Shares' ETF filing.

The cryptocurrency aggregate market cap dips by 1.4% in the early hours of Friday despite BTC price rallying above $97,000 for the first time in 70 days. Lagging altcoin performance signals a cooling risk appetite.

With active bullish catalysts from TON’s partnership with Ethena and 21 Shares’ spot SUI ETF launch, it remains to be seen if altcoins will attract more liquidity on Friday.

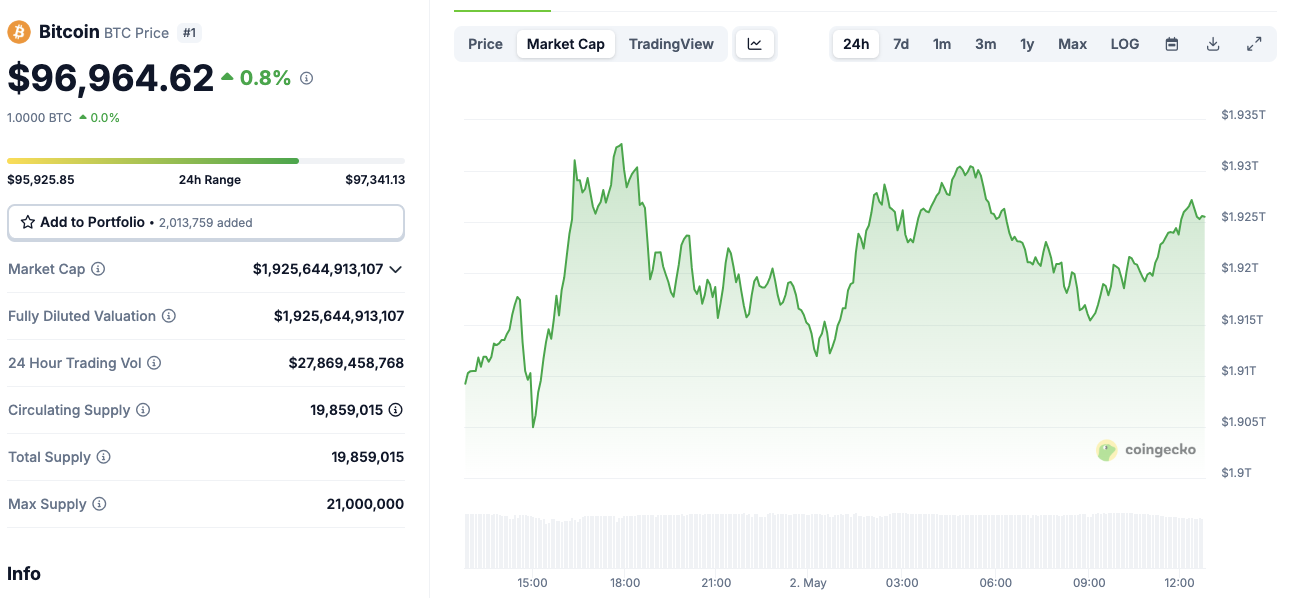

Bitcoin market updates:

Bitcoin price finally breached the 97,000 support on Friday after multiple unsuccessful attempts at flipping the $95,000 resistance earlier in the week.

Bitcoin price action (BTC) | Coingecko

Coingecko data shows BTC price reached a 24-hour peak of $97,431, before retracting to find support above the $96,500 at the time of writing.

Notably, with 24 billion in trading volume over the last day, BTC continues to find buyers at the current multi-month peak.

Further emphasizing this trend, BTC has successfully formed a short-term support cluster well above the previous rejection point at $95,500, holding up firmly within the narrow 2% range between $95,900 and $97,431.

Why is Bitcoin price going up today?

A weak labor market report published this week, unusually high ETF demand, Arizona State passing a bill to establish the first Bitcoin ETF reserve and the Q2 BTC purchase plan unveiled by Micheal Saylor’s Microstrategy are among top four factors propelling BTC price as of Friday.

Chart of the day: Bitcoin ETFs return to buying mode after brief blip.

Bitcoin ETFs returned to buying mode on Thursday, posting a notable $422 million of aggregate inflows.

After an eight-day buying spree that saw the ETFs acquire $4 billion in eight consecutive days of trading, the $54 million outflows on Thursday initially raised concerns of an abrupt sell-off.

Bitcoin ETF Flows | Source: Farside

But on Friday, the buying frenzy continues with Blackrock’s IBIT and Grayscale’s GBTC funds leading the way with another $351 million and $41 million of deposits, respectively.

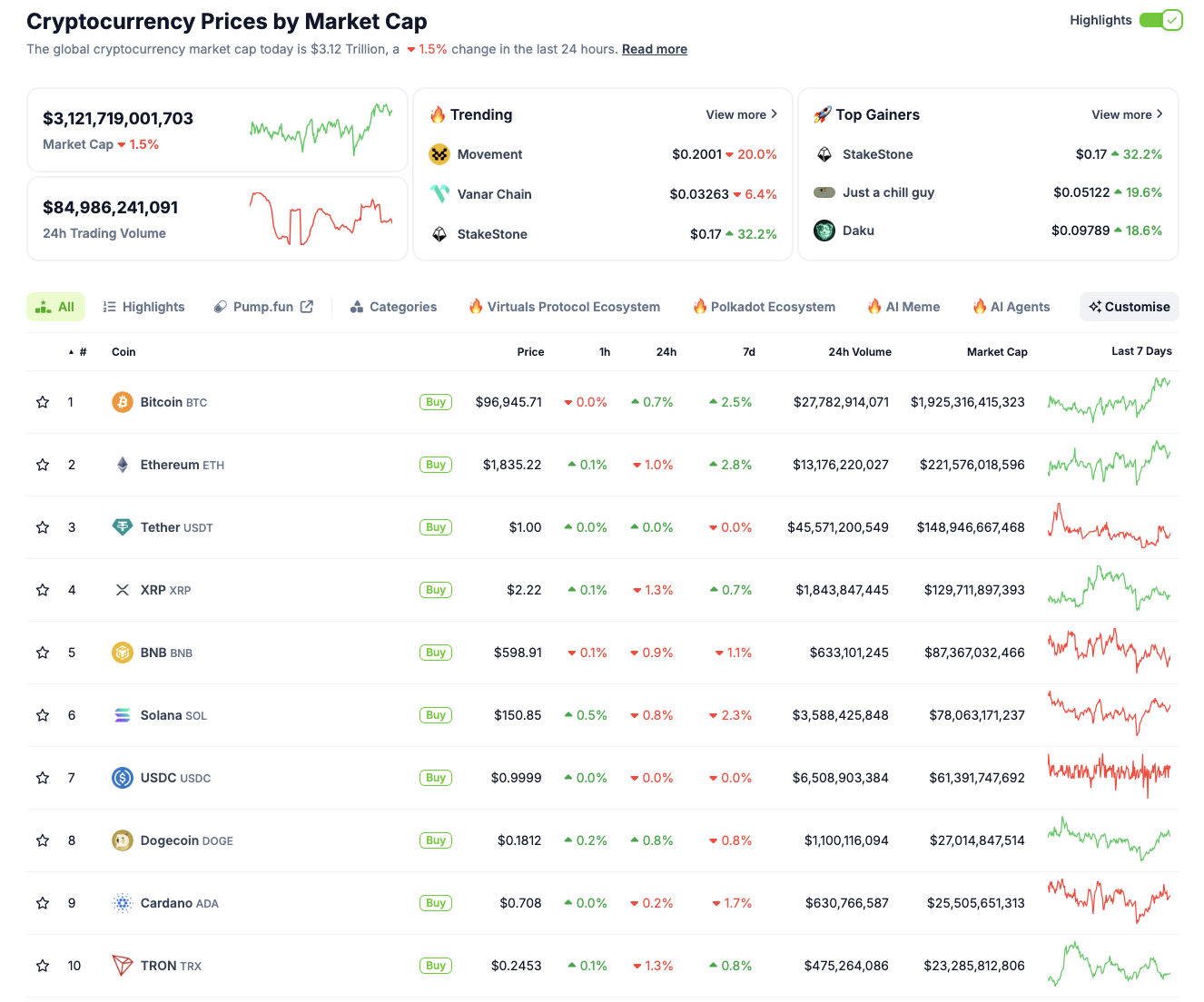

Altcoin market update: StakeStone, SUI and Vanar Chain lead mid-cap momentum

The global crypto market cap stands at $3.12 trillion on Friday, up 1.5% in the past 24 hours, signaling moderate optimism despite ongoing regulatory and delisting pressure across major exchanges.

Trading volume hit $84.98 billion, indicating healthy liquidity conditions amid a volatile week.

Major layer-1s showed modest gains. Solana (SOL) rose 0.7% to $150.85, Ethereum (ETH) rose 0.7% to $1,835.22, and Cardano (ADA) remained flat at $0.708.

Top 10 cryptocurrencies performance, May 2 2025 | Source: Coingecko

While mega-cap assets saw muted gains, investors have been looking toward mid-cap assets.

Leading the altcoin surge is StakeStone (STONE), climbing 31% to $0.173 after a surge in DeFi activity on new LST platforms. Analysts point to increased staking incentives and a rapidly expanding liquidity pool as key drivers. SUI, the native token of the Sui blockchain, gained 6.2% to trade at $3.45, benefiting from bullish tailwinds on 21 Shares’ ETF filing.

Vanar Chain (VANRY) also impressed, rising 36.4% to $0.0326, as the protocol secured a high-profile gaming partnership that fueled renewed community interest.

Despite Coinbase's delisting of MOVE, most mid-cap altcoins maintained resilience, supported by sector-specific narratives in liquid staking, AI agents and gaming infrastructure.

Adam Back-backed TBG outlines plan to acquire 260,000 Bitcoin by 2034

The Blockchain Group (TBG), a Bitcoin treasury firm listed on Euronext Growth Paris under the ticker ALTBG, has announced plans to accumulate between 170,000 and 260,000 BTC by 2034. The target, detailed in the company’s latest fiscal report, represents an ambition to capture up to 1% of Bitcoin’s total supply over the next decade.

TBG transitioned to a Bitcoin Treasury Company model in November 2024 and has since ramped up its BTC holdings from 15 BTC in December to 620 BTC by April 2025.

TBG’s strategic growth is backed by crypto-native investors including Fulgur Ventures, UTXO Management and TOBAM. Adam Back, CEO of Blockstream, serves as a strategic advisor to the firm.

Movement Labs suspends co-founder Rushi Manche amid governance investigation

Movement Labs has suspended its co-founder Rushi Manche amid an ongoing investigation led by Groom Lake into internal governance issues and incidents involving a market maker. The decision comes as the company faces scrutiny over alleged token manipulation and internal disputes that have destabilized its leadership structure.

Simultaneously, Coinbase announced it will delist the MOVE token on May 15, citing failure to meet the exchange’s listing standards following a routine review. The MOVE token has since dropped to an all-time low as investor confidence continues to decline in the wake of governance concerns and market maker-related controversies.

Tether acquires 70% stake in Adecoagro, expands into real-world infrastructure

Tether Investments has acquired a 70% controlling stake in Adecoagro (NYSE: AGRO), a leading South American sustainable production firm. The acquisition marks a significant pivot in Tether’s expansion strategy, moving beyond stablecoins into energy, agriculture, data and communications infrastructure. This follows Tether’s initial $100 million investment in September 2024 for a 9.8% stake in the company.

With majority ownership secured, Tether has restructured Adecoagro’s board of directors, replacing five outgoing members with new appointees aligned with its strategic goals. The board now includes new Executive Chairman Juan Sartori and four additional members as Tether aims to accelerate Adecoagro’s growth in renewable energy.