Crypto Today: SUI rallies 20%, Bitcoin price tops $95K for first time in 60 days after Trump calls Xi Jinping

- Cryptocurrencies’ aggregate market valuation gains $300 billion in 24 hours, breaking past the $3 trillion mark.

- Bitcoin price surges past the $95,000 level for the first time since February 25.

- SUI and Solana’s Pudgy Penguins have emerged as top trending tokens.

Cryptocurrencies added $300 billion to their aggregate market cap oft $3 trillion on Friday. The market rally was largely driven by fresh updates in the US-China tariff trade war.

Following a volatile month that saw US stocks shed more than $10 trillion in value, US President Donald Trump announced a call with Chinese President Xi Jinping to discuss the ongoing tariff war.

Bitcoin market updates:

Bitcoin price broke above $95,000 on Friday, its highest level in 60 days.

Chart of the day: Bitcoin ETFs acquired 6.3% of total holdings this week

Despite cooling trade war rhetoric, Bitcoin ETFs continue to funnel in unusual volumes of inflows.

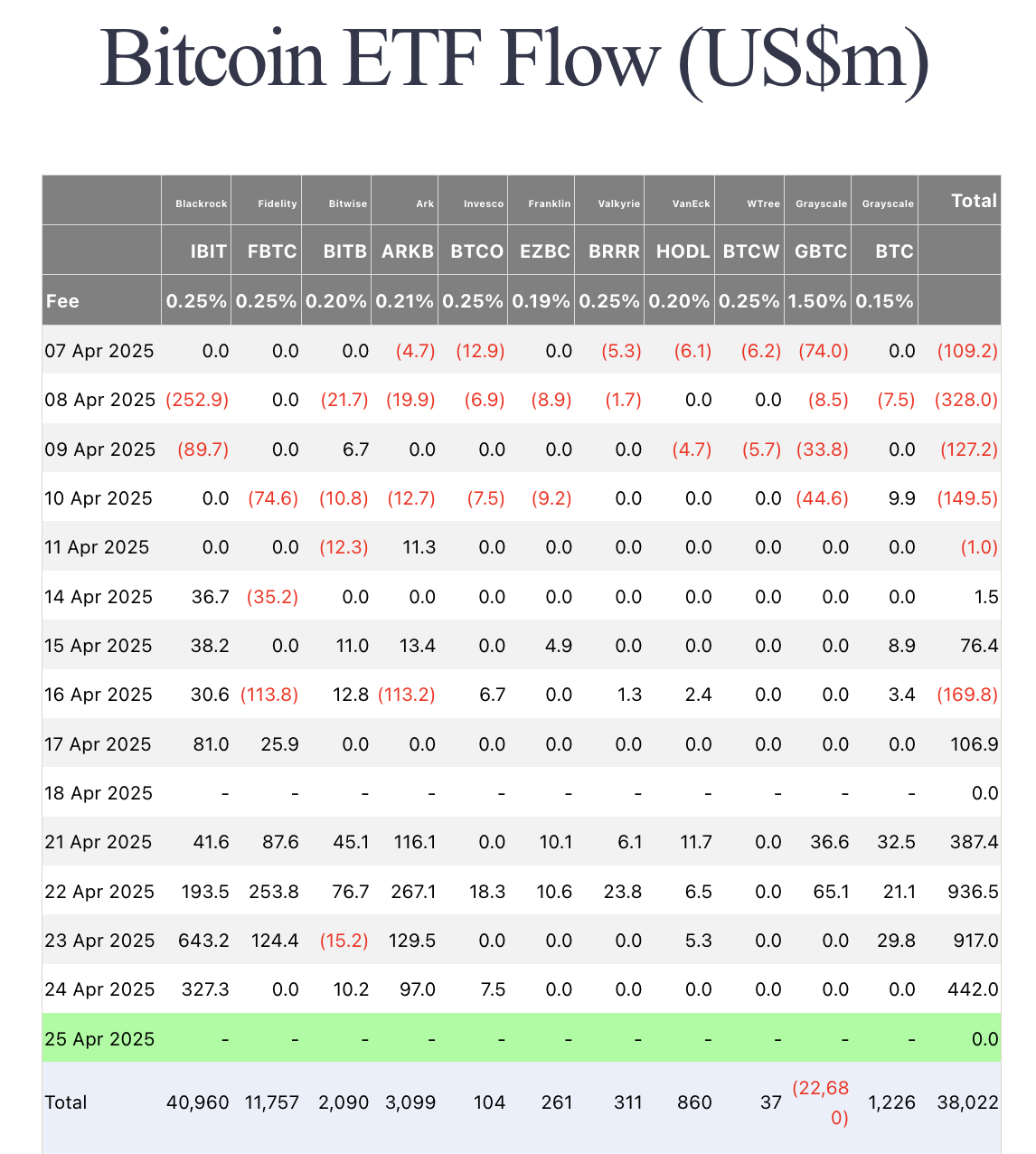

Bitcoin ETF Flows | Source: Farside

The Farside chart above shows that Bitcoin ETFs took in another $447 million of deposits on Thursday.

This comes after setting two new single-day inflow records with $936 million and $917 million on Tuesday and Wednesday, respectively. Total inflows for the week have now crossed $2.4 billion. For context, it implies that the ETFs acquired about 6.3% of their total $38 billion of BTC holdings in the last three days alone.

Altcoin market updates: Sui, Initia, and Pudgy Penguins are in-demand as Ethereum tests $1,800

Altcoins received healthy capital inflows on Friday, with the global market capitalization reaching $3.08 trillion, marking a 0.8% increase over the last 24 hours.

Market trading volume also showed healthy activity at $109.5 billion, reflecting sustained investor interest amid positive momentum across major altcoins.

At press time, Bitcoin (BTC) is trading just shy of the $95,000 mark after a 2.2% rise in the past 24 hours, while Ethereum (ETH) mirrored the uptrend with a 1.3% gain to reach $1,784.

Altcoins broadly participated in the rally with top assets like Solana (SOL) and Dogecoin (DOGE) posting double-digit gains on the weekly timeframe candle.

Crypto market performance | Source: Coingecko

The directional flow of capital reveals increased appetite for mid-cap assets, particularly within DeFi and NFT projects.

This was reflected in Sui (SUI), Initia (INIT), and Pudgy Penguins (PENGU), emerging Coingecko’s most-searched altcoins for the day.

Sui (SUI) emerged the standout performer on the day, as an initial 20% rally saw it reclaim $3.70 before retracting toward $3.50 at press time. According to DeFillma data, the SUI rally is backed by a 15.8% increase in DeFi Total Value Locked.

Notably, Pudgy Penguins (PENGU), a rising NFT brand, also featured among the top trending assets on the day as it rallied 47.5% to $0.0094. The resurgence in Pudgy Penguins’ market value is tied to increasing engagement metrics, new merchandise drops, and rising traction within the global NFT and Web3 communities.

Unlike previous NFT hype cycles that were driven predominantly by speculative flipping, Pudgy Penguins’ momentum appears rooted in growing real-world brand equity, adding a level of sustainability.

Crypto news updates:

PayPal and Coinbase expand partnership to accelerate PYUSD stablecoin adoption

PayPal and Coinbase have announced an expanded partnership aimed at promoting the adoption and utility of the PayPal USD (PYUSD) stablecoin. As part of the collaboration, Coinbase users will be able to access fee-free transactions and 1:1 fiat redemptions of PYUSD, enhancing the stablecoin's liquidity and ease of use. The initiative leverages PayPal’s extensive global network and Coinbase’s crypto infrastructure to broaden the reach of PYUSD across retail, enterprise and institutional markets.

The partnership will also explore the integration of PYUSD in decentralized finance (DeFi) applications and new commercial use cases. Both companies aim to advance stablecoin adoption by streamlining payment flows and expanding PYUSD’s role in digital commerce.

SEC seeks dismissal of Dragonchain lawsuit following Crypto Task Force launch

The US Securities & Exchange Commission (SEC) has filed a joint stipulation with Dragonchain to dismiss its lawsuit over the company’s 2017 initial coin offering. The filing cites the influence of the SEC’s newly formed Crypto Task Force, which is part of a broader shift in regulatory approach under the agency’s current leadership.

The dismissal reflects a change in enforcement strategy, moving away from the stricter actions taken during Gary Gensler’s tenure. The Crypto Task Force is reevaluating how securities laws apply to digital assets, leading to a significant reduction in litigation against crypto companies and prompting a reassessment of regulatory frameworks in the sector.

Paradigm invests $50 million in Nous Research at $1 billion valuation

Paradigm has invested $50 million in decentralized AI startup Nous Research through a Series A funding round, assigning the company a $1 billion token valuation. Nous Research uses the Solana blockchain to train AI models in a distributed system, diverging from the traditional centralized data center approach.

The startup, which had operated quietly for two years, aims to challenge major AI firms by leveraging blockchain for improved coordination and incentive mechanisms in model development.