Litecoin Price Prediction: Three catalysts hold LTC above $80 support despite BTC and ETH losses

- Litecoin price consolidated above $80 on Thursday despite BTC, ETH and XRP losing key support levels.

- Polymarket bettors raised LTC ETF approval odds in 2025 by 9% as the Senate committee approves Trump’s SEC chair nominee.

- LTC miners have acquired $24.6 million worth of LTC since the bearish market trend began in late February.

Litecoin (LTC) exhibited resilient price action, consolidating above $80 on Thursday, even as Bitcoin (BTC), Ethereum (ETH) and XRP failed to hold key support levels. Amid the global market downturn, Litecoin price has found strong backing from miners, regulatory developments, and rising LTC ETF approval odds.

Here are three key catalysts that could limit Litecoin losses as global markets struggle under the bearish overhang from the Trump administration’s sweeping tariffs.

1. US Senate Banking Committee approves Paul Atkins

In a pivotal move for cryptocurrency regulations in the US, the Senate Banking Committee has approved Paul Atkins as President Trump’s Securities and Exchange Commission (SEC) chair nominee.

Notably, Atkins, widely regarded as crypto-friendly, faced initial scrutiny last week over conflict-of-interest concerns.

Paul Atkin’s final appointment green light is now subject to a full Senate vote, with Trump’s Republican party holding a 220-215 majority in Congress.

Meanwhile, the odds of final LTC ETF approval increased from 36% to 40% within hours of the announcement, according to Polymarket.

Litecoin ETF Approval Odds, April 3 2025 | Source:Polymarket

Litecoin ETF Approval Odds, April 3 2025 | Source:Polymarket

The approval of Atkins is significant for the crypto market as it increases the likelihood of a more lenient regulatory environment.

If the Senate had rejected his nomination, a more skeptical and anti-crypto replacement would likely have taken his place.

Given the SEC’s direct role in approving or denying spot crypto ETFs, this decision holds substantial implications for Litecoin and other altcoins.

2. LTC miners accumulate $24.6 million despite bearish trend

Another key market catalyst supporting Litecoin’s resilient price action in positive disposition is shown by LTC miners over the past month.

Since the current bearish mark cycle began in late February, Litecoin miners have been quietly accumulating large amounts of their newly mined LTC.

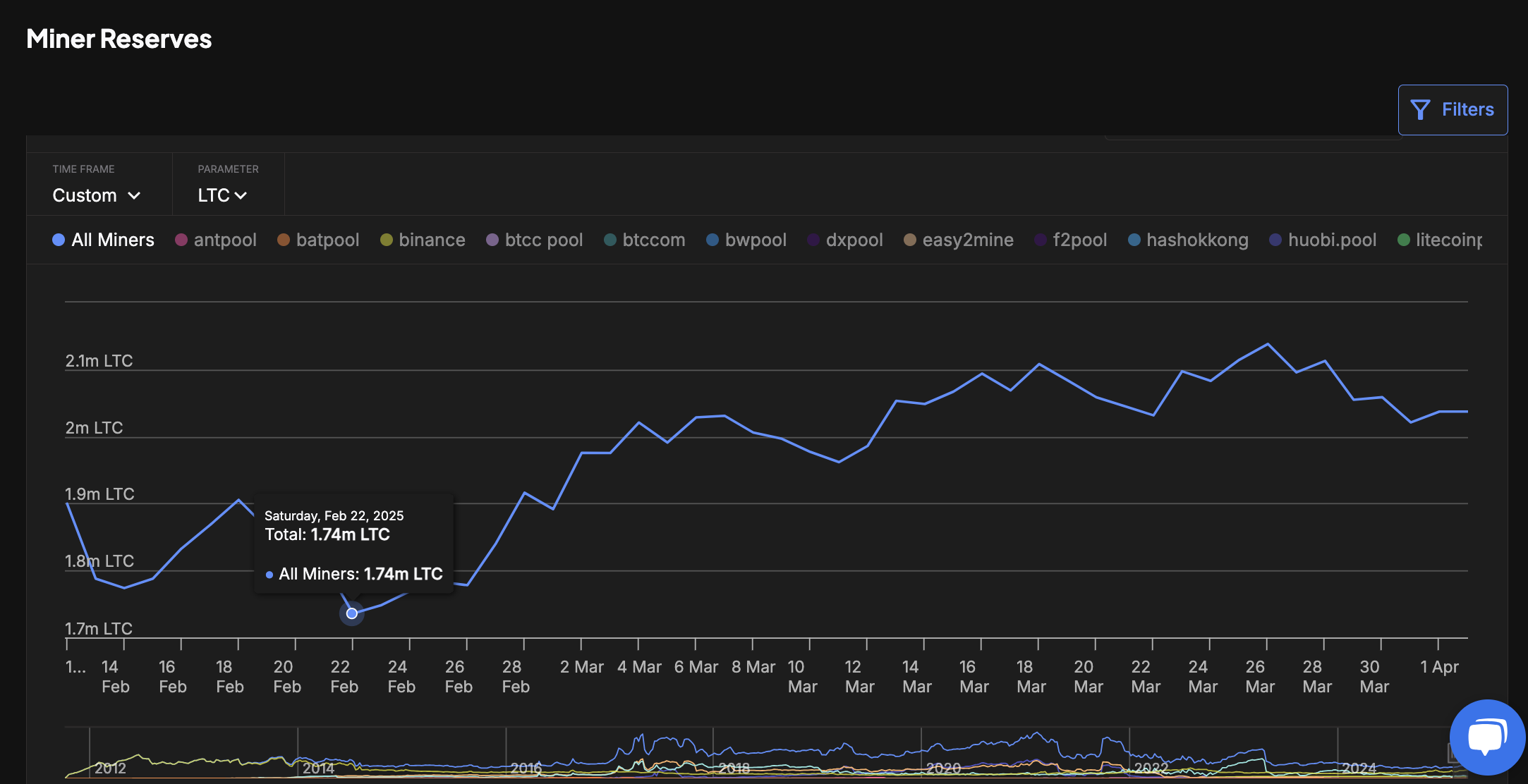

IntoTheBlock’s Miner reserves chart below shows the daily changes in the value of LTC deposited in wallets linked to miners and recognized mining pools.

Litecoin Miners | Source: IntoTheBlock

As seen above, LTC miners increased their holdings from 1.74 million LTC on February 25.

Their aggregate reserves have now reached 2.04 million LTC, according to the latest data recorded after Trump confirmed fresh sweeping tariffs on Wednesday.

Valued at the current prices of around $82 per coin, LTC miners have effectively acquired LTC worth $24.6 million in the last three weeks, while prices have plunged by more than 10% during that period.

When miners accumulate coins during a market dip, it signals that key stakeholders within the ecosystem have confidence in the asset’s long-term value.

The increasing likelihood of LTC ETF approvals odds after Paul Atkin’s nomination advance means that Litecoin miners are incentivized to hold longer for potential institutional inflows and potential breakout gains that could follow an approval verdict.

With fewer newly-mined LTC coins diluting the short-term supply, this partly explains why LTC showed resilience on Thursday, holding the $80 support while BTC, ETH and XRP prices tumbled below $82,000, $1,800 and $2, respectively, during the day.

Litecoin price forecast: $80 support remains strong as 716,000 LTC addresses look to avoid losses

In addition to the favorable odds LTC ETF approval verdict and miners’ optimistic stance amid Trump’s SEC chair nominee nears approval, another key factor keeping Litecoin price above $80 is the sheer number of addresses that bought in around this price level, looking to stay afloat.

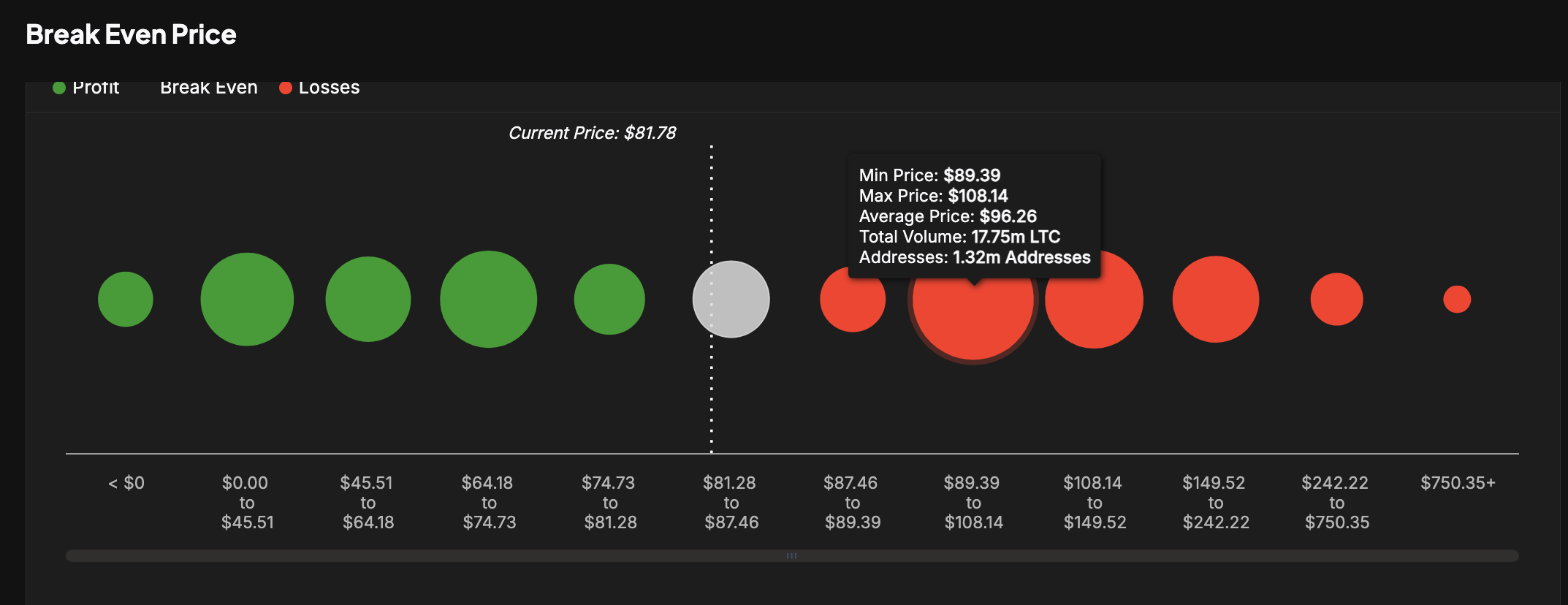

IntoTheBlock’s Break-Even price data groups all LTC holders according to their entry-price bands.

Historically, directional market moves may hit a roadblock when prices approach high accumulation points.

Based on the current data, over 716,700 addresses had acquired Litecoin at the average price of $79. As prices tumble towards the $80 level, support buy pressure from those looking to avoid slipping into a net-loss position has evidently played a role in limiting LTC losses within the current market dynamics.

Litecoin Break-Even Data | Source: IntoTheBlock

In terms of key resistance levels to watch, the chart clearly shows the Litecin largest accumulation cluster of 1.7 million addresses bought-into their LTC positions at the average price of $96.

Hence, even if the LTC ETF narratives gain enough traction to trigger a market rebound, strategic bull traders can expect the rally to slow down significantly as prices approach the $95 mark.