Bitcoin Weekly Forecast: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

- Bitcoin price stabilizes around $84,000 on Friday after recovering nearly 2% so far this week.

- The US SEC's announcement that PoW mining rewards are not securities could boost BTC investors' confidence.

- The Fed kept interest rates unchanged on Wednesday and maintained its rate cut forecast for the year.

- US Bitcoin spot ETF data recorded a total net inflow of $661.20 million until Thursday.

Bitcoin (BTC) price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the United States (US) Securities and Exchange Commission (SEC) that Proof-of-Work (PoW) mining rewards are not securities could boost BTC investors' confidence.

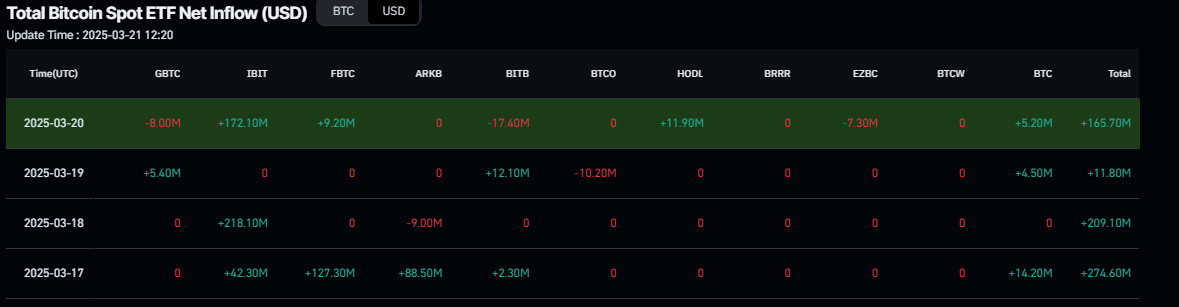

Moreover, the Federal Reserve's (Fed) decision to keep interest rates unchanged and maintain its rate cut forecast for the year, along with a net inflow of $661.20 million from the US spot Bitcoin Exchange Traded Funds (ETFs), have supported Bitcoin's mild recovery this week.

US SEC confirms Bitcoin and crypto mining does not violate securities law

The US SEC announced on Thursday that the PoW mining rewards are not securities. The statement revealed that both solo mining and mining pools do not fall under US securities laws as they do not require the efforts of a central entity or entrepreneurial figure to generate profits.

This announcement provides Bitcoin and other cryptocurrencies with regulatory clarity, reduces legal risks, boosts investor and miner confidence, reinforces its commodity status, and could potentially drive price and market growth.

Bitcoin institutional demand shows signs of a comeback

This week, the institutional demand for Bitcoin showed signs of recovery. According to Coinglass data, Bitcoin spot ETFs recorded net inflows of $661.20 million until Thursday, halting the sell-off seen over the past weeks. Bitcoin's price could recover further if this inflow continues and intensifies, indicating a reduction in sell-side pressure.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Macroeconomics data and global uncertainty

Bitcoin's price recovered nearly 5% on Wednesday, reaching a high of $87,000, bolstered by the Federal Reserve's decision to keep interest rates unchanged and maintain its rate cut forecast for the year.

However, Fed officials trimmed their growth forecast for the year amid the growing uncertainty over the impact of US President Donald Trump’s aggressive trade policies on economic activity. Since February, President Trump has imposed a flat 25% duty on steel and aluminum and threatened to impose reciprocal and sectoral tariffs taking effect on April 2, fueling worries about a global trade war.

On the same day, Donald Trump posted on the Truth Social platform, calling on the Fed to lower interest rates as tariffs start to hurt the economy.

Trump posted: “ The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”

In addition to supporting macroeconomic data this week, global uncertainty also eases slightly. Earlier this week, US President Donald Trump and Russian President Vladimir Putin agreed on an immediate pause in strikes against energy infrastructure in the Ukraine war.

Moreover, Ukrainian President Volodymyr Zelenskiy and Trump agreed to work together to end the protracted Russia-Ukraine war, further boosting investors' confidence toward risky assets like Bitcoin.

However, traders should also keep an eye on the rising tension in Gaza. The Israeli military said that it launched a limited ground incursion into Gaza a day after an aerial bombardment of the Strip that shattered the two-month-old ceasefire with Hamas. Moreover, Israeli Prime Minister Benjamin Netanyahu warned of fierce war expansion, which could hinder investors' confidence and lead to a risk-off sentiment in the crypto market.

Digital Crypto Summit and US SEC first round table

The Blockworks Digital Asset Summit on Thursday made history as the first sitting US President, Donald Trump, spoke at the event. During his speech, Trump called for US dollar dominance and vowed to make America a crypto superpower.

In an exclusive interview ahead of the summit, Bitfinex Analysts told FXStreet, “President Donald Trump's address at the Digital Asset Summit (DAS) in New York City marks a significant milestone, as it will be the first time a sitting US president has spoken at a cryptocurrency conference.”

The analyst continued, “Historically, political endorsements have influenced Bitcoin's market dynamics. For instance, following President Trump's announcement of a US strategic crypto reserve, Bitcoin experienced a 7.2% surge intra-day. Similarly, his re-election in 2024, accompanied by pro-crypto sentiments, propelled Bitcoin to surpass the $100,000 mark.”

“Broader macroeconomic factors, such as trade policies and ongoing tariff negotiations, will play a far more significant role in shaping the long-term impact on digital asset markets. While Blockworks’ involvement suggests a well-organized media event, the fundamental outlook for Bitcoin and the broader crypto market remains unchanged,” Bitfinex Analysts told FXStreet.

Moreover, the US SEC’s Crypto Task Force holds the first-ever roundtable on crypto asset regulation on Friday. This roundtable aims to discuss regulatory approaches for crypto assets, building on the SEC’s efforts to foster innovation while protecting investors. The roundtable will also be open to the public.

Bitcoin technical outlook: BTC fails to find support around its 200-day EMA

Bitcoin's price broke and closed above its 200-day Exponential Moving Average (EMA) on Wednesday, reaching a high of $87,000 that day. However, it failed to find support and declined 3% on Thursday, closing below it. At the time of writing on Friday, it continues to edge lower, around $84,000.

If BTC continues its correction, it could extend the decline to retest its next support level at $78,258.

The Relative Strength Index (RSI) on the daily chart reads 45 after being rejected from its neutral level of 50 on Wednesday, indicating rising bearish momentum. If the RSI continues to slide, Bitcoin’s price could fall sharply.

BTC/USDT daily chart

However, if BTC recovers, breaks, and finds support around the 200-day EMA at $85,508, it could extend the recovery to retest its key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.