Crypto Today: MicroStrategy to add $500M BTC, but XRP and ADA remain at risk despite Canary’s SUI ETF filing

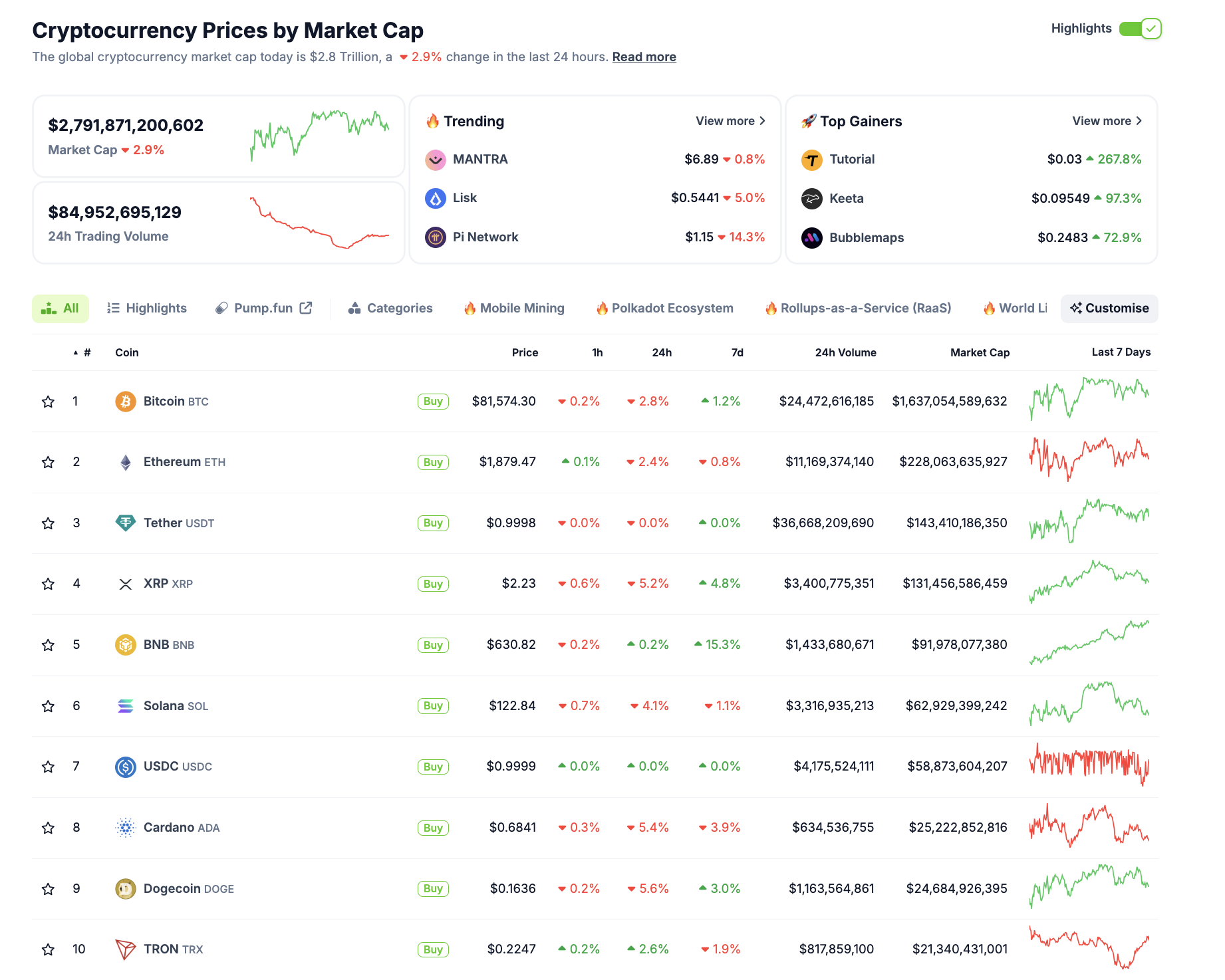

- Cryptocurrency markets shed another 2.9% on Tuesday, bringing aggregate sector valuation to $2.79 trillion.

- Bitcoin is trading at $82,400, down 2% from the previous close, range between highs around $84,700 and a low of $82,281.

- Canary Capital moves to list SUI spot ETF, marking the firm's sixth altcoin derivative filing.

Bitcoin market update:

- Bitcoin price is consolidating with a high of $84,705 and a low of $82,281.

- BTC price has stagnated around $84,000 as investors take on a sit-and-watch approach ahead of the next US FOMC meeting slated for Wednesday.

- Rising buzz around Gold’s (XAU) all-time high could prompt more outflows from BTC, especially if Fed rate decision fails to meet market expectations.

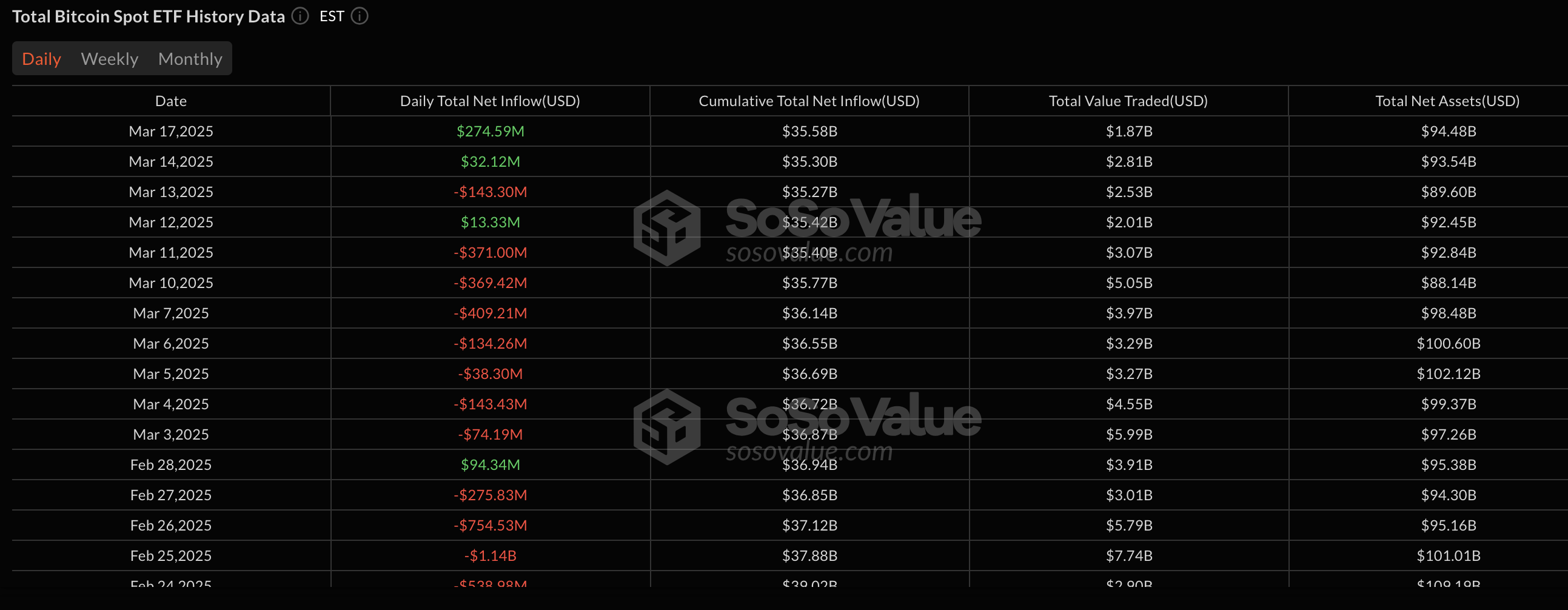

- Bitcoin ETFs registered $234 million in inflows on March 17, the largest single-day deposit on record.

Bitcoin ETFs Flows, March 18 | Source: SosoValue

This also marked the first time in 42 days, dating back to February 4, that Bitcoin ETFs experienced two consecutive days of inflows. Total net BTC holdings controlled by ETFs sponsors are currently worth $94.5 billion.

Altcoin market updates: SUI and Polkadot ETF Developments Fail to Draw Liquidity from XRP, ADA, and SOL

The global crypto market capitalization declined by 2.9% in the last 24 hours with market trends signaling how assets that were recently in profit are now facing liquidity outflows.

Crypto market performance, March 18 2025 | Source: CoinmarketCap

Last week, reports indicated that the US SEC was considering classifying XRP as a commodity as part of settlement talks in its long-running lawsuit with Ripple.

This fueled speculation about potential ETF approvals for XRP, LTC, ADA and HBAR, causing all four altcoins to experience double-digit gains before retracing over the weekend.

This week, new ETF developments have emerged with Canary Capital filing to list a SUI spot ETF — its sixth filing currently under SEC review. Similarly, NASDAQ has filed to list a

Polkadot ETF. These filings have driven short-term rallies in DOT (+7%) and SUI (+3%) over the last seven days.

However, a broader look at the market suggests that investors are rotating funds out of last week’s top gainers to chase fresh narratives.

This rotation is evident in the declining prices and volumes of XRP, SOL and Cardano, all of which are experiencing selling pressure in the past 24 hours.

XRP, SOL and Cardano market performance

- XRP: Trading at $2.23, down 0.6% in the last 24 hours, and 5.2% over the past week.

- Solana (SOL): Trading at $122.84, down 0.7% in the last 24 hours and 4.1% in the last week.

- Cardano (ADA): Trading at $0.6841, down 0.3% in the last 24 hours and 5.4% over the past week.

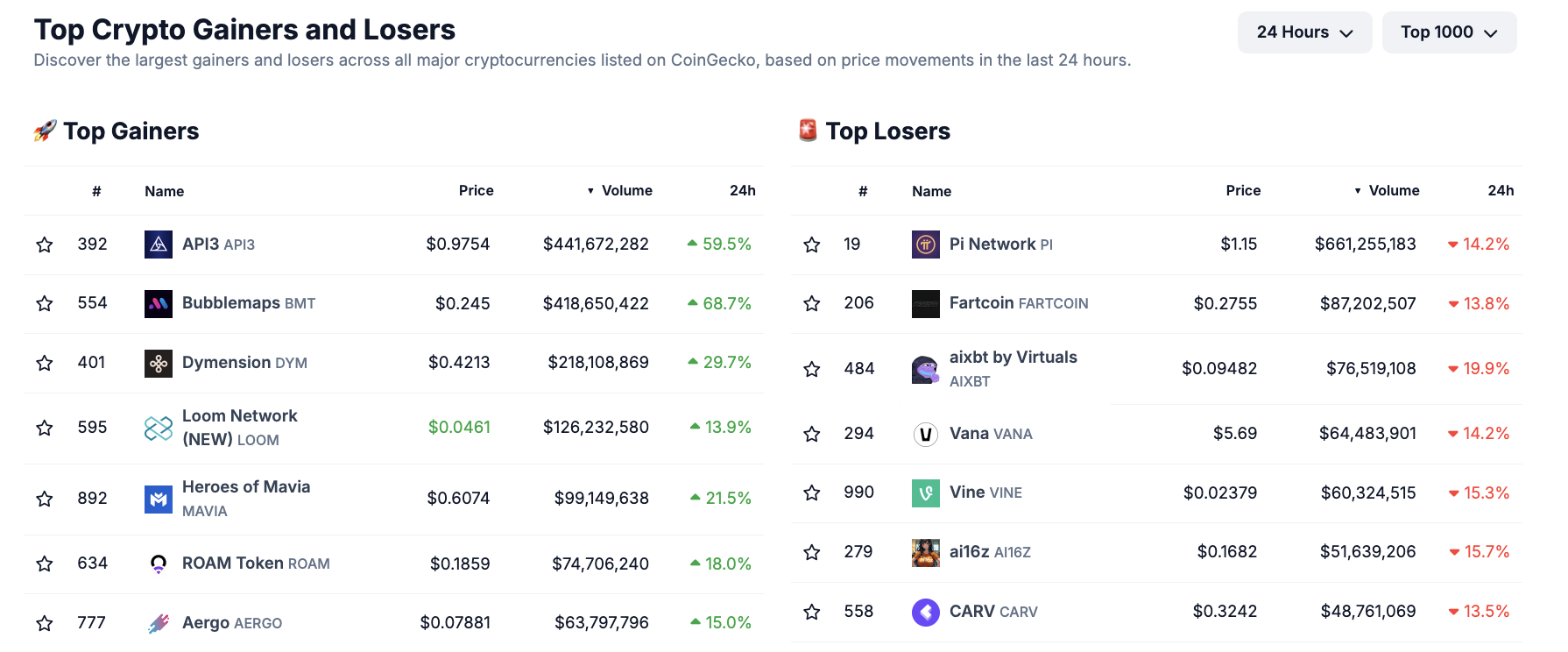

Chart of the day: Gainers vs. Losers

The sharp decline in trading volumes for these altcoins suggests a shift in market sentiment, with traders reallocating capital toward assets with new catalysts such as the SUI and Polkadot ETF filings.

Gainers vs. Losers

Top gainers today

- BubbleMaps (BMT): Up 68.7%, trading at $0.245.

- API3 (API3): Up 59.5%, trading at $0.9754.

- Dymention (DYM): Up 29.7%, trading at $0.423.

Top losers today

- Pi Network (PI): Down 14.2%, trading at $1.15.

- aixbt by Virtuals (AIXBT): Down 19.9%, trading at $0.09482.

- Vana (VANA): Down 14.2%, trading at $5.69.

Total crypto market cap tumbled toward $2.79 trillion on Tuesday , down 2.9% in the last 24 hours.

Trading volume also hit $84.95 billion, declining alongside major altcoins.

The current market trend highlights a shift in liquidity as traders move funds toward assets with fresh catalysts while exiting last week’s outperformers. ETF-related narratives remain dominant, with upcoming US Fed rate approvals potentially reshaping capital flows in the weeks ahead.

Crypto news updates:

VanEck to launch Bitcoin investment fund in Vietnam

VanEck, a US-based asset management firm with $113.8 billion in assets, is planning to launch a Bitcoin investment fund in Vietnam in partnership with SSI Securities.

CEO Jan van Eck met with Vietnam's State Securities Commission and Deputy Minister of Foreign Affairs to discuss the initiative and the country’s digital asset market development.

VanEck’s seeks to expand digital asset partnerships and technology transfer in Asia amid growing institutional interest in regulated crypto investment vehicles.

Paul Atkins' SEC chair confirmation delayed over pending financial disclosures

The confirmation of Paul Atkins, former SEC commissioner and Trump’s nominee for SEC chair, has been delayed due to pending financial disclosure paperwork from the White House, according to Semafor’s Eleanor Mueller.

The Senate Banking Committee, led by Tim Scott, is targeting March 27 for a confirmation hearing, but Atkins' complex financial holdings — particularly his ties to TAMKO Building Products LLC, a $1.2 billion roofing company connected to his wife’s family — have slowed the vetting process.

“No clarity yet on whether the committee has Atkins’ paperwork in hand, but either way, this is the most momentum we’ve seen so far,”

- Mueller wrote on X on Monday.

Meanwhile, the Senate Banking Committee has scheduled a bipartisan meeting this Friday to discuss his nomination.

Despite the delays, Atkins remains on track for confirmation, following a similar timeline to previous SEC chairs, Gary Gensler and Jay Clayton, whose hearings also took place in March.

Strategy launches $500M perpetual preferred share offering to expand BTC reserves

Strategy, the largest corporate holder of Bitcoin, has launched a $500 million perpetual preferred stock offering, STRF (Strife), aimed at institutional and select retail investors.

The company plans to issue 5 million shares of Series A Perpetual Strife Preferred Stock in a public offering to fund additional Bitcoin purchases and support working capital.

The preferred stock carries a 10% annual fixed dividend rate with quarterly payments starting June 30, 2025.

If dividends are unpaid, they will compound at 11% per annum, increasing by 100 basis points per quarter to a maximum of 18% annually until fully paid.