Crypto Today: BNB, OKB, BGB tokens gain $1.9 billion as BTC price, Shiba Inu and Chainlink lead market rebound

- Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation.

- With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9= billion.

- Bitcoin, Shiba Inu and Chainlink have emerged as top gainers among the 20 largest projects.

Bitcoin market updates:

- Bitcoin's price surged above $83,000 on Friday, marking a 5% increase from its 24-hour low of $79,000.

- Bitcoin ETFs saw $143 million in outflows on Thursday, following $13 million in inflows on Wednesday—the first positive flows since the start of March.

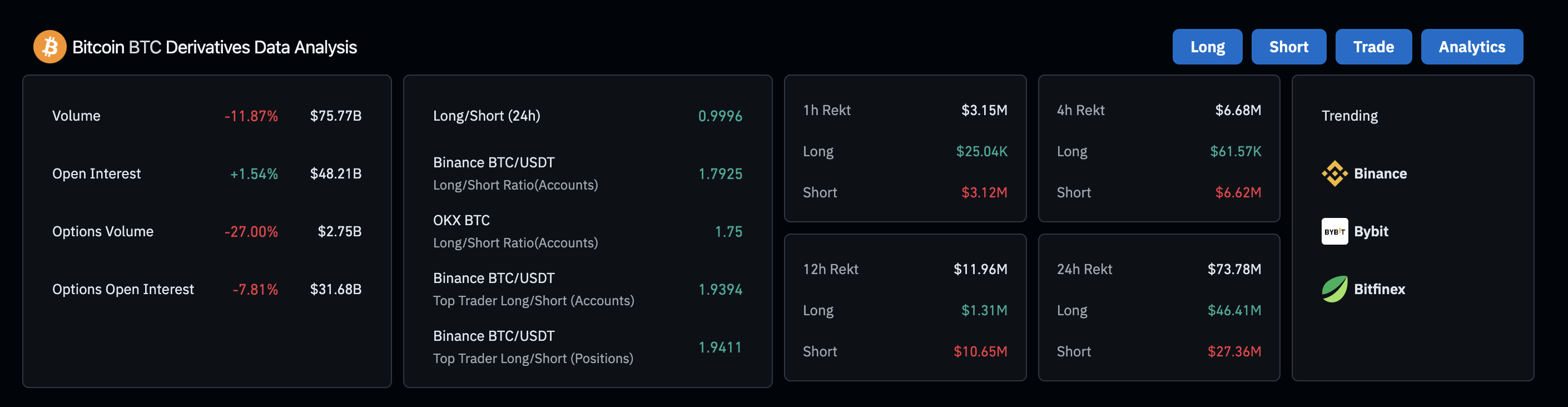

Bitcoin Derivatives Market Analysis, March 14 | Source: Coinglass

Bitcoin Derivatives Market Analysis, March 14 | Source: Coinglass

In derivatives markets, Bitcoin trading volumes declined 14% to $75.77 billion while open interest crossed $48 billion, which had increased by 1.5% over the past day.

This suggests that Bitcoin’s rebound lacks strong conviction, as traders entering new positions have done so with low-volume trades, signaling reluctance to take on larger commitments amid current market conditions.

Altcoin updates: Chainlink, Shiba Inu, Ripple among top gainers on Friday

Top altcoin assets like XRP, BNB, Chainlink and SHIB secured considerable gains in the early hours of Friday.

However, crypto markets only witnessed a mild recovery of 0.13%. This signals that gains seen in top-performing assets are mainly from traders rotating holdings between different sectors over the market.

- Ripple (XRP) price is up 2.3% in the last 24 hours, holding firmly above the $2.3 level at press time.

The prospect of the United States (US) Securities and Exchange Commission (SEC) considering XRP a commodity in settlement talks with Ripple is one of the dominant narratives that boosted demand.

- Binance Coin (BNB) price moved sideways, holding above the $570 level.

Recent media chatter surrounding President Donald Trump’s family entering negotiations to acquire Binance has lifted BNB markets this week.

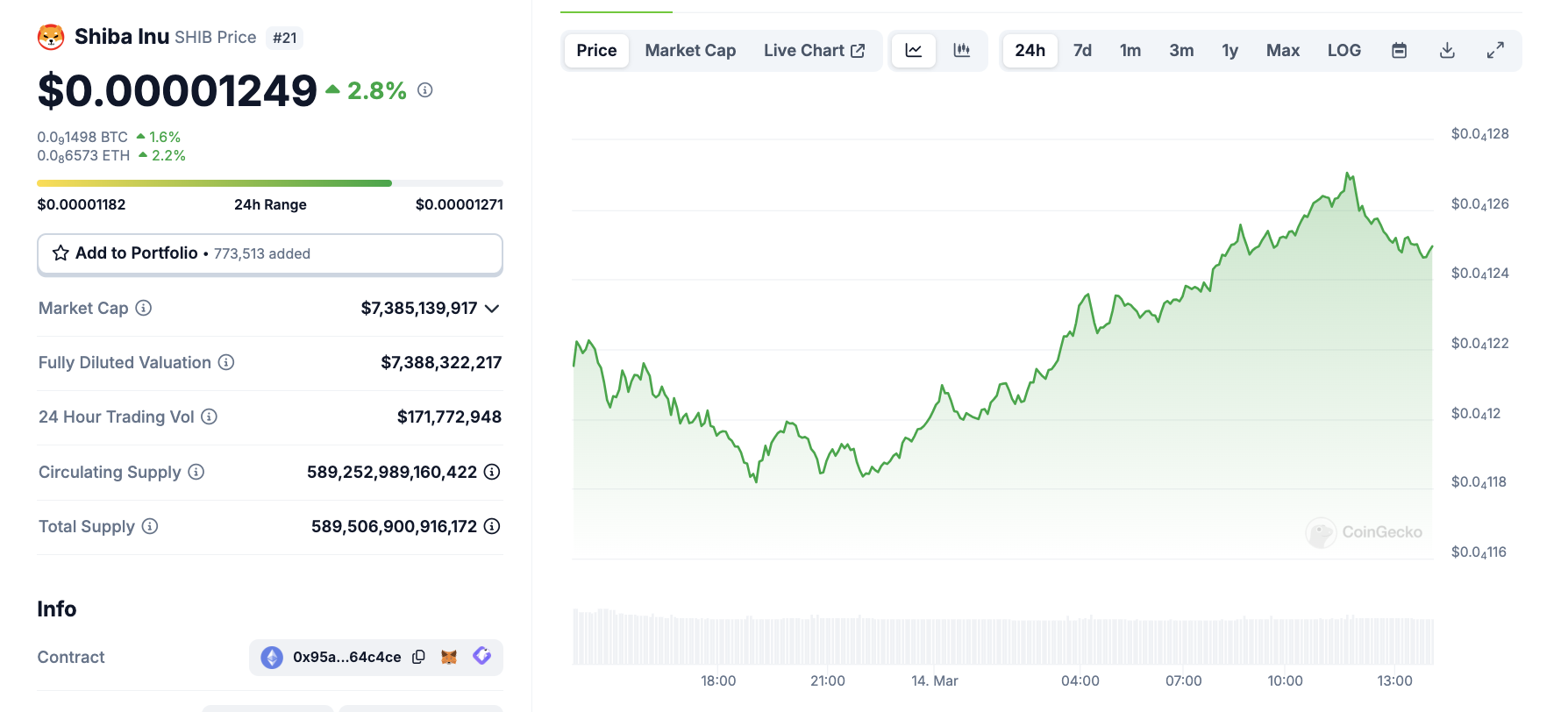

- Shiba Inu (SHIB) also posted 4% gains, trading around $0.000012 at press time.

Since the turn of the year, SHIB has underperformed as newer rival memecoin took center stage.

Shiba Inu price action, March 14 2025

Shiba Inu price action, March 14 2025

The current rally is linked to traders seeking bargain deals amid the market dip, capitalizing on SHIB’s oversold status.

- Chainlink price rose 5% to retake the $20 level. Despite the bearish market trends, major crypto projects continue to enter TradFi and AI integration partnerships, creating long-term play for Chainlink’s oracle price feeds.

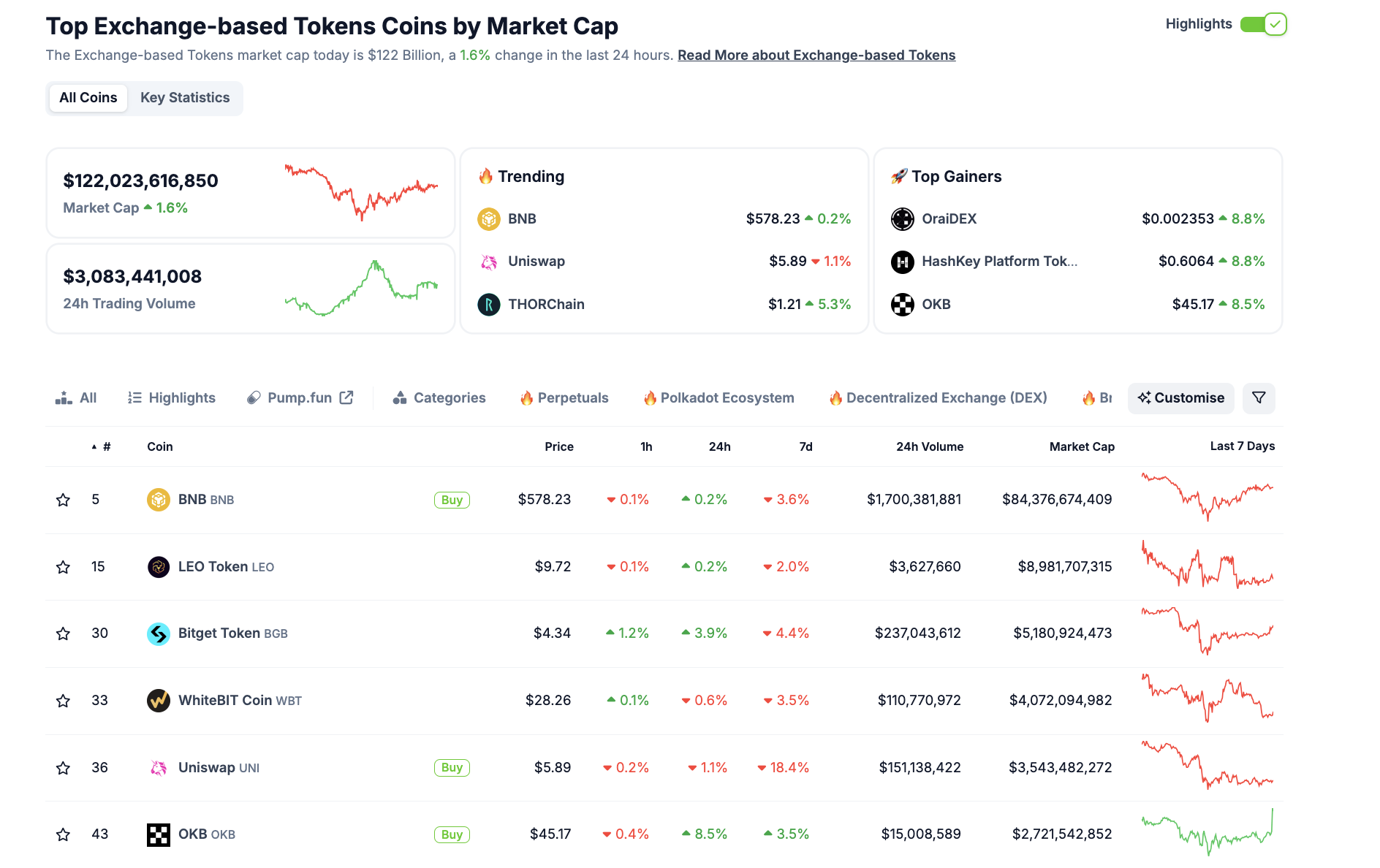

Chart of the day: Exchange tokens BNB, OKB, BGB on the rise as traders rotate profits

Crypto markets are seeing a mild recovery of 0.13% on Friday, signaling that recent gains in top-performing assets are primarily driven by traders rotating funds across different sectors rather than fresh capital inflows.

This reflects a cautious sentiment among investors as global macroeconomic uncertainties—particularly escalating trade war tensions—overshadow easing US inflation data published earlier this week.

With broader market sentiment still leaning bearish, traders are reallocating capital between different crypto sectors to capitalize on niche media narratives or exploit arbitrage opportunities. This shift has inadvertently boosted demand within the exchange token sector, led by Binance Coin (BNB), OKX (OKB), and Bitget (BGB).

According to Coingecko, the valuation of exchange-based tokens grew by $1.9 billion in the last 24 hours, reaching the $122 billion mark at the time of writing.

Exchange tokens sector performance, March 14 | Source: Coingecko

BNB trades at $578.51, posting 0.2% intraday gains, while OKB has climbed to $45.05, reflecting a 7.5% increase in 24 hours. Meanwhile, Bitget’s BGB token is trading at $4.18, rising 3.7% over the same period.

The exchange token sector, outperforming the broader market, affirms the narrative that crypto traders are moving liquidity into exchange-native assets.

These tokens typically offer fee discounts, staking rewards, and governance benefits—enhancing their attractiveness in high-volatility market phases, as observed this week.

If this dynamic persists, BNB, OKB and BGB could see further upside, particularly if volatility drives more trading activity.

However, strategic traders may be unwilling to deploy large leverage positions to drive aggressive rallies.

Without fresh bullish catalysts, buyer fatigue could set in, leading to potential liquidations across the board.

Crypto news updates:

Russia turns to crypto for oil trade with China and India to bypass Western sanctions

Russia is increasingly using Bitcoin, Ether and stablecoins to facilitate oil trade with China and India, as Western sanctions restrict traditional payment routes, Reuters reported on Friday.

Citing sources with direct knowledge of the transactions, the report noted that crypto payments remain a small but growing portion of Russia’s $192 billion annual oil trade.

Russian firms are using intermediaries to convert yuan and rupees into rubles, ensuring smoother transactions despite financial restrictions.

The move follows legislative changes in December, when Russia officially allowed cryptocurrencies for international trade, according to Finance Minister Anton Siluanov. One source claimed that a Russian oil trader’s crypto sales to China amount to tens of millions of dollars monthly.

BlackRock’s BUIDL fund reaches $1 billion milestone as tokenized treasuries gain traction

BlackRock’s BUIDL tokenized treasury fund has surpassed $1 billion in total investments, marking a significant milestone one year after its launch.

The fund, built in collaboration with Securitize, offers crypto investors exposure to U.S.

Treasury bills, cash, and repurchase agreements on the Ethereum blockchain. Recent capital inflows include a $200 million investment from Ethena Labs, further solidifying BUIDL’s position in the growing tokenized asset sector.

The broader tokenized treasury market has now expanded to a record $4.4 billion, driven by contributions from firms like Franklin Templeton, Ondo Finance, and Superstate.

US Senate Banking Committee advances key stablecoin regulation bill

The US Senate Banking Committee has approved a major stablecoin regulation bill with an 18-6 vote, moving it closer to full Senate consideration.

The legislation aims to establish federal oversight of US stablecoin issuers, marking a significant milestone in crypto regulation.

This development follows similar efforts in the House of Representatives, indicating growing momentum for comprehensive stablecoin rules.

Despite the progress, key challenges remain, including reconciling differences between Senate and House versions of the bill.

The proposed regulation seeks to address consumer protection, reserve transparency, and issuer compliance as lawmakers push for a structured framework to govern the expanding stablecoin market.