Binance Coin (BNB) Price Forecast: Will Changpeng Zhao’s latest memecoin statements drive BNB to $700?

- Binance Coin (BNB) price rose as high as $622 on Monday, reflecting 9% gains over the weekend.

- Binance ex-CEO Changpeng Zhao has denied rumored ties to TST, a memecoin recently launched on the BNB Chain.

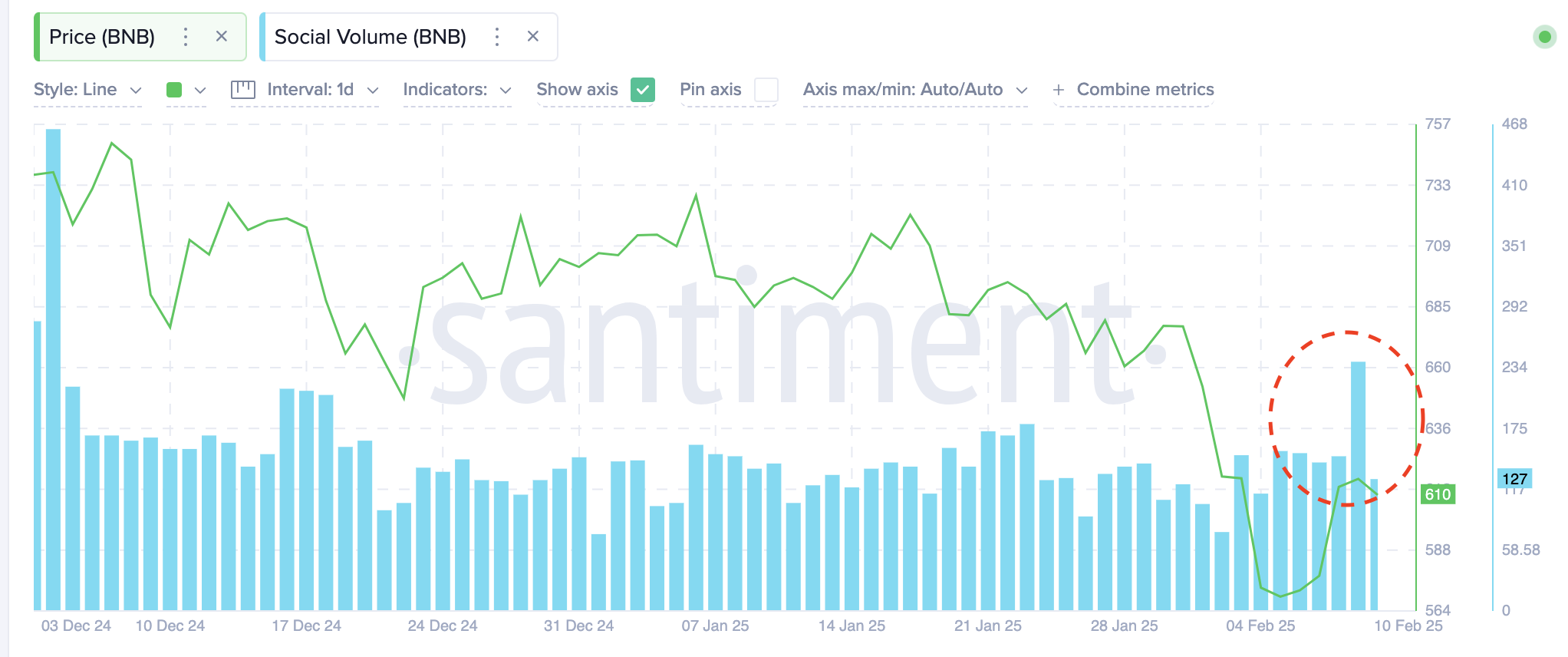

- Sanitment’s social volume charts show mentions of BNB have hit a 60-day peak.

Binance Coin (BNB) price rose as high as $622 on Monday, reflecting 9% gains over the weekend, as recent comments from Changpeng Zhao sparked intense market speculations.

BNB price scores 13% weekend rally amid CZ memecoin rumors

Binance Coin (BNB) emerged as one of the best-performing top 10 crypto assets over the weekend, posting a 13% rally.

The sudden price spike coincided with rumors that Binance Co-Founder Changpeng Zhao (CZ) was behind the launch of a new memecoin, TST, within the BNB Chain ecosystem.

TST purportedly gained traction on social media, leading to speculation that Binance’s former CEO was spearheading the project.

However, on Saturday, CZ issued a public statement via X , outright denying any connection to TST.

He clarified that the new memecoin had an unauthorized Binance logo and was not affiliated with Binance or the BNB Chain team.

According to the Google translate version of his post on X, CZ informed community members that the TST memecoin now has a functional website and X account.

As CZ revealed on X, neither the website nor the X account was created by the BNB Chain team.

He also pointed out that the protocol or staff from the crypto exchange does not control this memecoin.

To offer a better perspective, CZ said the TST memecoin is likely controlled by someone in the community. However, he claims he does not know who this person is. He flagged a 'problem' using the

Binance logo on the TST memecoin without authorization.

The Binance co-founder said this is an infringement and it needs to change. Known as a person of influence in the ecosystem, CZ reassured that, like other memecoins, he has never bought and does not own any TST token.

He advised his 9.5 million followers to protect themselves and be responsible for their actions.

Binance Coin (BNB) Price Action

Despite CZ’s prompt clarification, the excitement surrounding the TST memecoin triggered a surge in trading volume and speculation across BNB spot markets.

As illustrated in the chart above, BNB’s price rose 13% over the weekend, climbing from $569 on Friday to a high of $648 on Sunday, before stabilizing at the $615 level at press time on Monday.

This swift rally suggests that traders leveraged the heightened interest in Binance-related assets to drive short-term gains.

Memecoin speculations drive BNB social media mentions to 60-Day Peak

With BNB’s price holding strong above the $630 level, the positive effects of the memecoin speculation continue to resonate.

Further supporting this outlook, Santiment’s Social Volume chart shows a significant uptick in BNB-related discussions across crypto social media platforms.

Binance Coin (BNB) Social Volume vs. Price | Source: Santiment

Santiment’s data highlights that BNB’s social volume score surged to 240 on Sunday.

Notably, this marks the highest level of investor mindshare for Binance Coin in the past 60 days, dating back to December 4, when it reached a social volume score of 464.

The widespread discussions about the TST memecoin, combined with CZ’s response, played a crucial role in fueling investor interest.

This surged in media traction partially explains why BNB outperformed leading assets like Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL) over the weekend.

As BNB remains at the center of social media discussions, the coin could sustain its bullish trajectory if the broader crypto market starts the new week on a positive note. With bearish sentiment from the US-China trade war appearing to ease, BNB may have room for further gains in the near term.

BNB Price Forecast: More gains ahead if $615 support holds

Binance Coin (BNB) is consolidating above the $610 mark after a sharp rebound from recent lows, signaling a potential continuation of its recovery if bullish momentum persists.

The BNB price action shows a four-day 9.28% gain, reflecting increased buying interest.

The Relative Strength Index (RSI) at 40.68 remains below the neutral 50 level, but its upward trajectory suggests improving momentum, hinting at a possible trend shift.

Binance Coin (BNB) Price Forecast

A key bullish indicator is BNB’s ability to hold above the $615 support level.

The Bollinger Bands show price movement within the lower half, with the middle band at $640 acting as immediate resistance.

A decisive break above this level could fuel a run toward the upper band at $726.27.

The increasing volume further supports a bullish continuation if demand sustains.

On the flip side, failure to maintain support at $610 may invite renewed bearish pressure, potentially dragging BNB toward the $554 level.

However, as long as broader market sentiment remains positive, the bullish case appears stronger.