Bitcoin Price Forecast: BTC recovers above $98,000 as Eric Trump encourages WLFI to add BTC

- Bitcoin price recovers, trading above $98,000 on Thursday after losing nearly 5% in the last two days.

- Eric Trump encourages the addition of BTC to their family-backed crypto platform, World Liberty Financial.

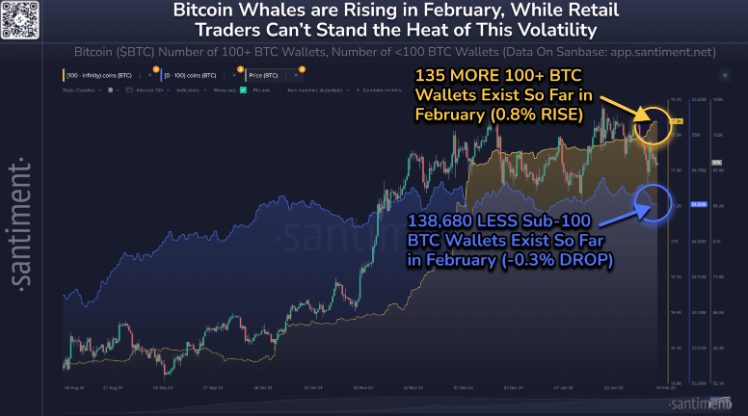

- Santiment’s data shows that Bitcoin whales have been stacking up more BTC during the recent correction while retail traders are getting liquidated.

Bitcoin (BTC) price recovers slightly, trading above $98,000 at the time of writing on Thursday after losing nearly 5% in the last two days. Eric Trump encouraged the addition of BTC to their family-backed crypto platform World Liberty Financial (WLFI) portfolio, which may be supporting Bitcoin’s recovery. Moreover, Santiment’s data shows that Bitcoin whales have been stacking up more BTC during the recent correction while retail traders are getting liquidated, hinting at recovery ahead.

Bitcoin recovers slightly as Eric Trump encourages WLFI to add BTC

Bitcoin price recovers, trading above $98,000 during the early European session on Thursday. This recovery was fueled after Eric Trump, son of US President Donald Trump, posted on his social media X encourages to add BTC to their family-backed crypto platform World Liberty Financial portfolio.

Feels like a great time to enter #BTC! @worldlibertyfi

— Eric Trump (@EricTrump) February 6, 2025

Early this week, President Trump’s crypto czar, David Sacks, announced during the digital asset press conference that they would evaluate a Bitcoin Reserve. The press conference announced several frameworks and regulatory support for digital assets and stablecoins.

Moreover, US Treasury Secretary Scott Bessent said late Wednesday the “focus is on bringing down 10-year Treasury yields, rather than the Fed’s benchmark short-term interest rate.”

Bessent further states, “US President Donald Trump wants lower interest rates.”

Lowering 10-year Treasury yields and interest rates is generally seen as a bullish sign for risky assets like Bitcoin.

Bitcoin whales add more BTC, while retail traders sell off

Santiment’s data shows that Bitcoin whales have been stacking up more BTC during the recent correction and major volatile conditions. Whereas small retail traders, especially the ones who first entered the markets in the past 6 months, the volatility is causing them to liquidate their holdings.

As shown in the graph below, February has seen a growth of 135 in wallets holding more than 100 BTC and a plummet of 138,680 in wallets with less than 100 BTC. This is an ideal setup for Bitcoin price to rise, even if it takes a few more weeks (or even months) to see the generally bullish impact of coins being absorbed by whales.

BTC holders chart. Source: Santiment

Bitcoin Price Forecast: BTC bears aim for $90,000 level

Bitcoin price faced a pullback, reaching a low of $91,231, but quickly recovered to close above $101,300 on Monday. However, it failed to maintain its recovery and declined 4.65% in the next two days. At the time of writing on Thursday, BTC recovers slightly, trading above $98,000.

If BTC continues its correction, it could extend the decline to test its psychologically important level of $90,000.

The Relative Strength Index (RSI) on the daily chart reads 43, after being rejected from below its neutral level of 50, indicating strong bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, hinting at further correction ahead.

BTC/USDT daily chart

Conversely, if BTC recovers and finds support around $100,000, it would extend the recovery to retest its Friday high of $106,012.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.