Ethereum Price Forecast: ETH could see new all-time high as Donald Trump wins US presidential election

Ethereum price today: $2,660

- Ethereum is showing signs of a parabolic run as investors expect it to largely benefit from Trump's campaign promises.

- Clear regulatory structures for the DeFi landscape could strengthen on-chain activity and boost ETH's appeal.

- Ethereum could aim for a new all-time high if it reclaims the $2,817 key level.

Ethereum (ETH) is up over 8% on Wednesday, as several decentralized finance (DeFi) tokens have been rising upon news of Republican candidate Donald Trump winning the US presidential elections. The top altcoin could aim for a new all-time high in the coming weeks if the President-elect follows through on his campaign promises to end the government's crypto crackdown.

Ethereum could be largest winner from Trump's victory

Ethereum has rallied over 8% in the past 24 hours following Donald Trump's election as the 47th American President, according to the Associated Press. The Layer 1 token is poised to be one of the largest beneficiaries of the Republican candidate's victory following key promises he made to the crypto industry.

NEW: “Promises made, promises kept,” Trump says in his victory speech.

— Eleanor Terrett (@EleanorTerrett) November 6, 2024

Trump promised to end the US government's unlawful crackdown on the crypto industry and fire Securities & Exchange Commission's (SEC) Chair Gary Gensler if elected as President.

With his victory now secured, investors expect a potential DeFi renaissance that could cause Ethereum to go on a parabolic run, especially as the sector suffered from being a key target of the SEC in the Biden administration. Additionally, many see Trump's family DeFi project, World Liberty Financial, running on Ethereum as a good sign of the President-elect potentially having a soft spot for Layer 1.

Several prominent Ethereum-based projects encountered serious regulatory challenges, including Uniswap, OpenSea, ConsenSys and Immutable, which received Wells Notices from the regulator concerning their activities in the digital asset space. As a result of the unclear regulatory landscape, several DeFi projects significantly slowed down their activities, causing on-chain activity to dwindle on Ethereum.

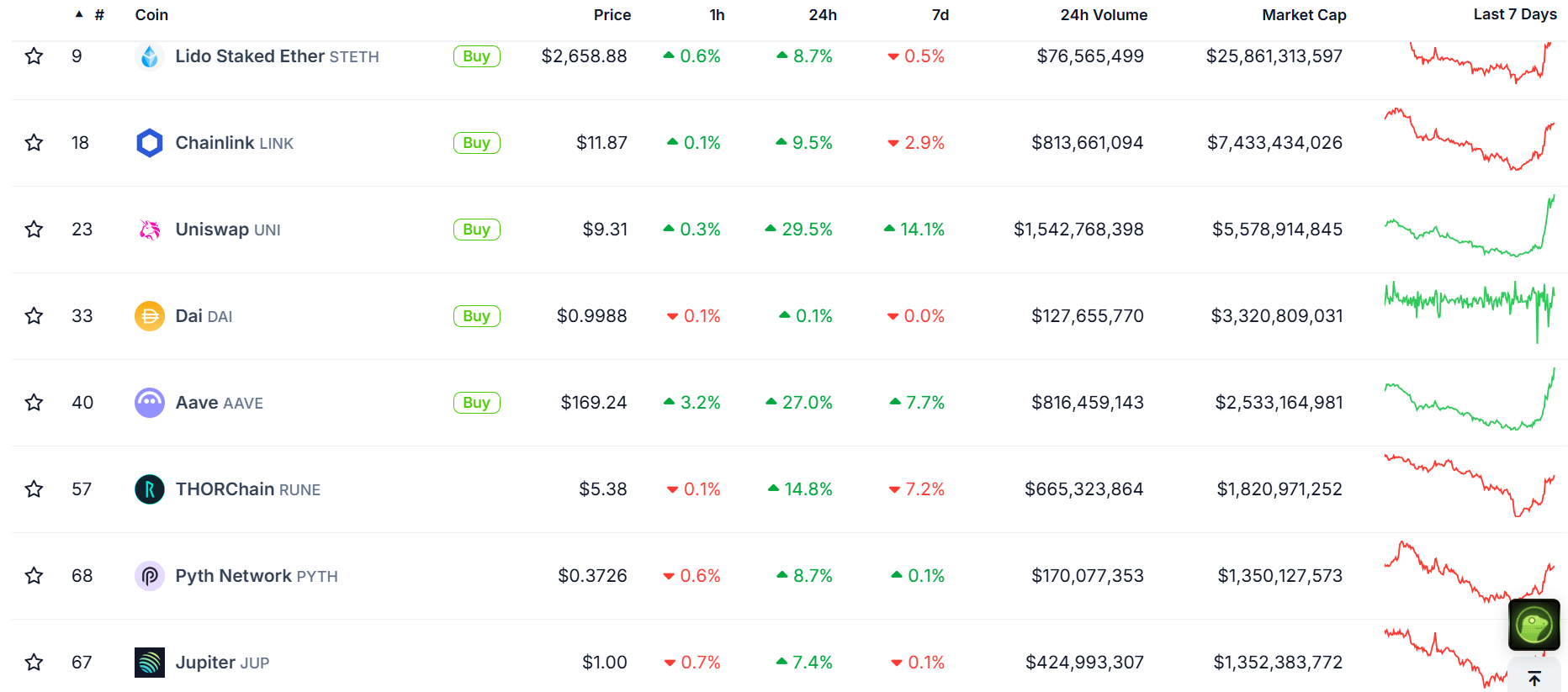

However, since the election results started flooding X, DeFi tokens have been surging, with the sector's market capitalization rising over 15%. If DeFi activity on Ethereum continues to rise, it could lead to increased demand for ETH, more fees captured on the L1, and more ETH tokens burned. This could lead to a significant price rise for the top altcoin.

Top DeFi Coins | CoinGecko

For example, during the DeFi boom of Q4'20 to Q1'21, Ethereum rallied nearly 1,500% from $300 to an all-time high of $4,878.

Meanwhile, Ethereum exchange-traded funds (ETFs) didn't record any flows on Tuesday, per Coinglass data.

Ethereum Price Forecast: ETH could aim for new all-time high if it reclaims $2,817 key level

Ethereum's 8% rise in the past 24 hours has sparked $55.25 million in liquidations, with long and short liquidated positions accounting for $27.71 million and $27.55 million, respectively.

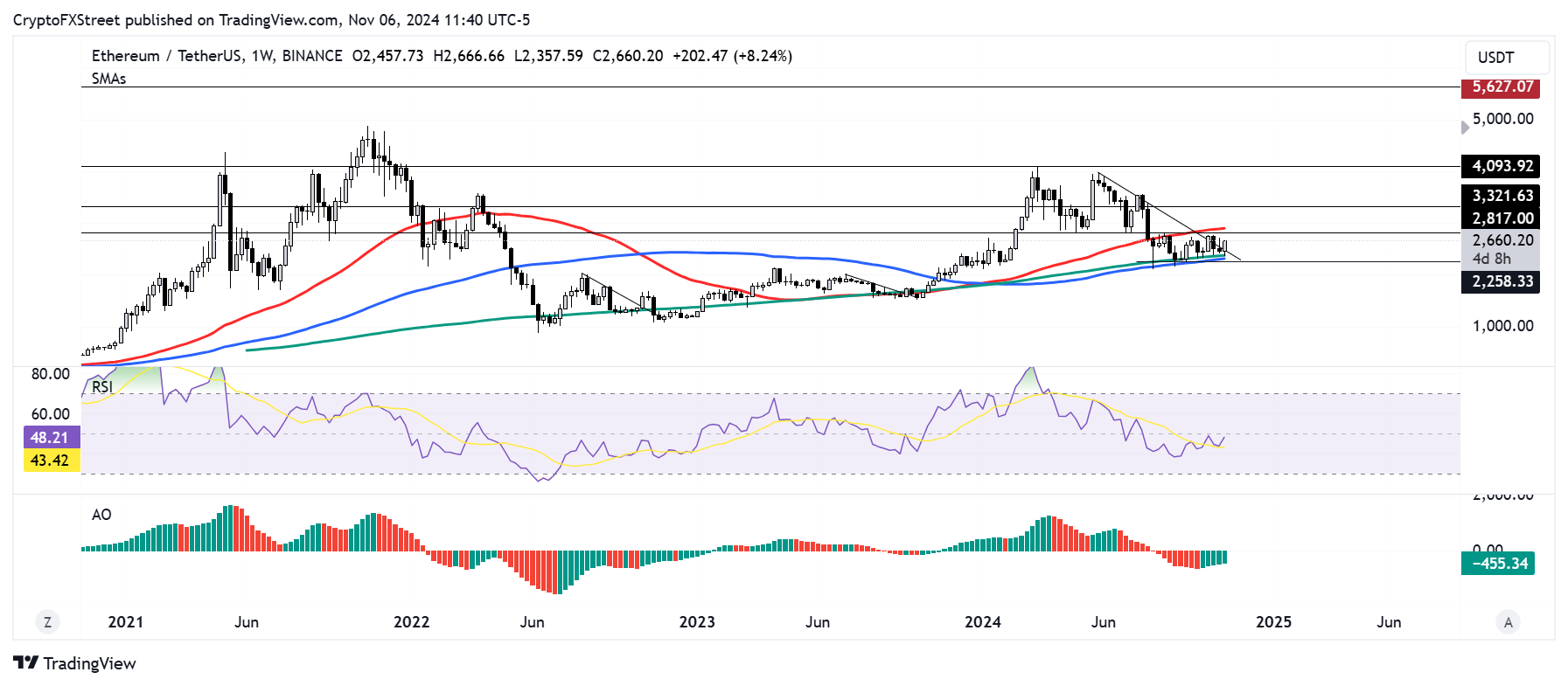

On the weekly chart, ETH is aiming for the $2,817 key resistance level — which prices have stayed below since August 5 — after bouncing off the convergence of the 100-day and 200-day Simple Moving Averages (SMAs).

ETH/USDT weekly chart

If ETH fails to see a rejection at $2,817 and crosses above the 50-day SMA hurdle, which has held since August, it could rally to $3,321. Notably, buyers defended the $2,817 for nearly four months before the market crash on August 5. Hence, a reclaim of this level could fuel the bullish momentum.

Furthermore, a move above $3,321 could see ETH aim for a new all-time high by tackling its yearly high resistance level of $4,093.

The Relative Strength Index (RSI) has bounced off its moving average yellow line and is aiming to test its midline again. Earlier in October, the RSI crossed above its moving average yellow line for the first time since March but saw a rejection near its midline. A cross above it would fuel the bullish momentum and potentially see ETH setting a new all-time high.

The Awesome Oscillator (AO) is still below its neutral level at -455. A move above this level would also strengthen the bullish thesis.

A weekly candlestick close below the 100-day and 200-day SMA convergence will invalidate the thesis. ETH could find support near the $2,258 historically high demand zone in such a scenario.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.