US presidential election outcome could make or break the future of crypto

- The White House plays a pivotal role in shaping the future of crypto, experts say, so the results of the US presidential election could impact the prices of Bitcoin and altcoins.

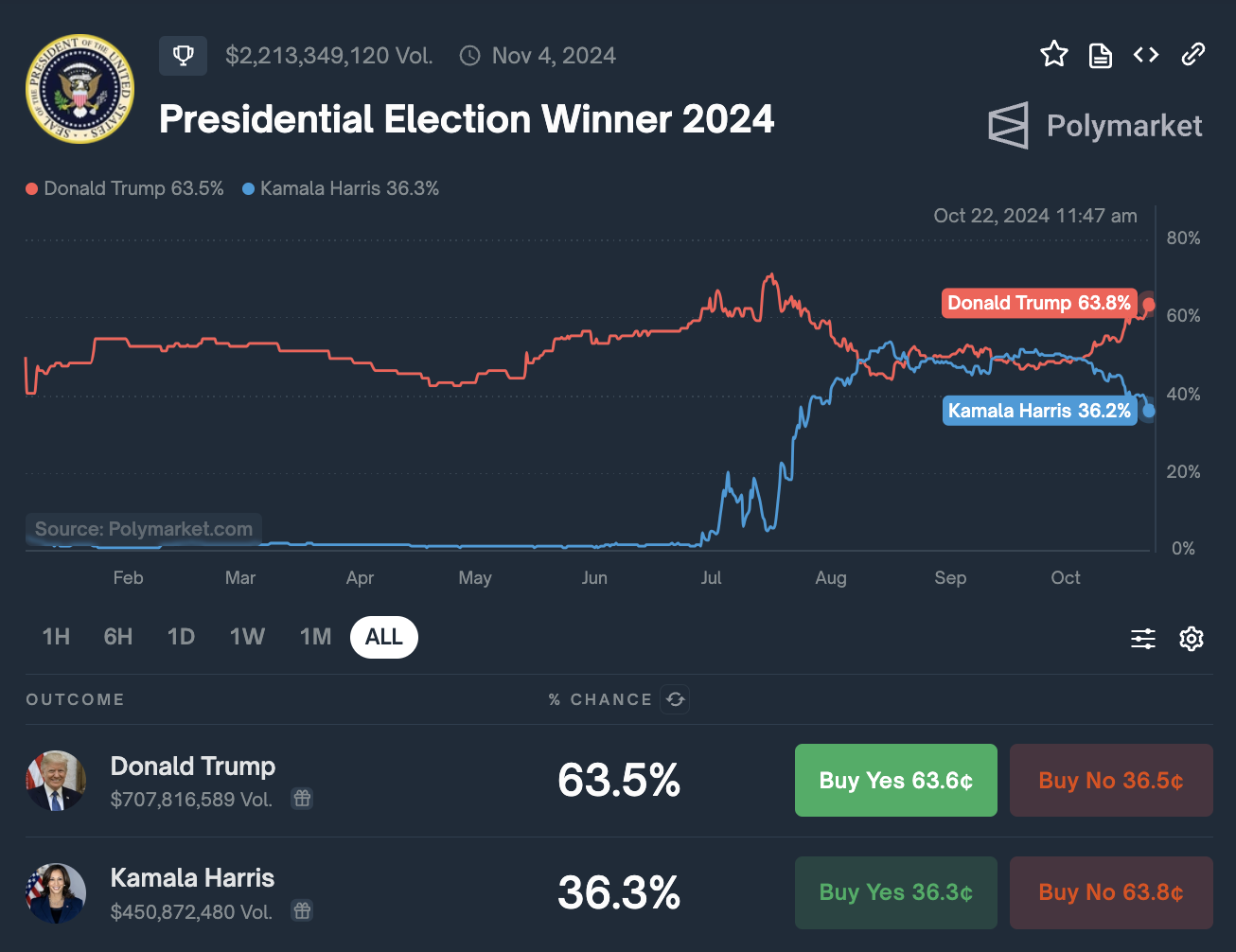

- Donald Trump’s odds of winning the US presidential election are higher than those of Kamala Harris, according to crypto prediction market Polymarket.

- Crypto regulation in the US has emerged during the campaign for the first time, with experts saying that Trump’s win would undoubtedly favor the industry.

- Ripple co-founder supports Harris as the firm continues to battle the SEC over the status of XRP.

US citizens will go to the polls to elect a new president on November 5, and their choice could be key for the future of the crypto industry and thus the price outlook for Bitcoin (BTC). While the role of crypto and how it should be regulated in the country was largely ignored four years ago, the matter has been part of the agenda during the election run-up.

Former President and Republican nominee Donald Trump and current Vice President and democrat nominee Kamala Harris seem to be divided over how to approach crypto, at least according to what they have said on the matter. With the US Securities and Exchange Commission (SEC) doubling down its enforcement actions against the sector, whoever sits in the White House could make a difference regarding whether and how the asset class will be regulated in the years to come.

Crypto prediction market favors Trump win

Polymarket, a crypto betting and prediction market, places the odds of former US President Trump’s win in the election at 63.7% and Kamala Harris at 36.1%. Until October 4, Trump’s odds were on a steady decline and Harris’s on the rise, but the narrative flipped thereafter in favor of the Republican candidate.

US presidential election winner 2024. Source: Polymarket.

Industry experts at Galaxy Research gathered insights and commentary on how a Trump or a Harris win could influence crypto, particularly its regulation but also other relevant issues.

Trump is more favorable for crypto, Galaxy Research says

Alex Thorn, Head of Research at Galaxy, published on X a policy scorecard comparing Trump and Harris on different crypto-related issues. The scorecard identifies several key factors, from the SEC to tax issues or Bitcoin mining, adding comments on the stance of the current Biden administration and which would be the approach from Harris and Trump’s administrations.

Thorn said that, while Trump’s win would be “undoubtedly more favorable for the industry”, Harris’s administration could also have positives, having an optimistic outlook to her win as well.

TRIGGER ALERT

— Alex Thorn (@intangiblecoins) October 14, 2024

i’m releasing our policy scorecard on the positions of biden, harris, and trump on major bitcoin & crypto issues

bottom line: while trump is undoubtedly more favorable for the industry, we’re optimistic that harris could be more supportive than biden has been pic.twitter.com/qNKeLtppcS

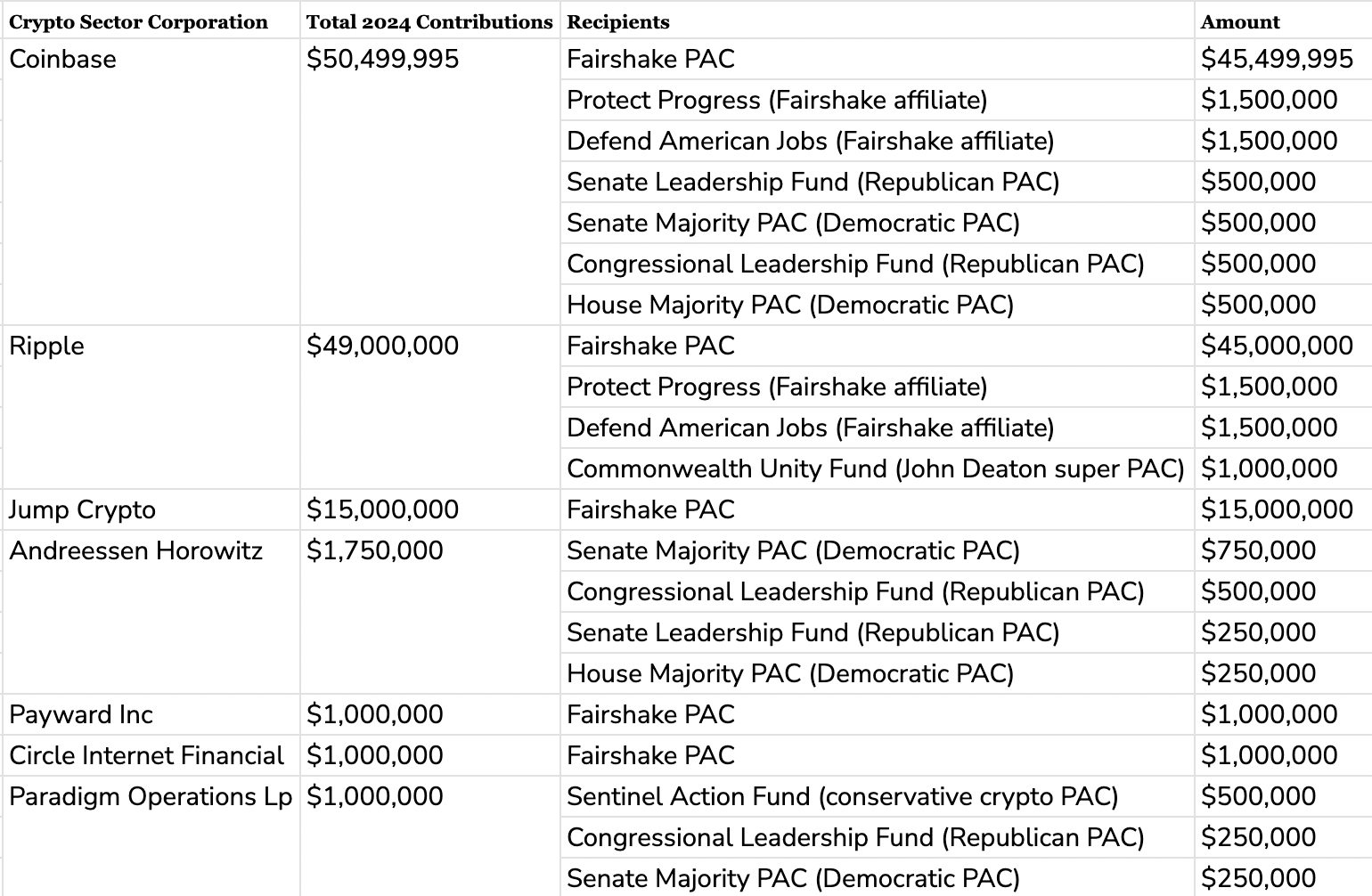

Crypto industry spends millions on donations: Ripple, Coinbase pick sides

Cryptocurrency corporations Ripple and Coinbase have spent around $100 million to make crypto regulation a top issue for presidential candidates in the 2024 election. The two firms have donated almost the entirety of the funds to Political Action Committees (PACs) focused on supporting pro-crypto candidates.

OpenSecrets.org, a non-profit organization that collates data on political campaign fundraising, lists the firms and their donation, alongside details of whether it was made towards Republicans or Democrats.

Crypto Sector Corporations and their donation amount

Reflecting the importance of the election, notable crypto firms have donated to either camp.

One of the co-founders of Ripple, a payment remittance firm that has been embroiled in a legal battle with the SEC for over four years, has explicitly endorsed Kamala Harris.

Ripple co-founder and executive Chairman Christian Larsen pledged $10 million in XRP – the firm’s native token – to Kamala Harris campaign’s Political Action Committee (PAC). Larsen said that he expects democratic lawmakers to have a “new approach to tech innovation” under the Harris presidency.

It's time for the Democrats to have a new approach to tech innovation, including crypto. I believe @KamalaHarris will ensure that American technology dominates the world, which is why I’m donating $10M in XRP in support of her. https://t.co/vb9KJA87JK

— Chris Larsen (@chrislarsensf) October 21, 2024

Back in August 2024, Larsen announced a $1 million donation to Future Forward, a Democratic Party-aligned PAC in California.

About the election, Ripple CEO Brad Garlinghouse said: “we need to immediately change course from this administration’s misguided war on crypto,” adding that the firm will engage with both Democrats and Republicans to promote pro-crypto policies.

Why the US election could determine the future of ETFs: Expert commentary

Eric Balchunas, Senior ETF analyst at Bloomberg Intelligence, says that Exchange Traded Fund (ETF) applications for XRP and Solana (SOL) tokens “won’t happen” if Kamala Harris wins, regardless of the issuer.

Meanwhile, the approval odds of ETFs tracking XRP and SOL could improve significantly under Trump's presidency. Balchunas said that Donald Trump’s win could offer a “decent chance” to more crypto ETFs.

Along the same lines, Nate Geraci, President of The ETF Store, said:

It seems highly unlikely that a Harris administration would approve additional spot crypto ETFs, at least not anytime soon after the election.

Issuers have now filed for xrp, sol, & ltc ETFs…

— Nate Geraci (@NateGeraci) October 21, 2024

What role might November’s election play in approval?

"It won't happen if Harris wins, regardless of the issuer.” -@EricBalchunas

I largely agree & offer some addn’l color here.

via @HeleneBraunn https://t.co/u2deloNDRP pic.twitter.com/9uGRbv6vFT

Observing President Joe Biden administration’s approach to crypto, Geraci concludes that democrats are “combative” and that Harris could follow the status quo.

White House is critical to drive crypto regulation

Kyla Curley, crypto expert and partner at StoneTurn – a global advisory firm – told FXStreet that historically digital assets have been less of a political issue and more of a jurisdictional enforcement issue, which will continue to impact the US crypto market.

“The SEC has taken the lead on enforcement actions related to crypto. However, it remains unclear when, how, and by whom will new frameworks be developed to stay ahead of the global regulatory and financial curve, and who will be charged with owning the enforcement coming out of those frameworks,” Curley said.

“It’s a complicated space that has largely been on hold as we wait on the fate of the various proposed legislation sitting with Congress,” Curley said. “While the White House is one critical aspect of driving the regulatory agenda, the environment is also contingent on the actions of those in the House and Senate,” she added.

The highlight of the current crypto cycle is cryptocurrency’s relationship with US politics. While this is new to the industry, it could have a positive impact on regulatory outcomes, according to experts.

Crypto’s growing influence in politics could drive favorable regulatory outcomes

Jake Ostrovskis, an OTC Trader at Wintermute, told FXStreet that a Trump win could mean more deregulation, possibly creating a more business-friendly environment for crypto firms. “The former US President is likely to prioritize financial innovation over strict oversight, although this might come with risks of less investor protection,” he said.

If current SEC Chair Gary Gensler is replaced, it could lead to less stringent SEC enforcement actions.

Meanwhile, Kamala Harris’ win could result in a continuation of a more cautious regulatory approach, focusing on consumer protection and ensuring compliance with existing financial regulations, Ostrovskis says.

“This points to a possible integration of insights from the current administration's enforcement-heavy approach to crypto,” he adds.

Ostrovskis says that, “the influx of funding from crypto PACs and pro-crypto entities highlights the growing influence of crypto in politics. This could drive more favorable regulatory outcomes for firms in the industry.”

Opportunity for Democrats and Republicans to collaborate on crypto regulation

About chances of cooperation between both parties to push ahead regulation for crypto assets, Ostrovskis says that

“both parties have received donations from pro-crypto entities and this creates a unique opportunity for bipartisan collaboration in crafting clear and balanced regulations.”

This increased political engagement could also pave the way for policies that encourage innovation and broader adoption, such as tax incentives for crypto companies and frameworks that recognize the importance of decentralized finance (DeFi), he said.

No matter Harris or Trump, movement on crypto regulation is expected

Curley says that regardless of who is sitting in the Oval Office come January, digital asset regulation should be anticipated to return to the agenda.

“It is long overdue, and has become too large of an industry to continue operating with regulatory opacity,” she says.

With the lack of federal regulation, states such as New York have rolled out clear parameters for BitLicenses with NYDFS, actions that the next administration could apply at a federal level, Curley illustrates.

“The US can continue as a global leader and take the opportunity to demonstrate that regulation and compliance don’t need to come at the cost of innovation,” she says.

Bitcoin should fare well, altcoins face risk from Harris, rally likely with Trump win

In his policy scorecard research, Thorn said that the largest cryptocurrency, Bitcoin, is expected to fare well irrespective of the election outcome. However, Thorn said that altcoins – cryptocurrencies other than Bitcoin – face risks in the scenario of a Harris administration and could “see outperformance” under Trump’s rule.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.