Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

- Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest.

- Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

- XRP consolidates around $1.36 while holding well below the 50-, 100- and 200-day EMAs.

Bitcoin (BTC) holds above support at $65,118 at the time of writing on Friday. The Crypto King shows subtle signs of recovery after extending declines for four consecutive days through Thursday, reflecting a sticky rise-off sentiment in the broader crypto market.

Ethereum (ETH) remains choppy in a narrow range between support at $1,900 and resistance at $2,000, while Ripple (XRP) attempts another upward move toward the pivotal $1.40 level.

Bitcoin, Ethereum and XRP's weak institutional interest in focus

Bitcoin, Ethereum, and XRP continue to face low or declining institutional interest, as evidenced by the performance of spot Exchange-Traded Funds (ETFs) over the past few weeks.

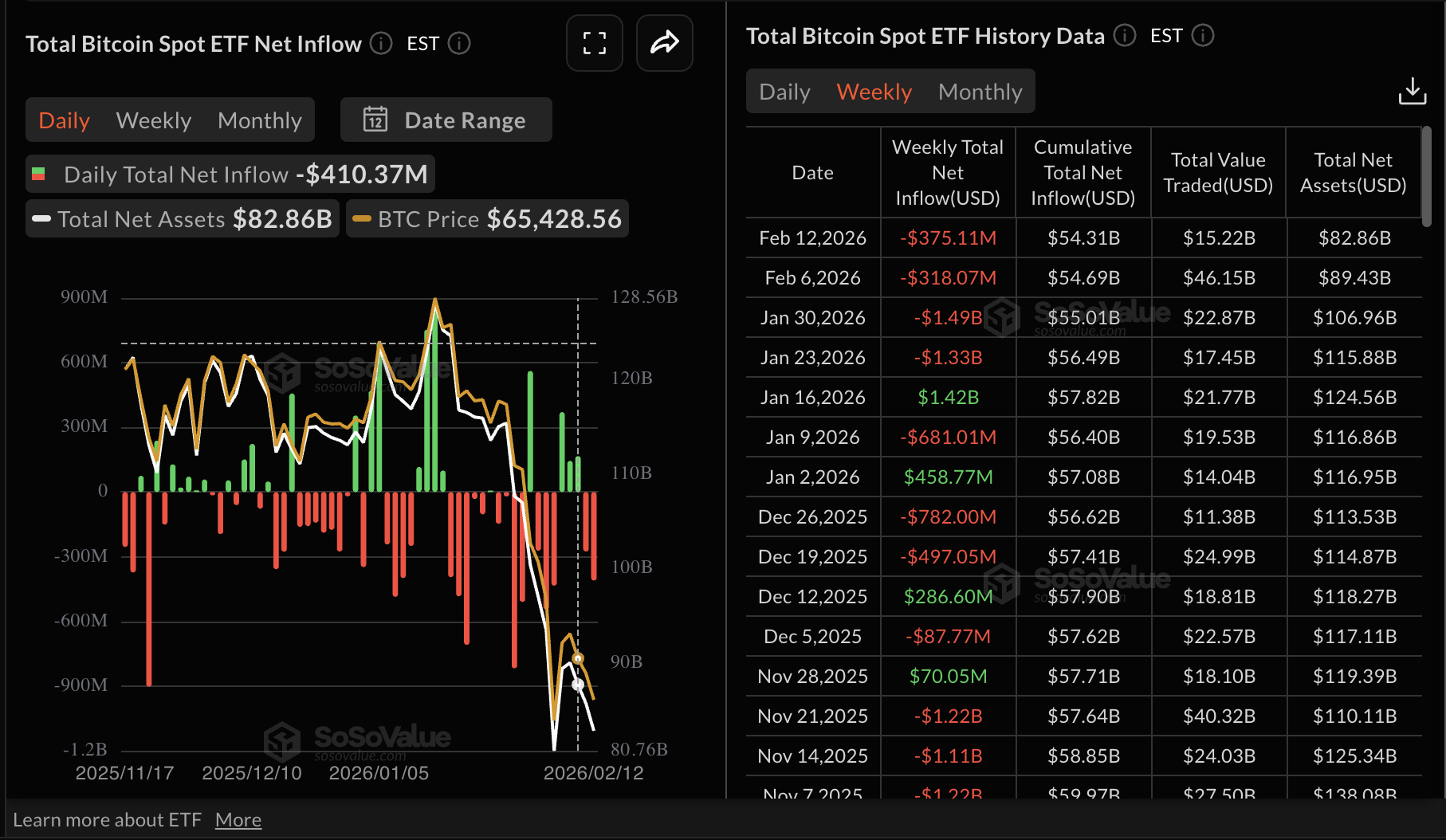

According to SoSoValue data, Bitcoin ETFs are like to log four consecutive weeks of outflows (awaiting Friday's data), driving the cumulative inflows to $54.31 billion, and net assets under management to $82.86 billion. Investors pulled approximately $410 million from the US-listed BTC spot ETFs on Thursday.

The decline undermines risk appetite, suggesting that investors are rebalancing their portfolios and reducing exposure to high-risk assets.

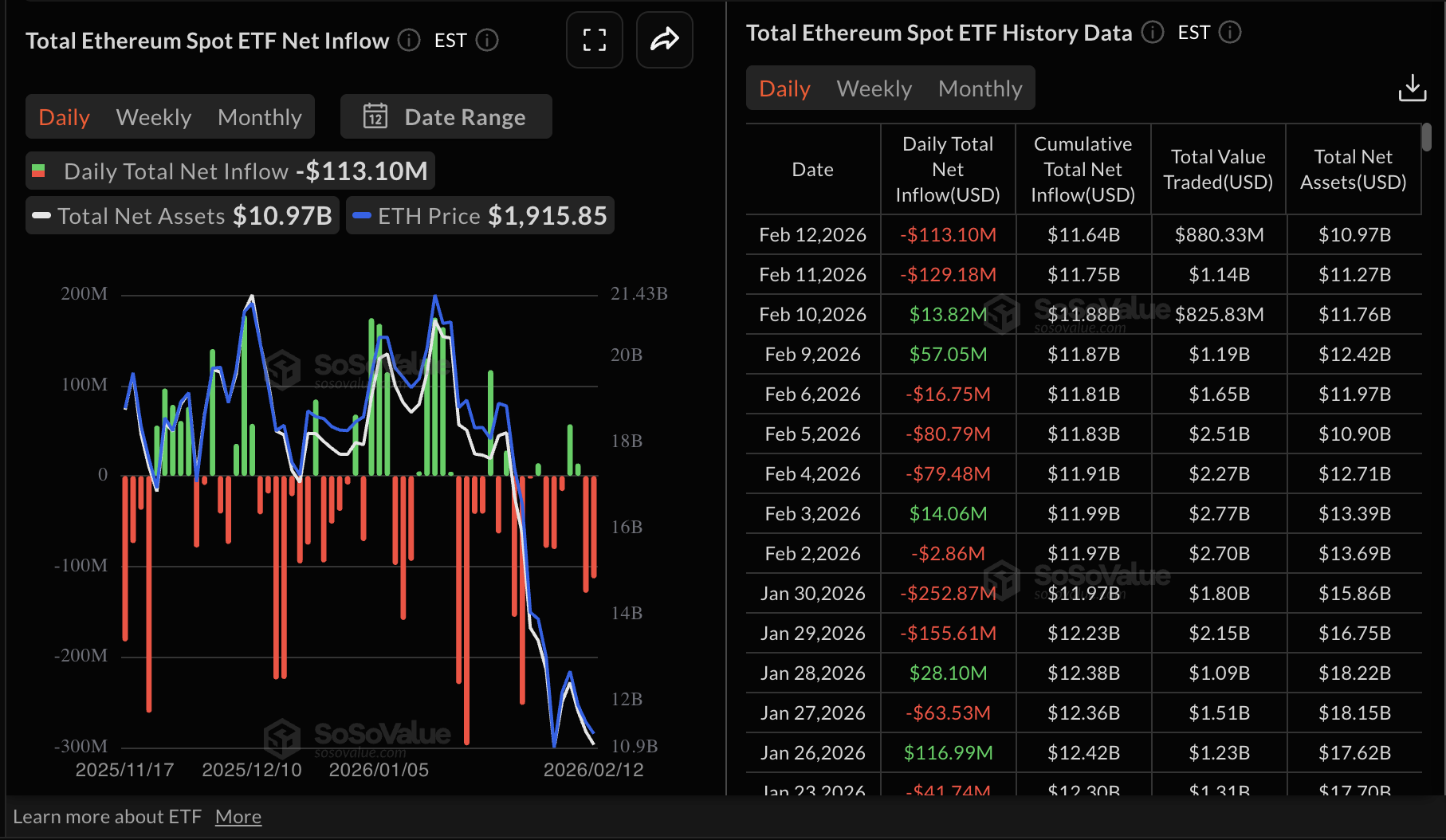

Ethereum also extended outflow on Thursday, as investors drew slightly over $113 million from spot ETFs. This marked the second consecutive day of outflows, after Wednesday's $129 million. Cumulative inflows now stand at $11.64 billion and net assets at $10.97 billion.

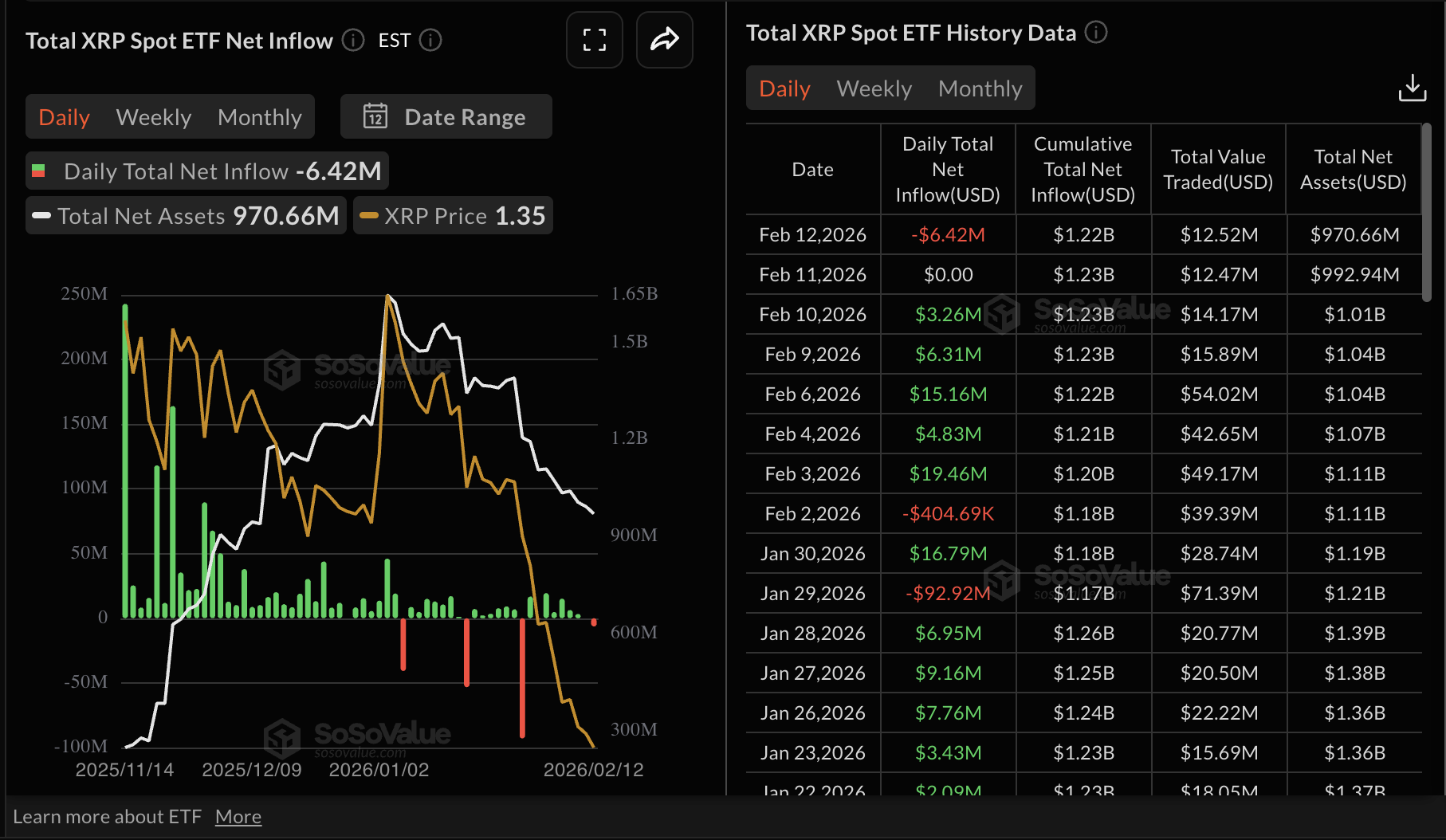

Meanwhile, sentiment around XRP dipped further, with outflows reaching approximately $6.4 million on Thursday after muted flows on Wednesday. Despite Thursday's outflow, the cumulative inflows stand at $1.22 billion with net assets at $971 million.

In contrast, XRP ETFs have maintained steady inflows over the last few months, unlike Bitcoin and Ethereum, underscoring skewed investor interest toward certain altcoins.

Chart of the day: Assessing Bitcoin's technical outlook

Bitcoin is attempting to recover above support at $65,118, supported by the Relative Strength Index (RSI), holding at 31 on the daily chart after recently rising from oversold territory. An extended recovery of the RSI toward the midline would affirm a fresh bullish grip, as bearish momentum eases.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator is narrowing the gap with the signal line on the same chart. Added to this, the red histogram bars continually contract, suggesting that sellers are overextended and a reversal could be in the offing.

Traders will watch for the blue MACD line to cross above the red signal line, signaling a potential bullish shift and increasing their exposure. The next resistance at $70,000 and Sunday's high at $72,271 are the next key targets. However, closing below the immediate $65,118 could push Bitcoin down toward $60,000.

Altcoins technical outlook: Ethereum, XRP test recovery strength

Ethereum is trading between two key levels: Support at $1,900 and resistance at $2,000. Although the RSI at 29 is within oversold territory on the daily chart, it has recovered slightly, supporting a potential knee-jerk upswing.

The MACD indicator also shows signs of a bullish momentum shift, but it must first cross above the signal line on the same chart to confirm the shift. The contracting red histogram bars are likely to prompt investors to lean into risk as they rise above the zero line, turning green.

A decisive break above $2,000 would reinforce the bullish grip and point ETH toward the red resistance zone around $2,150. Still, Ethereum may accelerate its downtrend toward last Friday's low at $1,747 if it closes below $1,900.

As for XRP, bulls are battling to regain control, but the token's position well below the 50-day Exponential Moving Average (EMA) at $1.76, the 100-day EMA at $1.97, and the 200-day EMA at $2.16 underscores strong overall bearish momentum. All three moving averages are sloping downward, reinforcing the bearish grip.

Meanwhile, the RSI has stabilised at 33 (not oversold) on the daily chart, suggesting a delicate balance between bulls and bears. An extended recovery toward the midline would skew the odds toward the bulls and increase the probability of a sustained uptrend toward last Friday's high at $1.54.

Although the MACD remains below its signal line on the same chart, it is poised to cross above it. Such a move would prompt traders to increase risk exposure and support a stable recovery. Nevertheless, XRP is not out of the woods and may extend the correction to the October 10 low at $1.25.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.