The Great Debasement Trade: Declining trust in the US Dollar drives investors to Gold, Bitcoin

- Trust in the US Dollar is declining amid ballooning US debt, a government shutdown, a trade war, and uncertain political conditions.

- A rise in Gold, Silver, Bitcoin, and other commodities or assets considered as havens indicates a shift from the US Dollar.

- Major financial institutions and countries are actively attempting to de-dollarize.

The US Dollar (USD), the global trade settlement currency, is losing trust among investors and international holders of US sovereign debt, as indicated by the shift to alternatives such as Gold or Bitcoin (BTC). The mounting US debt, ongoing tariff adjustments by the US President Donald Trump administration, and the extended US Government shutdown amid political uncertainty are putting the Greenback at risk. This shift, now generally referred to as “the great debasement trade,” is catalyzing the bull cycle in the Commodities market and could force Bitcoin’s narrative of being a “digital Gold, hedge against inflation” for the next crypto market bull run. To gain deeper insights into debasement trades, the surge in Gold and Bitcoin prices, and market cycles, FXStreet interviewed multiple experts.

Why are investors moving away from the US Dollar?

Ever since Richard Nixon, the 37th US President, derailed the Bretton Woods system, the US Dollar’s notes have been backed by the US Government's faith and credit. The Greenback sustained its dominance through the “petrodollar,” which refers to the revenues collected by Oil exporters, mainly the Organization of the Petroleum Exporting Countries (OPEC), which were directed to US Treasuries and financial assets.

The Bretton Woods system was an international monetary system established in 1944 that fixed exchange rates based on the US Dollar, which was pegged to Gold.

However, the shift from the Gold standard lowered the trust in the US Dollar, and current financial indicators suggest further decline. Here are the key reasons why investors are losing confidence in the USD.

Rising US debt

Most developed economies worldwide, including the United States, are experiencing rising debt, which is gradually eroding their Gross Domestic Product (GDP).

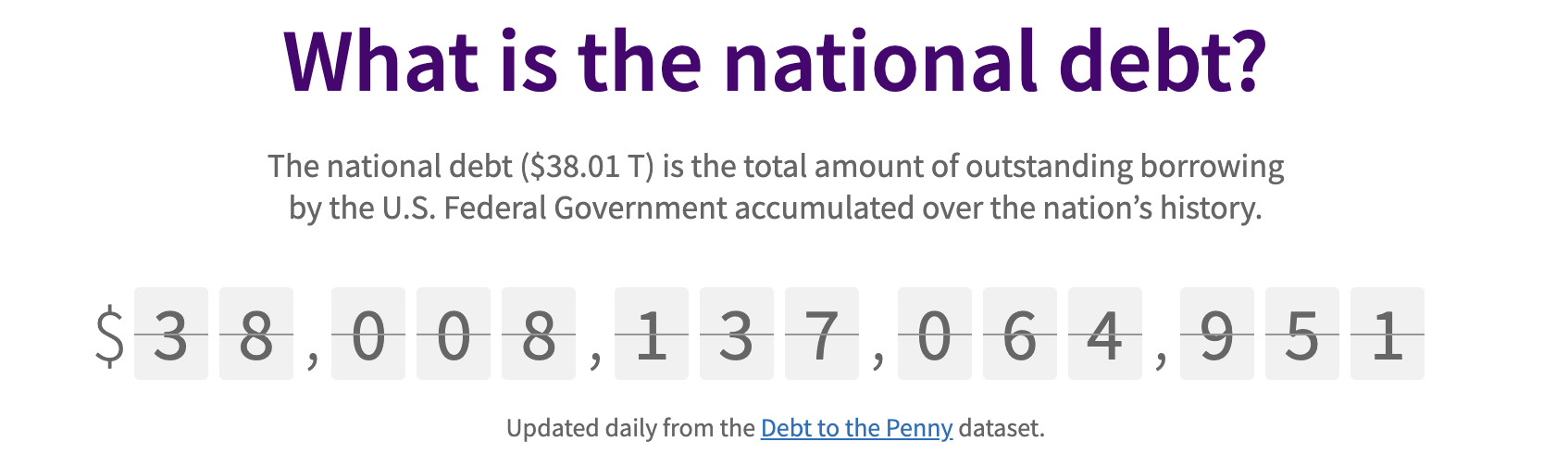

The US Government debt has reached $38 trillion as of October 27, up from $24.71 trillion in 2015. Of the total debt, $30.28 trillion was held by the public, according to the September US Treasury Monthly Statement of the Public Debt.

US national debt as of October 27. Source: Fiscal data.

As per the Congressional Budget Office’s (CBO) federal finances report for Financial Year (FY) 2025, the fiscal deficit has reduced to $1.809 trillion, or 6.0% of the US GDP, from $1.817 trillion, or 6.3% of GDP in FY 2024.

However, the numbers for 2025 improved on the artificial reduction of $234 billion from federal student loan programs. If included, the difference between debt and GDP would have been $2.043 trillion, or 6.7% of GDP.

David Kelly, the Chief Global Strategist at JP Morgan, in a note named "Going Broke Slowly: The Investment Implications of Still-Rising Federal Debt,” on October 13, underlined “if nominal GDP grows by roughly 4.5% going forward, (comprised of 2.0% real growth and 2.5% inflation), then any budget deficit north of 4.5% will cause the debt-to-GDP ratio to rise. Under our assumptions, the debt-to-GDP ratio climbs from 99.9% on September 30th, 2025, to 102.2% of GDP 12 months later.”

With the US suffering from high national debt, interest on government Bonds is pushed higher, which in turn boosts Bond yields. However, the surge stemming from fiscal stress, rather than real financial growth, highlights the underlying risks that could erode confidence in the US Dollar and its assets.

In simple terms, the pressure to pay the debt reduces the funds available for national growth, potentially leading to additional debt.

Domestic troubles amid the international trade war

To address the rising debt problem, US President Donald Trump imposed higher tariffs on countries with trade deficits, such as China, India, and other major nations. The tariff revenues reached $31 billion in August, bringing the total revenue to $158 billion for the calendar year so far.

However, Trump faces opposition on the domestic front, as the tariffs increased under the Emergency Economic Powers Act of 1977 are being challenged in the US Supreme Court. If the tariffs are declared illegal, it could force a refund to the partnering countries, potentially bringing the US back to square one.

On the other hand, the US Government is under shutdown as the partisans stand off over federal spending. The shutdown began on October 1 and remains in effect as of October 27, fueling ongoing political tensions. Historically, this is the second-longest US government shutdown, second only to the 35-day shutdown that started in December 2018 over US border wall funding.

Possibly anticipating the rocky road ahead, Moody's, a globally renowned credit rating agency, downgraded the US credit rating to Aa1 from Aaa in May, citing rising government debt and political instability under Donald Trump’s second administration as the key reasons.

The debasement trade

Debasement trades are a strategic shift in investment, typically seen amid expectations that money or other financial assets will lose their value. These trades involve a capital reallocation to “safe haven” Commodities, such as precious metals. Bitcoin and other top cryptocurrencies, along with Digital Asset Treasuries (DATs) in the pipeline, are also offering a hedge to the US Dollar.

Signs of debasement trade

Gold and Silver at record highs are a clear signal of a tectonic shift in investors' sentiment as they seek safe investments. As of October 24, an ounce of Gold trades at $4,056, marking an over 60% rise so far this year. Similarly, Silver trades at nearly $48, having stepped down from its all-time high of $54.86 on October 16, has outpaced Gold with nearly an 80% rise so far this year.

Gold and Silver daily price chart.

The DATs, including Michael Saylor’s Strategy with 640,418 BTC worth $74.01 billion, Marathon Holdings with 53,250 BTC worth $6.15 billion as of October 27, and others, have significantly increased their exposure to Bitcoin. This indicates a confident shift of corporate institutions towards Bitcoin.

On the other hand, the US-based Exchange Traded Funds (ETFs) like BlackRock’s iShares Bitcoin Trust (IBIT) with $85.52 billion and Fidelity’s FBTC with $21.93 billion in net assets, and others have increased holdings by over $38 billion and recorded just three net monthly outflows so far this year.

Countries shifting away from the US Dollar

Many countries around the world are shifting away from the US Dollar to reduce their dependence on the Greenback, in an effort to boost trade. BRICS is an intergovernmental organization comprising Brazil, Russia, India, China, and South Africa, as well as other emerging economies, aiming to de-dollarize and potentially introduce a Central Bank Digital Currency (CBDC).

Currently, Russia is accepting local currency trade settlements with China and India, due to the ongoing conflict with Ukraine, which resulted in multiple international sanctions from the US and EU.

Who is betting on the decline of the US Dollar?

Hedge funds are investment vehicles that use diverse strategies — both long and short — to generate returns and manage risk. Some funds profit from market declines, which can align with themes like the ongoing ‘great debasement trade.’ Here are some hedge fund founders predicting a shift amid US debt.

Ray Dalio

Ray Dalio, founder of Bridgewater, the world's largest hedge fund with over $90 billion in assets under management as of 2024, has issued multiple warnings about the rising US Government debt, comparing the situation to the conditions in the years leading up to World War II. In a Bloomberg interview on October 10, Dalio commented, “It’s like plaque in the arteries that then begins to squeeze out the spending,” if debt is rising relative to income.

Dalio further emphasized in an X post on October 24 that “sanctions reduce the demand for fiat currencies and debts denominated in them and support gold.”

Kenneth Griffin

Kenneth Griffin, CEO of Citadel LLC, said in an interview with Bloomberg on October 7 that rising inflation is a leading cause of decline in the US Dollar value. Griffin said, “It’s [inflation] part of the reason the Dollar's depreciated by about 10% in the first half of this year.”

Noting the record high prices of Gold and the “appreciation in other Dollar substitutes,” the hedge fund CEO finds the situation unbelievable. Furthermore, Griffing highlighted that “people are looking for ways to effectively de-dollarize or de-risk their portfolios vis-à-vis US sovereign risk.”

Apart from hedge fund managers, Elon Musk, CEO of Tesla, recently replied to a ZeroHedge X post, which said, “AI is the new global arms race, and capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it's the "debasement" to fund the AI arms race.”

As per Musk, “Bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.”

Expert insights on debasement, Gold, and Bitcoin

To gain further insight, FXStreet interviewed experts in the cryptocurrency markets.

Karim AbdelMawla, senior researcher at 21Shares

What role could tokenized commodities or on‑chain treasuries play in the emerging debasement hedge ecosystem?

Tokenized US treasuries, which reflect short-term government debt, have grown to nearly $9 billion in total value locked across more than 50 products, offering investors programmable access to 4–5% yields and around-the-clock liquidity. They anchor DeFi’s emerging risk-free rate and give participants a low volatility yield instrument independent of the banking system. Tokenized Gold, led by Tether Gold (XAUT) and Pax Gold (PAXG), has surpassed $2.5 billion in market cap, enabling investors to hold physically-backed Gold with blockchain settlement and collateralization. Together, on-chain treasuries and tokenized commodities form the core of a new debasement hedge architecture by allowing treasuries to provide yield and stability, Gold to establish insurance against fiat erosion, and Bitcoin to provide convex upside as it plays a dual role of being a risk-on and risk-off asset. Thus, this integrated structure is becoming central to the debasement hedge thesis in both traditional and crypto-focused portfolios.

Will Gold outperform Bitcoin in the ongoing “great debasement trade”?

In 2025, Gold has outperformed Bitcoin year to date by roughly 25 to 30%, reaching new highs above $4,000, while Bitcoin remains volatile after its October correction. This outperformance reflects institutional preference for liquidity and lower career risk amid fiscal uncertainty and geopolitical stress. Gold remains the first responder hedge in crisis phases, while Bitcoin retains higher long-term convexity and scarcity value. Over five-year horizons, Bitcoin still vastly outperforms Gold, but investors pay for that upside sometimes through higher volatility. That is why the ideal debasement trade portfolio, therefore, blends Gold for stability and credibility, Bitcoin for convex optionality, and tokenized treasuries for yield — balancing resilience, return potential, and liquidity in a structurally inflationary macro regime.

Could stablecoin diversification (USD‑pegged vs commodity‑pegged vs Bitcoin‑pegged) amplify or weaken the “anti‑fiat” narrative?

In theory, stablecoin diversification reinforces the anti-fiat narrative by reducing dependence on the US Dollar and introducing non-sovereign collateral such as Gold, Bitcoin, hardware-backed synthetic stablecoins like USDAI, where real-world assets such as GPUs and AI infrastructure support a Dollar-pegged token, or stablecoins backed by private credit yield like Maple Finance’s syrupUSDC.

More advanced designs, such as Ethena’s USDe, extend this idea through delta-neutral market strategies. In practice, however, the USD remains dominant, with USDT and USDC together accounting for more than 80% of the stablecoin market. The rise of Gold and Bitcoin-pegged stablecoins signals growing interest in fiat-independent units of account, yet their scale remains too limited to meaningfully challenge USD dominance. For now, the spread of alternative pegs strengthens the anti-fiat narrative symbolically rather than structurally. True diversification will only emerge once non-USD-backed stablecoins achieve significant liquidity and settlement volume across DeFi and global trade rails.

Which metrics best measure the rise of debasement‑driven capital allocation trends?

The debasement trade is increasingly evident when monetary pressure gauges are viewed alongside capital flow dynamics. US M2 stands near $22.2 trillion, roughly 40% higher than in 2020, compared with only 12 to 15% cumulative real GDP growth over the same period. The Federal Reserve balance sheet, at about $6.6 trillion, remains well above its pre-COVID level of $4.2 trillion despite ongoing tightening. With the debt-to-GDP ratio near 125% and projected to approach 156%, and after more than two years of negative real rates between 2021 and 2023, the overall monetary environment continues to favor hard assets over nominal claims.

Bitcoin’s correlation with Gold has risen to around 0.85, near a record high, while the Bitcoin-to-Gold ratio has fallen roughly 30% since mid-August 2025, indicating renewed relative strength in Gold. On an M2-adjusted basis, Bitcoin reached an all-time high in September 2025, suggesting a structural shift in capital flows rather than a purely cyclical upswing. Institutionally, cash allocations have fallen to 3.8%, a 12-year low, even as US money market funds hold roughly $7.4 trillion, highlighting continued liquidity preference on a large scale.

Within crypto, spot Bitcoin ETFs have drawn about $60 billion in cumulative inflows since launch, with BlackRock’s IBIT approaching $100 billion in assets. The stablecoin market expanded from roughly $205 billion to more than $300 billion in 2025, reflecting strong demand for US Dollar-linked liquidity inside the digital asset ecosystem.

In the broader hard asset complex, Gold’s total market value now stands near $28 to 30 trillion, up roughly $10 trillion this year amid record central bank accumulation. Across assets, Bitcoin remains closely correlated with both equities and Gold, while Gold’s correlation with the US Dollar remains deeply negative; a macro alignment consistent with persistent monetary debasement pressure and a widening global preference for tangible stores of value.

Are the BRICS nations’ efforts to de-dollarize creating genuine demand for Bitcoin or just CBDCs and stablecoins?

BRICS de-dollarization so far has been transactional rather than reserve-based, focusing on bilateral settlement in local currencies, new cross-border payment systems, and central bank digital currency pilots, not Bitcoin accumulation. Central banks have instead expanded Gold reserves rather than BTC holdings, although some are seriously contemplating this, like Pakistan and the Czech Republic. Among private citizens in high-inflation BRICS economies, USD stablecoin adoption has surged as a practical hedge against local currency volatility, preceding any material Bitcoin uptake. Therefore, BRICS de-dollarization currently fuels CBDC experimentation and stablecoin utility, while Bitcoin demand remains retail-driven and largely outside official channels.

Jonathan Morgan, lead crypto analyst, Stocktwits

How does the growing US debt burden influence global investor sentiment toward fiat currencies and crypto alternatives?

I think the debt story hits people in two ways: short term, it doesn’t scare them off the US Dollar, probably reinforces it. More debt means more treasuries/T-bills, and they’re considered the safest income generator on earth. That helps the US Dollar, and it helps with all the stablecoins backed by treasuries. I believe that’s going to explode even more because there’s such an appetite for it.

But the longer this debt grows and stacks, people might get worried. Is the growth of BTC, Gold, and Silver evidence of that? Maybe, but you don’t see a lot of retail ringing the alarms yet.

Do the USD-pegged stablecoins just shift the inflation, US Debt, or the risk of holding the US Dollar to the crypto market?

They do, but that’s the trade-off. HODLing USDT (USDC, etc), you are in effect holding tokenized money-market exposure (just a broad interpretation). You’re not escaping the Fed or trade policies. The funny part is, more US debt helps because it creates more collateral.

How does the $19 billion liquidation event on Friday, the largest-ever in crypto history, fit into Bitcoin’s “hedge against regulations, inflation, and digital Gold” narrative?

It doesn’t. If you had any exposure to leverage on the 10th, then you got wrecked and probably wiped out. If you didn’t, then all you’ve lost is the paper loss on the value of your crypto dipping. For leveraged traders, it was a life-altering horror fest, but for everyone else, it was just another day - at least when it comes to the value of their accounts.

What are your views on Gold outperforming Bitcoin?

This depends on where you’re setting your calendar when it comes to Gold outperforming Bitcoin. Measured in recent months, yes, Gold is outperforming Bitcoin. But context is needed.

Let me put it to you this way: if I put $100 into Gold, $100 into the SPY, and $100 into Bitcoin in January 2020, my SPY would be worth $204, Gold $280, and BTC $1,500 (roughly).

If you want to do the same thing and go back 10 years, it’s even more stupidly dramatic: your $100 of Gold is worth $360, your $100 of SPY is worth $321 (with dividends and you’re looking at $420ish), but your $100 of BTC is worth close to $34,000.

Maarteen AKA Maartunn, community analyst at CryptoQuant

How do you view the relationship between US debt levels and the price movements of Bitcoin and Gold?

Increasing US debt levels can make investors worry about the government’s ability to manage its future obligations. This loss of confidence can weaken trust in the US Dollar and Treasury bonds, prompting investors to seek alternative assets.

The best thing to do? Invest in what the government can’t print: stocks, Gold, and Bitcoin are the most common examples. Luxury goods, high-end cars, and even collectible items like Pokémon cards have also risen in value, partly due to speculation as investors look for assets that hold or increase in value over time.

Do the liquidation spikes in the crypto market after the $19 billion wipeout event reposition Bitcoin’s claim as a safe haven?

No, in my opinion, it’s not. Bitcoin has a fixed supply, whereas the US Dollar does not. It will take decades for Bitcoin to gain more ground, and that process will naturally come with both positive and negative shocks.

The $19 billion wipeout is a negative shock, but it shouldn’t change the long-term perspective.

What role do on-chain metrics play in identifying these trade opportunities?

On-chain data helps identify when Bitcoin is relatively cheap compared to historical values or the cost basis of long-term holders. For example, the MVRV ratio (Market Value to Realized Value) compares Bitcoin’s current market price to the average cost basis of all holders. When the MVRV ratio is low, it suggests that Bitcoin is trading below the average holder’s cost basis — a signal that the asset might be undervalued and potentially near a market bottom.

By analyzing these on-chain signals alongside macro factors such as US debt trends, traders can make more informed decisions about when to enter or exit the market.