Gold holds above $5,000 despite strong NFP and rising US yields

- Gold ignores strong US Nonfarm Payrolls as dip buyers step in despite rising Treasury yields.

- Hawkish remarks from Jeffrey Schmid curb aggressive Fed rate cut expectations.

- Geopolitical and trade risks tied to US President Trump keep bullion supported above $5,000.

Gold (XAU/USD) price holds firm above $5,000 on Wednesday after the latest US jobs report exceeded forecasts, triggering a re-pricing for a less dovish than expected Federal Reserve (Fed) throughout the first semester of 2026. At the time of writing, XAU/USD trades at $5,054, up 0.61%.

XAU/USD steadies as central bank buying and political uncertainty offset firmer Treasury yields and hawkish Fed rhetoric

Earlier, the latest US Nonfarm Payrolls report, delayed by the three-day government shutdown, crushed estimates, rising by 130K in January, up from December’s 48K and above estimates of 70K. Consequently, the Unemployment Rate dipped to 4.3% from 4.4% and triggered a reaction by investors, who are now eyeing the Fed’s first rate cut in July.

Gold’s reaction was downwards towards its daily low of $5,018, before resuming towards $5,050, and it has remained there since the NFP announcement.

US Treasury yields rise and underpin the Greenback

US Treasury yields are recovering some ground, a headwind for Bullion. The US 10-year Treasury note is up almost three basis points to 4.168%. The US Dollar Index (DXY), which evaluates the performance of the US Dollar against a basket of six major currencies, has increased by 0.07% to 96.95

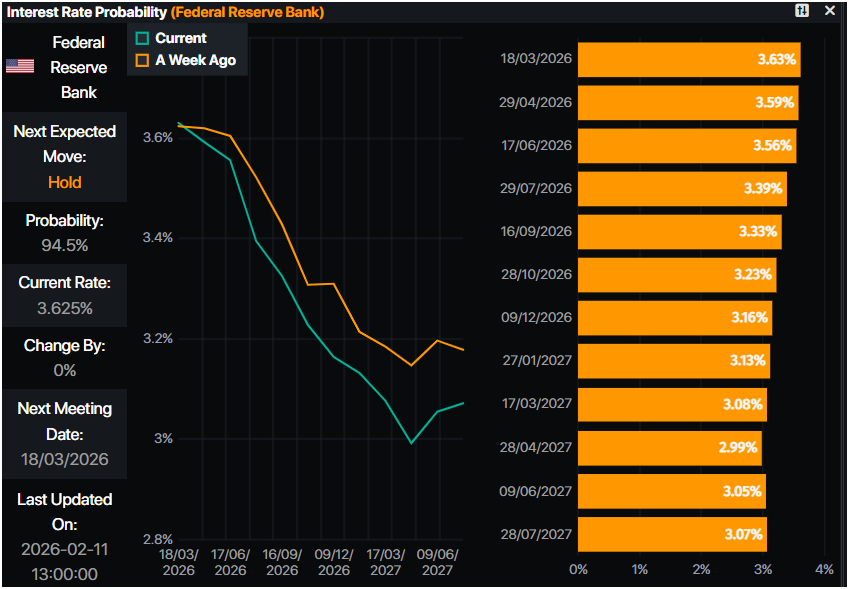

Money markets are pricing in a 100% chance for a Fed rate cut in July 2026, according to Prime Market Terminal data.

In the meantime, Kansas City Fed President Jeffrey Schmid poured cold water on US President Donald Trump’s support of lowering interest rates. Schmid said that “rate cuts might permit higher inflation to continue for a longer time,” reiterating his hawkish stance.

Schmid commented that policy is not restraining the economy and added that monetary policy needs to remain restrictive as long as inflation is near 3%.

Nevertheless, Gold prices remain underpinned by central bank buying, the debasement trade and uncertainty around controversial politics by the White House.

A Bloomberg article headline on Wednesday read that “Trump privately weighs quitting USMCA trade pact he negotiated.” The article mentions that “Such a move would shake the foundations of one of the largest trading relationships in the world — the pact covers roughly $2 trillion in goods and services — and even the threat of a US departure would stoke uncertainty for investors and world leaders.”

Ukraine’s President Volodymyr Zelenskyy said that a deal on territory is the focus point of the next talks with the US, signaling that they may surrender territory to end the war.

What’s in the US economic schedule?

The docket will feature Initial Jobless Claims data for the week ending February 7 and Fed speeches on Thursday. By Friday, traders’ eyes will be on January’s Consumer Price Index (CPI) report, which is expected to come in softer than expected. Headline and core inflation figures are foreseen to dip from 2.7% to 2.5% YoY and from 2.6% to 2.5%, respectively.

If the data is aligned with estimates, Gold could extend its rally as Fed officials had stressed that if the disinflation process resumes, they might consider lowering rates.

XAU/USD Price Forecast: Bullish momentum builds on Gold above the 20-day SMA

Gold price action shows that the uptrend remains intact, and as long as the yellow metal remains above the 20-day Simple Moving Average (SMA) at $4,935, the trend remains constructive with buyers eyeing higher prices. If they reclaim the $5,100 mark, this could exacerbate a rally towards $5,451, the January 30 high. On further strength, the challenge of the record high at $5,598 is on the cards.

Conversely, if XAU/USD dives underneath the 20-day SMA, sellers may target the February 6 swing low of $4,655 before testing the 50-day SMA at $4,588.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.