Gold slides nearly 1% as US Dollar firms, geopolitics tensions de-escalate

- Gold retreats from $5,091 daily highs as modest US Dollar strength pressures prices near $4,900.

- Markets digest mixed US data, with softer employment signals offset by firm services activity and rising prices.

- Reduced tensions after talks between Donald Trump and Xi Jinping cap haven flows despite Middle East risks.

Gold price retreats during the North American session on Wednesday, down more than 1% after reaching a three-day high of $5,091. A mixed market mood and modest US Dollar strength keep XAU/USD trading with losses at around $4,901 at the time of writing.

XAU/USD pulls back from three-day highs as calmer geopolitics and resilient US data weigh on safe-haven demand

The yellow metal erased some of its earlier gains even though the latest round of US jobs data showed signs of weakness. At the same time, business activity in the services sector remained solid, yet showed mixed readings in the PMI’s sub-components of employment ─edging lower─ and the Price Index rising.

On the geopolitical front, a positive call between US President Donald Trump and his Chinese counterpart Xi Jinping keeps tensions calm between Washington and Beijing.

In the meantime, Iran and the US are poised to begin talks in Oman on Friday as tensions escalated after the US military shot down an Iranian drone approaching an aircraft carrier in the Arabian Sea on Tuesday.

The short US government shutdown delayed the January Nonfarm Payrolls report until February 11, revealed the US Bureau of Labor Statistics (BLS).

Worth noting that US Treasury Secretary Scott Bessent reiterated the strong US Dollar policy is in the interests of Washington, while adding that “tariff inflation was the dog that didn’t bark.”

Ahead this week, the US economic docket will feature the US JOLTS job openings and the release of jobless claims for the week ending January 31.

Daily market movers: Broad US Dollar strength, steady US yields weigh on Gold

- Gold is losing its shine due to overall US Dollar strength, with the US Dollar Index (DXY) rising 0.31% at the time of writing. The DXY, which measures the performance of six currencies against the Greenback, is at 97.67.

- Steady US Treasury yields capped Bullion’s advance. The US 10-year Treasury note is yielding 4.27%, unchanged.

- The US ADP Employment Change for January showed that private employers hired just 22K people, below the 48K projected.

- The Institute for Supply Management reported that the Services PMI for January came in above expectations, rising to 53.8 versus forecasts of 53.5 and matching December’s reading. The Employment Index expanded for a second consecutive month, though at a slower pace than in December. Meanwhile, the Prices Paid component climbed to 66.6 from 65.1, reaching its highest level in the past two months.

- US President Donald Trump said that he had an excellent telephone conversation with President Xi of China. Trump revealed that he would be traveling to China in April and that they discussed trade, military, Taiwan, the Russia/Ukraine war, Iran and China’s purchasing oil and gas from the US.

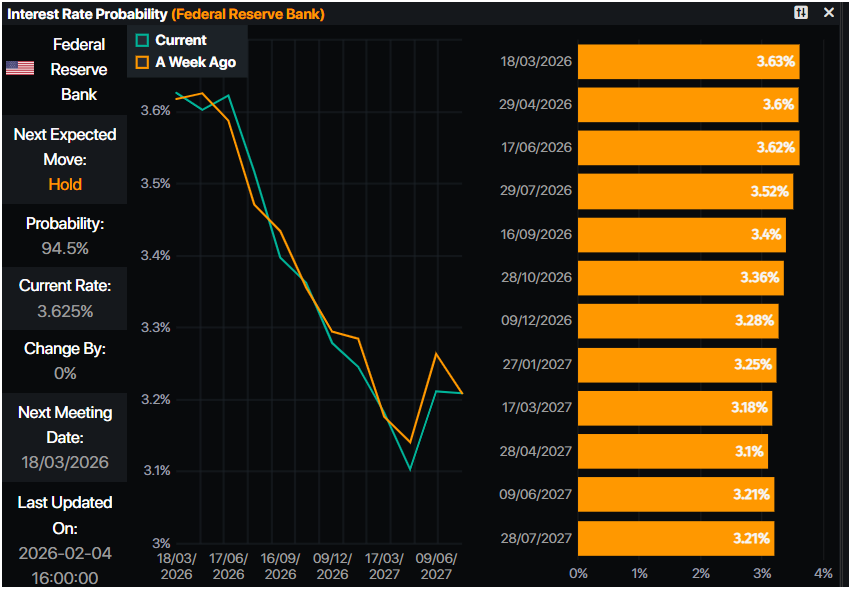

- Money markets had priced in 47 basis points of Fed easing towards the year-end, according to data from Prime Market Terminal.

Technical outlook: Gold drops towards $4,900, bears eye lower prices

Gold price is forming an ‘inverted hammer’ bearish candle pattern, which could shift to a ‘shooting star’ if Thursday’s price action is bearish. Momentum as measured by the Relative Strength Index (RSI) shows that buyers are losing steam, despite the index standing at bullish territory.

If XAU/USD ends on a daily basis below $4,900, traders could expect a test of the $4,850, followed by $4,800. A breach of the latter will expose the February 3 daily low of $4,643. Once cleared, the ‘shooting star’ pattern will be confirmed along with Gold’s bearish bias in the short-term.

On the flip side, if Bullion rises past $4,950, buyers could test the $5,000 once more.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.