Gold tanks below $5,000 as Warsh Fed pick, US inflation weigh

- Gold sinks sharply after Trump nominates Kevin Warsh, reviving expectations of a more hawkish Fed.

- Hot US producer inflation reinforces the Fed’s hold decision, pushing Treasury yields and USDollar higher.

- Rising yields and fading rate-cut bets trigger aggressive profit-taking after Gold’s parabolic rally.

Gold price (XAU/USD) extends its losses on Friday, plunges nearly 10% to sink below $4,900 after US President Donald Trump revealed his pick for Fed Chair, while a hot inflation reading in the US justified the Federal Reserve’s (Fed) decision on Wednesday to keep rates steady. The XAU/USD trades around the top/bottom of the $5,000 mark.

Bullion plunges over 7% as a hawkish Fed chair nomination and stubborn inflation crush easing hopes

On Friday morning, Trump revealed that he chose Kevin Warsh to become the new Chair of the US central bank. Warsh wasknown as a hawk in his previous period as Governor at the Fed.

Since the announcement, Gold prices have reaccelerated their losses, while the Greenback recovered, despite being poised to sustain losses of over 1.42% in January, based on the US Dollar Index (DXY).

The DXY, which measures the US currency performance versus six peers, surges 0.74% to 96.87, a headwind for Bullion prices.

Long-dated US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up one-and-a-half basis points at 4.247% as of writing.

In the meantime, Fed speakers are crossing the wires, led by Atlanta’s Fed Raphael Bostic, Fed Governors Christopher Waller and Stephen Miran.

On the data front, prices paid by producers in the US missed estimates for a deceleration and remained steadily above the Fed’s 2% goal. This supports the Fed’s decision on Wednesday to hold rates amid growing concerns that inflation could reaccelerate.

Next week, the US economic docket will feature a tranche of US jobs data, speeches by Fed officials, and the ISM Manufacturing and Services PMIs for January.

Daily market movers: Gold plunges sharply as US Dollar recovers

- Fed Governor Stephen Miran described Warsh as an excellent choice for the Fed, noting that the main drivers of the recent increase in PPI are house prices and portfolio management fees.

- Governor Christopher Waller pointed out that the labor market remains weak despite steady economic growth and remarked that inflation would be close to 2% if not for tariffs, which have kept it near the 3% mark. Waller also stated that policy should be closer to neutral, around 3%.

- Atlanta Fed President Raphael Bostic emphasized the need for patience regarding monetary policy, suggesting it should be somewhat restrictive, and noted that the full impact of tariffs on prices has yet to be seen. He anticipates that inflation will remain persistent.

- The US Bureau of Labor Statistics (BLS) featured the Producer Price Index (PPI) for December, which rose by 3% YoY, remaining unchanged from November and missing expectations of a 2.7% decline. Core PPI, which excludes food and energy components, rose by 3.3% YoY, above the prior month's 3% increase and contrary to consensus estimates anticipating a decrease to 2.9%.

- Last Wednesday, the Fed held rates unchanged, adopting a cautious approach and revealing that policy decisions would be taken meeting by meeting.

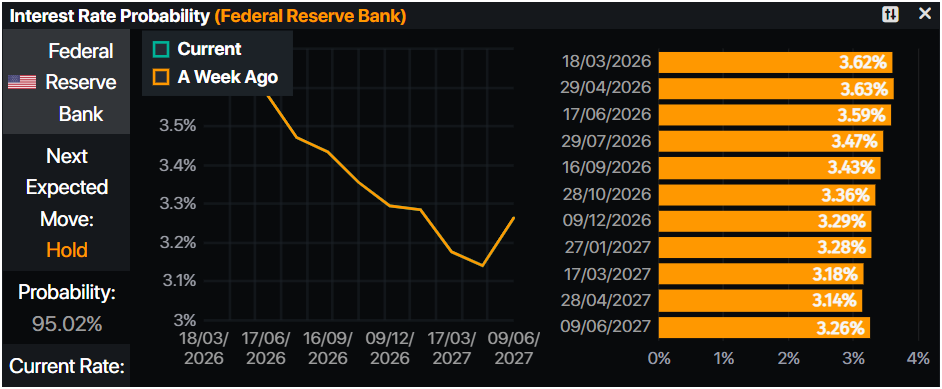

- As of writing, money markets had priced in 51 basis points of easing by the Fed toward the end of the year, revealed data from Prime Market Terminal.

Technical outlook: Gold crashes below $5,000 as bears push prices lower

Gold is diving sharply on Friday, clearing key support levels like $5,000, extending its losses toward $4,850. Bullish momentum seems to be fading as depicted by the Relative Strength Index (RSI), which is reaching its neutral level.

However, the uptrend remains intact, unless XAU/USD drops below December 26 high of $4,549, which could exacerbate a test of the 50-day SMA at $4,474.

If XAU/USD reclaims $5,000, the first resistance would be the January 27 high at $5,182, ahead of $5,200. Up next lies $5,300.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.