Gold trims losses, peaks near $5,600, set for strongest month in decades

- Gold pulls back from record highs as traders take profits after a steep, parabolic rally.

- A broad sell-off hits metals, equities, and crypto, signaling short-term risk reduction across markets.

- Despite retreat, Gold remains up over 23% YTD, eyeing the best monthly gain since the 1980s.

Gold (XAU/USD) trims some of its earlier losses on Thursday as traders book profits following the Federal Reserve’s (Fed) monetary policy decision, which barely moved the needle as the yellow metal seems poised to record its best month since the 1980s. At the time of writing, XAU/USD trades at $5,315, down 1.83%.

Bullion pares earlier losses as profit-taking follows the Fed hold, poised for historic monthly gains

The yellow metal hit a record high near $5,600 on Thursday before volatility in the financial markets spiked, sending Bullion prices towards its daily low at $5,098.

During the day, the financial markets witnessed a plunge in precious metals, which also sent Silver prices to a daily low of $106.62 a troy, with the Nasdaq also plunging while Bitcoin and Ethereum followed suit.

Although speculation suggests that escalating tensions between the US and Iran could have been the trigger, it seems that investors took some of their chips off the table, amid the ongoing parabolic run that keeps Gold up 23% year-to-date (YTD).

In the meantime, the nominee to succeed Jerome Powell as the Chair of the Federal Reserve will be named next week, revealed US President Donald Trump.

Data-wise, the US economic docket revealed jobs data as the number of Americans filing for unemployment benefits rose above estimates, according to the Department of Labor. At the same time, the US trade deficit widened the most since March 1992, rising to $56 billion in November, due to a surge in capital goods imports.

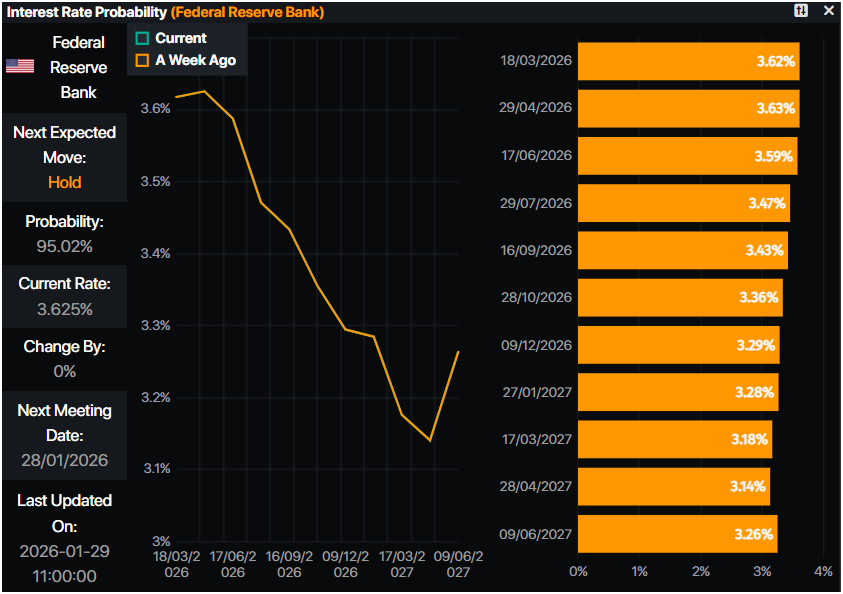

The Federal Reserve held rates unchanged on Wednesday, signaling that it would adopt a cautious approach and decide policy meeting by meeting.

Ahead this week, the US economic docket will feature December’s Producer Price Index (PPI) data, the Chicago Fed PMI and speeches by Fed Governor Michelle Bowman and St. Louis Fed President Alberto Musalem.

Daily market movers: Gold's advance halts as the Dollar recovers

- The drivers behind Gold's move have been the US Dollar being steady and, investors booking profits. The US Dollar Index (DXY), which measures the performance of the buck’s value against a basket of six currencies, is nearly flat at 96.27.

- Falling US Treasury bond yields capped Gold’s losses, as the 10-year Treasury note is down two basis points at 4.227%, as of writing.

- The Labor Department revealed that the number of Americans filing for unemployment benefits dipped from upwardly revised 210K figures to 209K in the week ending January 24. Economists expected 205K claims for the latest week. Continuing Claims fell from 1.865 million to 1.827 million, beneath estimates of 1.86 million, an indication that the labor market had stabilized, as stated by the Fed Chair Jerome Powell at his presser.

- After the Fed’s decision, money markets are still expecting 48 basis points of easing, according to Prime Market Terminal Data.

- On Thursday, UBS increased its forecast for Gold prices to $6,200 a troy ounce for March, June and September, up from $5,000 foreseen. Nevertheless, by the end of the year, they expect Bullion to finish at around $5,900.

Technical outlook: Gold lacks clear direction following volatile session

Gold price remains upward biased, but it seems poised to consolidate if it doesn’t close above the January 28 daily high of $5,415. Bullish momentum has faded as depicted by the Relative Strength Index (RSI).

The RSI dipped from extreme overbought territory, yet as it aims towards the 70 threshold, it indicates that neither buyers nor sellers are in charge.

If XAU/USD stays above $5,300, it could trade sideways within the $5,300-$5,400 range. A break at the top of the range will expose $5,500 and the record high at $5,598. Conversely, if Gold dives below $5,300, it could exacerbate a drop towards $5,200 and below.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.