Gold extends rally to seven days as trade war, FX fears roil markets

- Gold rises over 0.60% as US–South Korea trade tensions fuel haven demand across markets.

- The US Dollar slides amid rumors of Yen intervention and renewed fears of a US government shutdown.

- Traders brace for the Fed decision, Powell’s guidance, and a potential Fed Chair announcement.

Gold (XAU/USD) rallies for the seventh consecutive day, up by more than 0.60% on Tuesday, sponsored by increasing geopolitical tensions sparked by the trade war and threats of a possible intervention in the FX space to boost the Japanese Yen. XAU/USD trades at $5,091 after bouncing off a daily low of $4,990.

Bullion jumps above $5,090 as escalating tariffs and Yen intervention speculation

The escalation of the trade war, now between the US and South Korea, is spilling over the financial markets, increasing Gold’s appeal. US President Donald Trump's threats to imposing 25% tariffs on goods from Seoul pushed the Greenback lower and the precious metals space soared. So far, year-to-date (YTD) Gold prices are up 17.72%, aiming to surpass 2025 returns of nearly 60%.

Risks of another potential US government shutdown on January 30 are surfacing, amid increasing domestic tensions in the country.

Aside from this, threats of possible coordinated intervention in the FX markets to propel the Japanese Yen sent the US Dollar tumbling.

Economic data in the US showed that consumers are becoming pessimistic in the short term about income, business and the employment situation, according to the Conference Board (CB).

Aside from this, traders’ eyes are on the Federal Reserve’s (Fed) monetary policy decision on Wednesday, followed by the Fed Chair Jerome Powell's press conference. Additionally, beware of a possible announcement of the Fed Chair pick by US President Donald Trump.

Daily digest market movers: Gold capitalizes on soft US Dollar, Fed up next

- Bullion’s uptrend is mainly sponsored by broad US Dollar weakness. The US Dollar Index (DXY), which tracks the performance of the Greenback versus six currencies, dives 0.90%, cleared last year’s low of 96.21 and reached a four-year low of 96.14. DXY's next milestone to the downside would be January 14, 2022, daily low of 94.63.

- The US 10-year Treasury note yield is up one and a half basis points, at 4.227%, but is failing to cap Gold’s advance.

- Analysts had begun to price in a substantial Gold rally. Deutsche Bank and Société Générale now forecast Gold prices to reach $6,000 per ounce by 2026.

- Data-wise, the US Consumer Confidence by the Conference Board tumbled to its worst level since 2014, landing at 84.5 in January, down from an upwardly revised 94.2 in December.

- Dana M Peterson, Chief Economist at the Conference Board, wrote, “Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened.” She added that “All five components of the Index deteriorated, driving the overall Index to its lowest level since May 2014 (82.2)—surpassing its COVID-19 pandemic depths.”

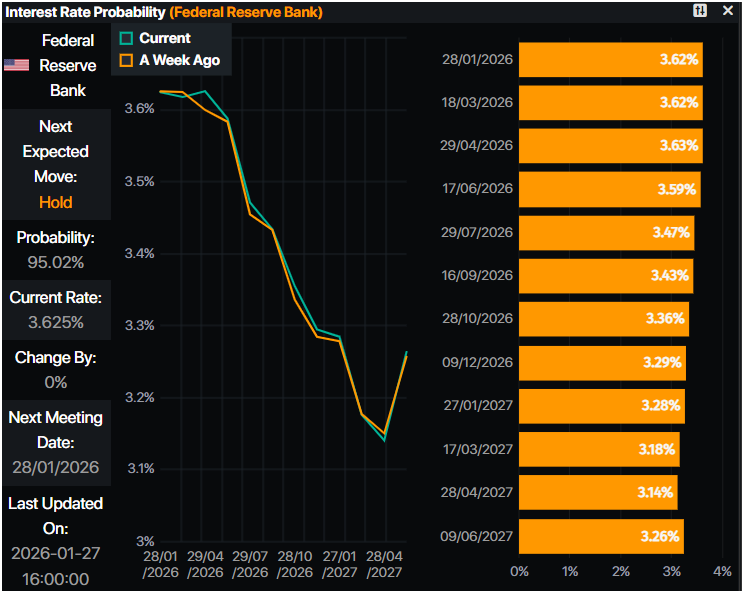

- The Fed is expected to hold rates on Wednesday, but what traders are looking for Is the press conference of the Chairman Jerome Powell. It would be of interest to ask questions regarding the independence of the central bank.

- Prime Market Terminal data shows that traders are expecting 45 basis points of easing by the Federal Reserve towards the end of the year.

Technical outlook: Gold price surpasses $5,000, approaches the $5,100 record

Gold price uptrend remains in place, poised to retest the $5,100 milestone in the short term. Bullish momentum remains strong as depicted by the Relative Strength Index (RSI), and further upside is seen.

The next key resistance levels would be $5,100 and the record high of $5,111. On further strength, $5,150 and $5,200 lie overhead.

Conversely, a mild hawkish tone of the Fed Chair Jerome Powell on Wednesday could trigger a massive take profit and push Gold lower. In that event, XAU/USD’s first support would be $5,000, followed by $4,950 and $4,900.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.