Gold stalls near $4,455 on rising yields, US Dollar recovery

- Gold holds flat after dipping to $4,407 as US yields and the US Dollar extend their recovery.

- Stronger US jobs data and a narrower trade deficit support the Greenback ahead of NFPs.

- Markets still price 56 bps of Fed cuts in 2026, keeping downside pressure contained.

Gold price hovers around its opening price on Thursday after hitting a daily low of $4,407 as US Treasury yields rise and the Greenback follows suit. Economic data in the US has improved the outlook of the labor market ahead of the release of the crucial December Nonfarm Payrolls report. XAU/USD trades at $4,455, virtually unchanged.

Bullion steadies ahead of US Nonfarm Payrolls on firmer labor data, strong US Dollar

The US Dollar is staging a recovery after US jobs data showed that companies shed half of the people slashed in November. Furthermore, Initial Jobless Claims came below estimates despite jumping compared to the previous week, while a reduction of the US trade deficit was cheered by Dollar bulls.

The US Dollar Index (DXY), which tracks the performance of the Greenback against a basket of six currencies, is up 0.20% to 98.92 after clearing a key technical resistance level seen at the 200-day Simple Moving Average (SMA) at 98.87. However, US Dollar bulls must achieve a daily close above the latter to remain hopeful for a recovery.

Meanwhile, the New York Fed Survey of Consumers reported that inflation expectations and job perceptions deteriorated in December, according to the poll.

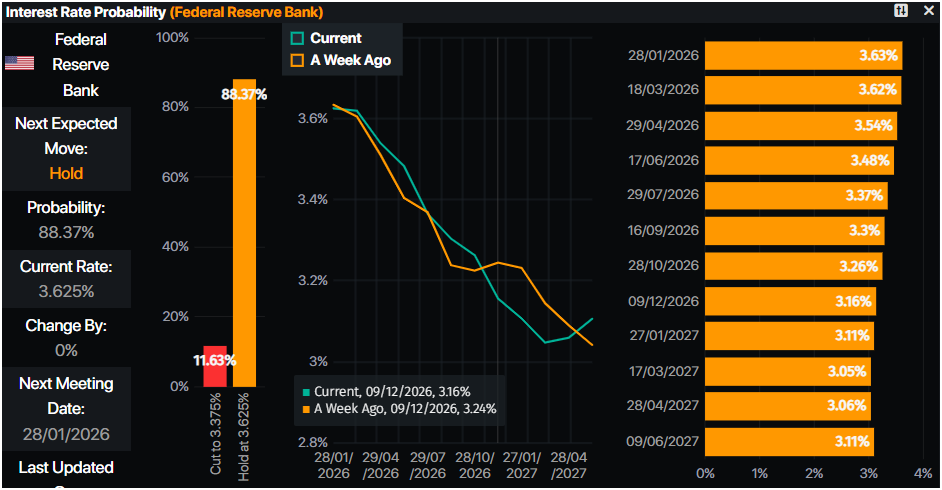

All in all, money markets have priced in 56 basis points of rate cuts by the Federal Reserve in 2026, according to Prime Market Terminal data.

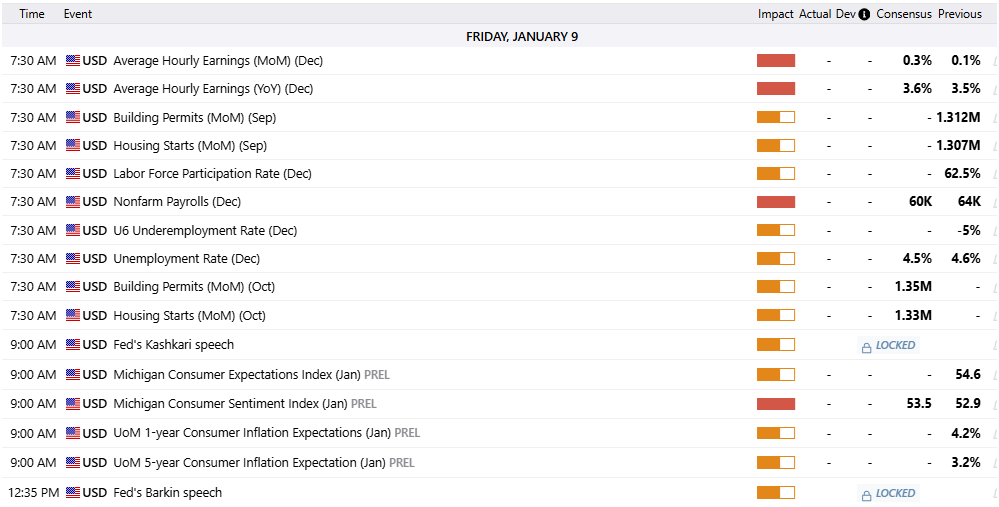

US economic docket for January 9

On Friday, traders will eye Nonfarm Payrolls figures, which are expected to show the economy added 60K jobs in December, less than November’s 64K. The Unemployment Rate is projected to dip from 4.6% to 4.5%.

Daily digest market movers: Upbeat US jobs data caps Gold advance

- US Initial Jobless Claims for the week ending January 3 were below estimates of 210K, which came at 208K, above the previous week’s 200K. The report confirmed that the jobs market is improving following the release of the Challenger Job Cuts report in December, which revealed that companies shed 35,553 jobs, nearly half of November’s 71,321.

- Andy Challenger, the Chief Revenue Officer for Challenger, Gray & Christmas, wrote that “The year closed with the fewest announced layoff plans all year. While December is typically slow, this coupled with higher hiring plans, is a positive sign after a year of high job-cutting plans.”

- The US Goods and Services Trade Balance revealed that the trade deficit narrowed from $48.1 billion to $29.4 billion in October, exceeding estimates of a widening of $-58.9 billion, on a sharp pullback in imports, notably pharmaceuticals.

- The New York Fed Survey of Consumer Expectations (SCE) revealed that households’ inflation expectations rose in the short term and remained unchanged for the medium term. Job finding expectations declined, while expectations of losing a job worsened.

- Inflation expectations increased in December to 3.4% from 3.2% for one year, and for three and five years were unchanged at 3%.

- Following the US data releases, the Atlanta Fed GDP Now estimate for the last quarter of 2025 rose from 2.7% to 5.4%.

- Gold falls as US Treasury yields rise. The US 10-year note yield rises nearly two and a half basis points to 4.173%. US real yields, which correlate inversely with Gold prices, climbed two basis points to 1.903%.

Technical analysis: Gold consolidates at around $4,450

Gold price uptrend is intact, but a daily close below Wednesday's daily low of $4,423 could accelerate a test of the $4,400 figure. Bullish momentum continues to fade as depicted by the Relative Strength Index (RSI), which remains above its neutral line, but is flat.

For a bullish continuation, traders need to regain $4,500, which could clear the path to test the all-time high of $4,549. Above lies $4,600. If XAU/USD tumbles below $4,400, the first support would be the 20-day Simple Moving Average (SMA) at $4,376. A breach of the latter will expose $4,300. On further weakness, Gold’s uptrend might be compromised if it drops below $4,274, the latest cycle low.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.