Gold hits $3,674 record before US Dollar rebound caps rally

- XAU/USD climbs 0.30% after earlier record high of $3,674, retreating as US yields and US Dollar rebound.

- BLS revises annual payrolls down by -911K, exceeding estimates and reinforcing September Fed rate cut expectations.

- Traders eye PPI, CPI and Initial Jobless Claims this week, with hotter inflation possibly limiting Fed easing scope.

Gold price advanced for the third consecutive day and reached a new record high of $3,674, before retreating somewhat as a jump in US Treasury yields boosted appetite for the Greenback. The revision of job figures in the US further cemented the case for a cut by the Federal Reserve (Fed), though traders are also attentive to coming inflation prints.

Bullion rises for third straight day as weak payroll revisions cement Fed cut bets

The XAU/USD trades at $3,646, up 0.30% but capped by the recovery of the US Dollar. The US Dollar Index (DXY), which tracks the performance of the buck’s value versus six currencies, is up 0.24% at 97.68.

The Bureau of Labor Statistics (BLS) revised down its annual benchmark payrolls to -911K for March 2025, exceeding economists’ estimates of -682K, according to Bloomberg.

The review of employment figures further cemented the case for an interest rate cut by the Fed next week. Nevertheless, looming inflation figures could prevent the US central bank from easing policy if the Producer Price Index (PPI) or the Consumer Price Index (CPI) figures rise more than expected.

At the same time, traders will eye the release of Initial Jobless Claims for the week ending September 6 on Thursday.

Daily market movers: Gold’s upside capped as traders await US inflation data

- US Treasury yields are recovering, with the 10-year Treasury note up two and a half basis points (bps) to 4.068%. US real yields — calculated by subtracting inflation expectations from the nominal yield — have increased nearly three basis points to 1.718% at the time of writing.

- US inflation data will be announced this week. On Wednesday, traders await the US PPI, which is expected to remain unchanged at 3.3% YoY. Core PPI is expected to drop from 3.7% to 3.5%.

- CPI is expected to increase from 2.7% to 2.9% YoY on Thursday. Core CPI, excluding volatile items, is expected to hold steady at 3.1% YoY.

- Physical demand for the precious metal is also a tailwind for Bullion prices, which are up 38% since the beginning of the year.

- Chinese official data revealed that the People’s Bank of China (PBoC) extended its buying streak to a tenth straight month in August.

- Weakness in the labor market in the United States, prompted investors to “fully” price in a 25-basis-point rate cut by the Fed. An anemic print of 22K jobs created in August, coupled with an uptick in the Unemployment Rate from 4.2% to 4.3%, bolstered Gold’s appeal to the detriment of the US Dollar.

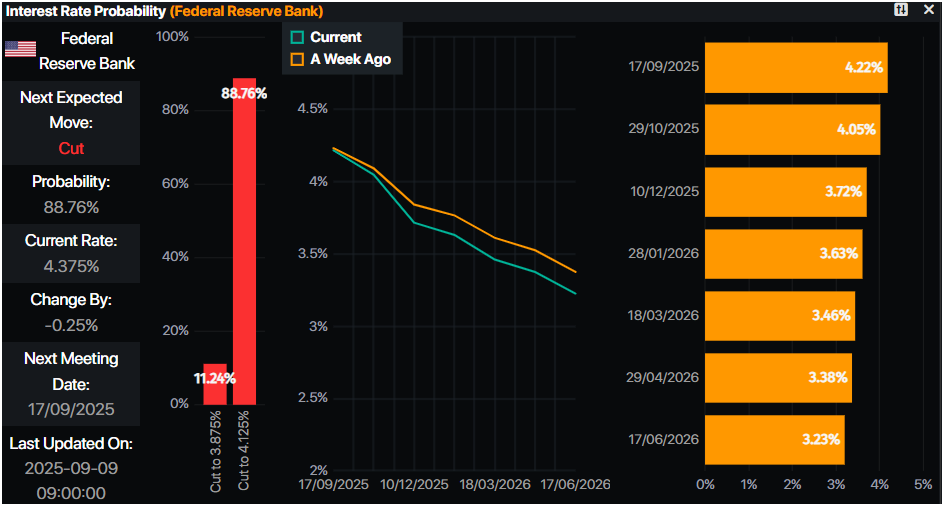

- Expectations that the Fed will cut rates next week by 25 bps are at 88%. The chances for a 50 bps are slim at 12%, according to the Prime Market Terminal interest rate probabilities tool.

Source: Prime Market Terminal

Technical outlook: Gold price hovers near $3,650

Gold price uptrend stalled after hitting an all-time high (ATH) of $3,674, before retreating below $3,650. If XAU/USD ends negatively on the day, a test of $3,600 is on the cards. On further weakness, the next stop would be the April 22 high of $3,500.

The Relative Strength Index (RSI) is currently overbought but has not yet reached the critical threshold of 80, suggesting that the bullish trend in Gold remains intact.

If Gold clears $3,674, up next would be the $3,700 figure, followed by $3,750, and $3,800.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.