Bitcoin price wobbles, trimming gains after largest US payrolls revision

- Bitcoin retreats below $111,000, highlighting a sell-the-news narrative.

- The US benchmark payrolls revision showed job counts were 911,000 lower than previously reported for 12 months through March.

- Market participants expect the Fed to cut interest rates on September 17.

Bitcoin (BTC) price is facing a surge in volatility after a brief run above $113,000, followed by a sharp correction below $111,000 on Tuesday.

The release of the annual revisions to Nonfarm Payrolls data for the year prior to March 2025 by the Bureau of Labor Statistics (BLS) highlighted a significantly weaker United States (US) labor market.

US job growth revised down as Bitcoin claws back gains

The US labor market created fewer jobs for the year ending March 2025, according to the preliminary report released by the BLS on Tuesday. Annual revisions to Nonfarm Payrolls (NFP) data for the period show a decrease of 911,000 jobs, compared to the previously reported reading of 598,000 and the overall expectations of a 700,000 decrease.

This marks the largest revision on record, dating back to 2002, and 50% higher than the previous year’s adjustment, according to CNBC.

The jobs data comes at a time when the Federal Reserve (Fed) is under pressure from US President Donald Trump’s administration to cut interest rates. Since the data is adjusted on a quarterly consensus, it implies that the US had been grappling with a weakening job market long before President Trump took office in January.

Data released by the BLS in recent months has suggested a softer labor market in the US, with the average job growth in June, July and August averaging at 29,000. In other words, the US is hardly meeting the required break-even level for a steady unemployment rate.

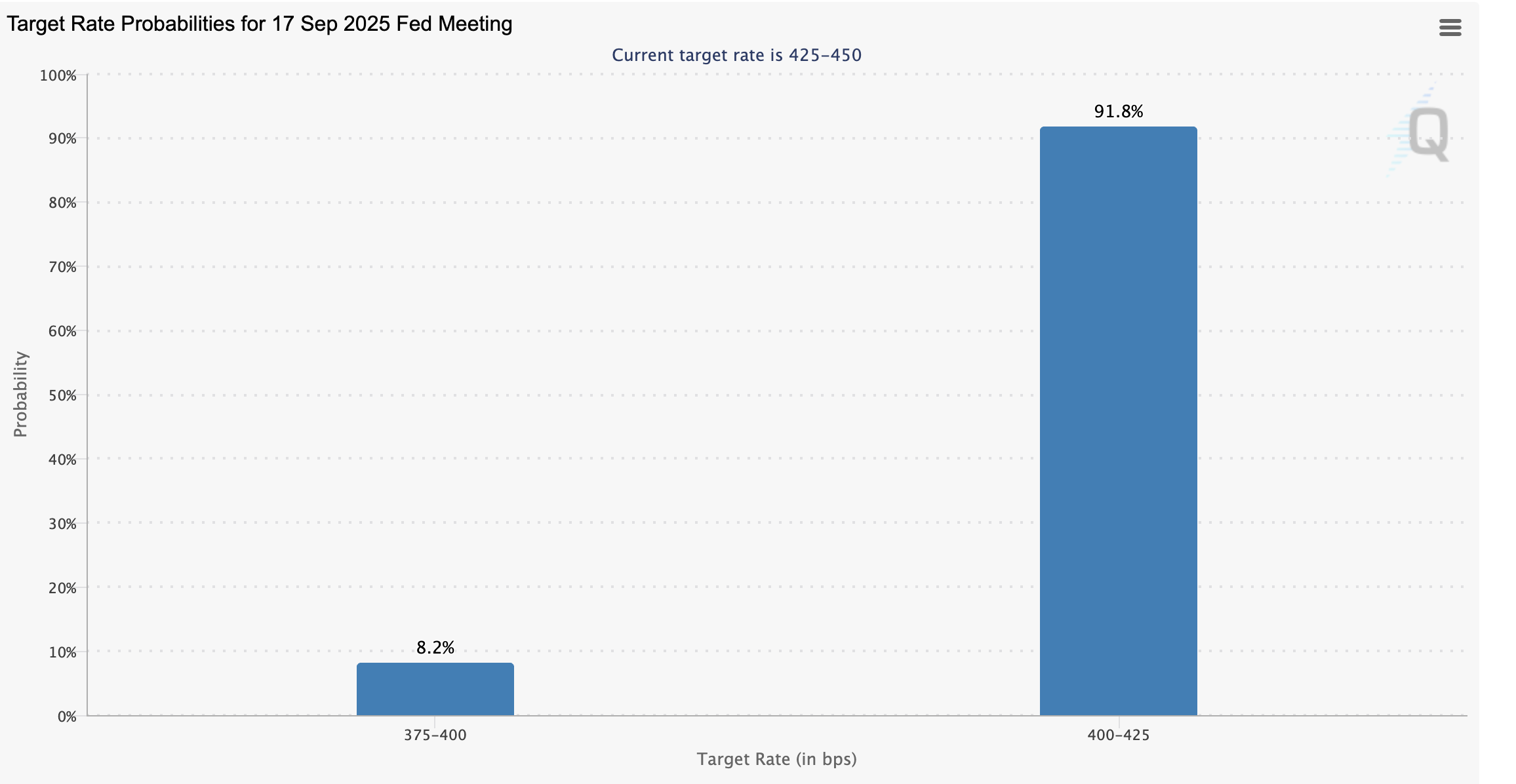

Market participants generally expect the Fed to lower interest rates by 25 basis points from the current range of 4.25% - 4.50% to 4.00% - 4.25%. According to the CME Group’s FedWatch tool, there’s a 91.8% chance that the central bank will lower rates to that level at the end of the Federal Reserve Open Market Committee (FOMC) meeting on September 17. The rest of the market participants bet on a 50 bps cut.

FedWatch tool | Source: CME Group

Lower interest rates often encourage investment in riskier asset classes, such as cryptocurrencies and equities. Therefore, lower rates could boost investor interest in Bitcoin and other digital assets in the fourth quarter.

Technical outlook: Bitcoin eyes $110,000 support

Bitcoin is testing the 100-day Exponential Moving Average (EMA) at $110,762 after extending the pullback from an intraday high of $113,293. A reversal of the Relative Strength Index (RSI) to 46 after peaking at 49 indicates a reduction in buying pressure.

If the RSI reading drops further, Bitcoin price’s path of least resistance could remain downward, increasing the chances of the decline extending below the $110,000 round-figure support.

BTC/USDT daily chart

Still, traders should exercise caution and temper their bearish expectations, considering the Moving Average Convergence Divergence (MACD) indicator has retained a buy signal since Sunday. The Bitcoin price will likely recover if traders seek exposure, underpinned by the blue MACD line holding above the red signal line.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.