Gold futures hit $3,534 as US tariffs target Bullion imports; spot remains near $3,400

- Gold spot steady at $3,397, while Comex futures hit all-time high on US import tariffs.

- The Financial Times reports US imposed duties on one-kilo Gold bars, citing Customs & Border Protection letter.

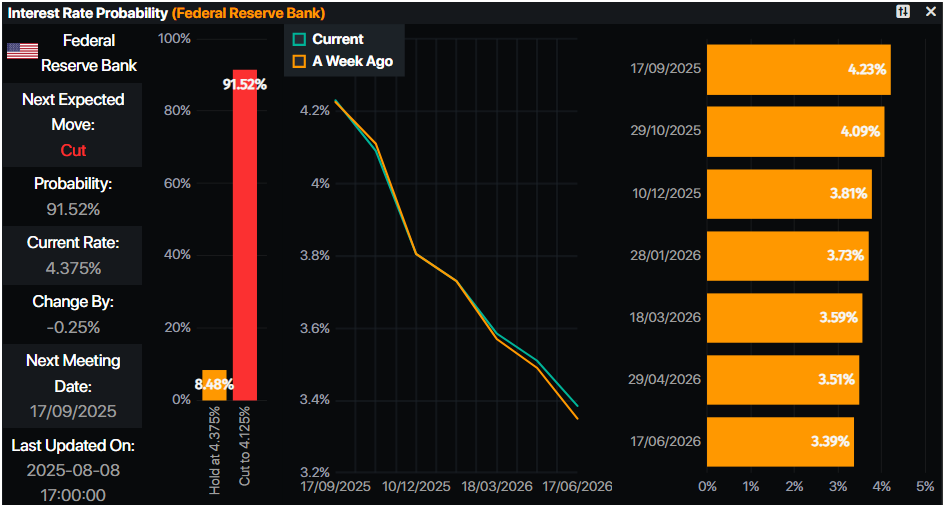

- Markets price in 25 bps Fed cut in September after weak NFP and soft ISM Services PMI employment data.

- Upcoming US data: CPI, PPI, Retail Sales, Jobless Claims, UoM Sentiment, and multiple Fed speakers.

Gold Price steadies in the spot markets, yet the futures reached a record high of $3,534 on reports that the United States (US) will apply tariffs on imports of Gold bars. Besides this, market players continued to digest US economic data revealed during the week as traders brace for the release of inflation figures next week. The XAU/USD trades at $3,397, virtually unchanged.

During the overnight session, the price spread between New York Comex futures and spot prices widened by more than $100, as revealed by Reuters after the Financial Times reported on Thursday that the US imposed tariffs on one-kilo Gold bars, citing a letter from US Customs & Border Protection.

Despite this, XAU/USD spot prices continued to consolidate at around the $3,400 figure, as investors seem convinced that the Federal Reserve (Fed) will slash rates by 25 basis points (bps) at the September meeting.

Last week's dismal Nonfarm Payrolls report sounded the alarms amongst Fed officials, who had previously struck a more hawkish tone but now are shifting to a more balanced one. Additionally, a slowdown of business activity in the services sector, as revealed by the ISM Services PMI, along with a contraction in the employment sub-component, suggests that there are some cracks in the labor market.

However, Fed doves are not out of the woods yet. The Prices Paid sub-component of the Services PMI rose to its highest level since November 2022. This and next week’s release of inflation figures on the consumer and producer sides will dictate whether the Fed remains more worried about inflation or shifts to achieve the maximum employment mandate.

Next week’s economic docket will also feature further Fed speakers, Initial Jobless Claims data, Retail Sales and the University of Michigan (UoM) Consumer Sentiment.

Daily digest market movers: Gold price steadies despite tariffs on Swiss Bullion

- In response to the US decision, the Swiss Gold Association stated that the imposition of tariffs on these Gold cast products makes it economically unviable to export them to the US. The association is "Concerned that this specific clarification from us may negatively impact the international flow of physical gold…Particularly concerned about the implications of the tariffs for the gold industry and the physical exchange of gold with the US, a long-standing and historical partner for Switzerland."

- On Thursday, the US Department of Labor revealed that the number of Americans filing for unemployment benefits rose by 228K, above estimates of 221K and exceeding the prior print of 218K. Although the print was close to forecasts, economists' focus shifted to Continuing Claims, which rose toward levels last seen in November 2021, after increasing to 1.97 million in the week ended July 26.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is up 0.10% at 98.14. The US Dollar’s recovery capped Gold’s advance toward $3,400.

- The US 10-year Treasury yield recovered from yesterday's losses and is up three basis points, sitting at 4.285%, capping Gold prices.

- Traders have priced in a 92% chance of a 25 bps rate cut at the September meeting, according to Prime Market Terminal data.

Source: Prime Market Terminal

Technical outlook: Gold price moves sideways, hovers around $3,400

Gold price consolidates within the $3,380 - $3,400 range during Friday’s session, with neither buyers nor sellers committing to push prices outside those boundaries. The Relative Strength Index (RSI) is bullish but flat.

If XAU/USD clears $3,400, the next area of interest would be June’s 16 peak at $3,452, followed by the record high of $3,500. Otherwise, Gold could test the confluence of the 50-day and 20-day Simple Moving Averages (SMAs) between $3,355 and $3,348. On further weakness, Bullion could slide toward the 100-day SMA at $3,279, previously breaking $3,300.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.