Mexican Peso cheers on weaker US Dollar following new tariff threats

- The Mexican Peso firms as renewed tariff threats by US President Donald Trump dent the appeal for the US Dollar.

- The United States increases tariffs on steel and aluminium imports to 50%.

- USD/MXN slides back below prior psychological support at 19.30.

The Mexican Peso (MXN) is trading firmer against the US Dollar (USD) on Monday, as traders digest the impact of a surprise tariff escalation by the United States. The USD/MXN pair is struggling to maintain any recovery momentum, with risk sentiment dented and the Greenback broadly offered.

US President Donald Trump doubled the tariff import charge on steel and aluminum on Friday from the existing 25% rate to 50%. The policy move, aimed at shoring up the US steel industry, reintroduces trade tensions into the market narrative just as investors had begun to focus on improving economic data and stabilizing inflation.

Although Mexico remains a key trade partner and exporter of metals to the US, the Peso has held firm in the early response. Part of the resilience may be due to a broader retreat in the US Dollar, as markets reassess the implications of protectionist policy shifts for growth and inflation.

Mexico’s response to the increase in tariffs has been measured so far. President Claudia Sheinbaum said Monday that Mexico remains exempt from the newly announced tariffs, attributing this to ongoing diplomatic cooperation. “Our strong bilateral ties and open dialogue have helped shield Mexico from broader trade penalties,” she stated during a morning press briefing at the National Palace in Mexico City.

However, Economy Minister Marcelo Ebrard was more direct in his criticism, labeling the tariff hikes as “unjustified.” In a statement released over the weekend, Ebrard added, “That tariff is not justified. It’s unfair according to President Trump’s own arguments. The US runs a trade surplus with Mexico in steel and aluminum. This policy penalizes one of America’s most reliable trading partners.”

While no retaliatory measures have been announced, Ebrard confirmed that Mexico is in ongoing talks with US officials to ensure trade terms remain “balanced and predictable”.

Mexican Peso daily digest: USD/MXN faces renewed tariff threats ahead of US data-packed week

- On Tuesday, the US JOLTS Job Openings report for April and Factory Orders are in focus, offering insights into labor demand and industrial activity. Markets will use these figures to refine expectations ahead of Friday’s Nonfarm Payrolls release.

- On Wednesday, the ADP Employment Report, the ISM Services PMI, and the Federal Reserve’s Beige Book will provide a broader view of job creation and regional economic trends. These indicators may shift sentiment around the Fed’s “higher-for-longer” stance on interest rates.

- Friday’s US Nonfarm Payrolls (NFP) report for May is expected to show job gains of around 130,000, down from April’s 177,000, potentially signalling softer labor market conditions. The data will be critical for shaping Federal Reserve rate expectations, with a downside surprise likely reinforcing dovish sentiment. Stronger-than-forecast numbers, however, could challenge hopes for near-term rate cuts and support the US Dollar.

- Friday’s US Personal Consumption Expenditures (PCE) Price Index for April showed a MoM increase of 0.1%, slightly up from March's unchanged rate. The YoY figure decreased to 2.1% from 2.3%. The core PCE rose by 2.5%, down from 2.7% in the previous month. This data suggests a dovish outlook for future US interest rates.

- According to the CME FedWatch Tool, meeting probabilities for rates to remain on hold at the June meeting are at 98.7% with a 56.4% probability of a rate cut in September. This would reduce interest rates from the current 425 - 450 range to the 400 - 425 range.

- In Mexico, data published on Friday showed that the Jobless Rate increased to 2.5% in April, in line with analyst forecasts, from 2.2% in March. Employment trends serve as a leading indicator of economic growth.

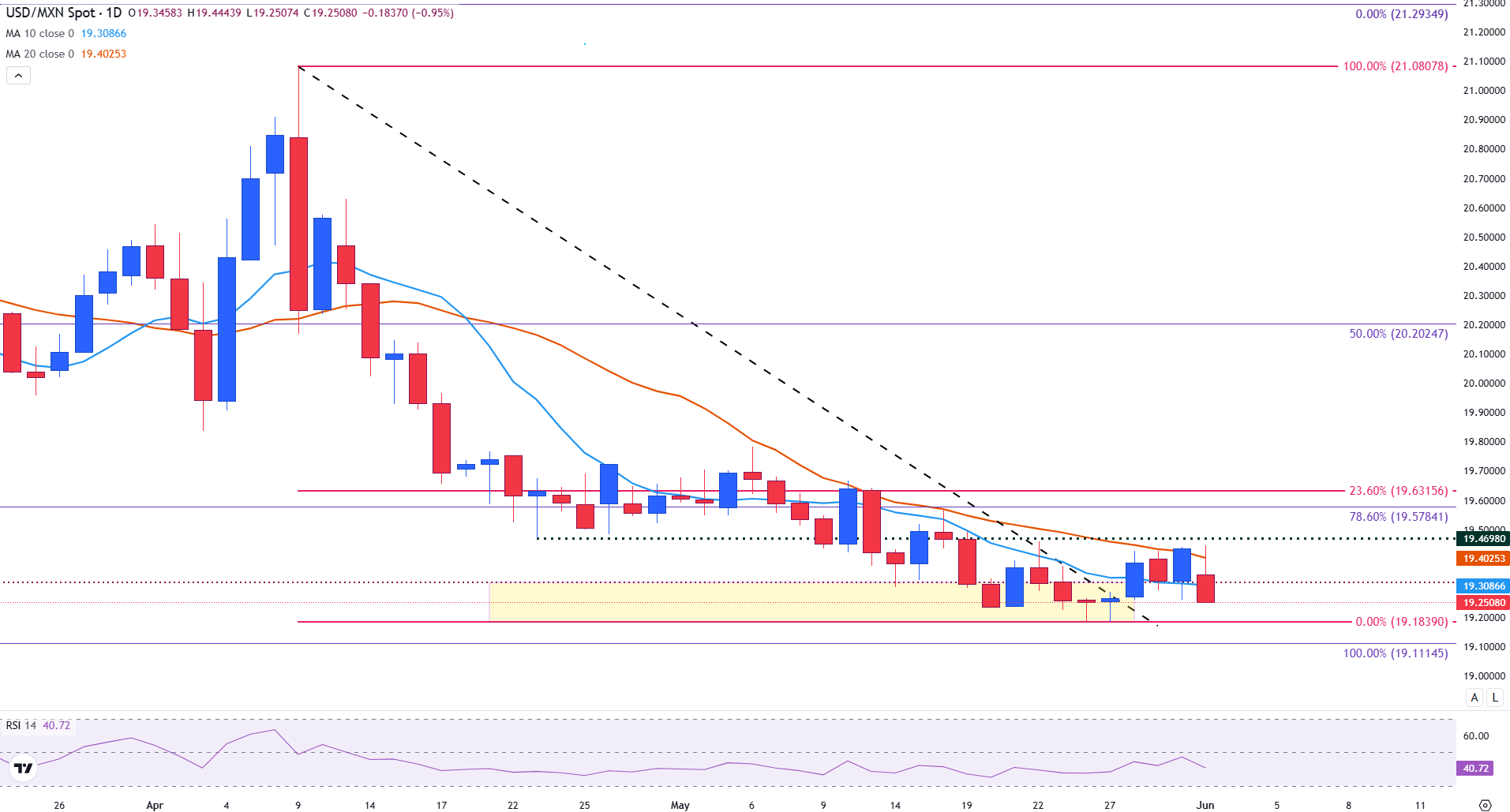

Mexican Peso technical analysis: USD/MXN pushes below Moving Average support

USD/MXN is trending lower. The pair has failed to break above the 19.47-19.63 resistance zone, capped by the 20-day Simple Moving Average (SMA) and the 23.6% Fibonacci retracement of the April-May drop. The latest rally attempt stalled below the falling trendline, reinforcing the downside bias.

Support is building around 19.18, with the broader bearish channel still intact. A decisive break below this level could open the path to test the 19.11 area, last seen in early 2023.

USD/MXN daily chart

The Relative Strength Index (RSI) points downward near 40, suggesting increasing bearish momentum and room for further declines.

The Peso’s near-term strength may persist if global markets continue to price in the negative impact of trade frictions on US growth. However, risks remain tilted to the other side as well, especially if Mexico becomes a direct target of further trade actions.

A sustained move below 19.18 would validate the bearish technical setup and potentially open the door toward fresh lows. On the other hand, a break above 19.63 is required to shift the short-term outlook and bring 20.20 back into focus.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.