GBP/USD drifts higher ahead of late-week run of UK and US data

- GBP caught a mild bid amid USD weakness, approaching 1.3400.

- Trade sentiment continues to dominate market attention as traders hope for tariff clarity.

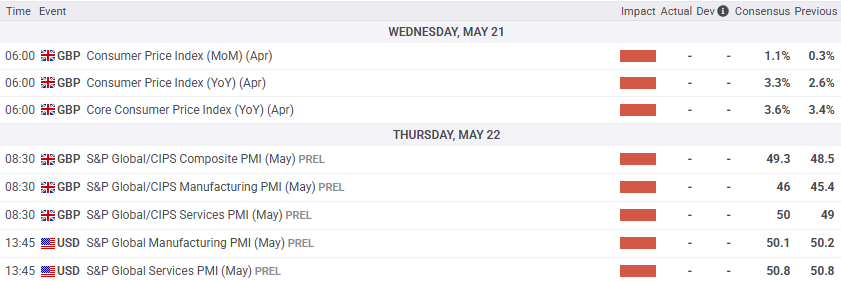

- UK CPI inflation due Wednesday, UK and US PMI double header due on Thursday.

GBP/USD rose slightly on Tuesday, climbing toward (but still not able to capture) the 1.3400 handle. Cable is heading into a run of key inflation and business outlook data releases, with UK Consumer Price Index (CPI) inflation slated for Wednesday, with a double-bang of UK and US Purchasing Managers Index (PMI) survey results due on Thursday.

Trade headlines remain the key driver for global markets this week. Investors remain hopeful that deals will be struck with the US that will encourage the Trump administration to take the tariff gun away from its own economy’s head, but the steady drift into the unknown is beginning to limit bullish sentiment. The Trump administration is rapidly approaching its own self-imposed 90-day deadline on its own “reciprocal tariffs” package. While some potential trade deals have been announced, nothing concrete has been forthcoming.

UK CPI inflation for April will print early Wednesday. Median market forecasts are calling for a jump in monthly CPI to 1.1% MoM from the previous 0.3%. Annualized CPI is also expected to rise, forecast to print at 3.3% from 2.6%. Core UK CPI inflation is also expected to tick higher, expected to climb to 3.6% YoY from 3.4%.

Thursday will bring a double-header PMI release for both the UK and the US. Markets are expecting a broad uptick in indexed forward-looking business survey results, while US figures are expected to come in mixed. US Manufacturing PMI in May is expected to tick down to 50.1 from 50.2, while the Services component is seen holding flat at 50.8.

GBP/USD price forecast

Cable remains capped by the 1.3400 for the time being, however bullish momentum has remained stubbornly determined, albeit slow-moving. GBP/USD broke out of near-term consolidation this week, but the pair could be poised for a downside correction back into congestion as technical oscillators begin to flash overbought warning signs.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.