Unlike long-term traders, day traders seek to make relatively smaller profits per trade, and close the trades within the same day. Make no mistakes. The traders open several trades daily, and the profits can quickly add up. However, it requires a great deal of discipline to avoid overtrading. In fact, a Charles Schwab study shows that 83% of traders believe day trading helps them become more disciplined and organized. This explains why day trading appeals to many traders. According to Brokersnote, there are about 9.6 million traders in the world.

Getting started is a cakewalk. With substantial capital and a Mitrade account, you are good to go. But that's just the easy part. To make profits, you need to be conversant with reading charts. Perhaps, the challenging part is interpreting the charts and patterns to discern the right time to enter the market. That's right. A study in Brazil shows that 97% of day traders lose in the long run. No trader wants to be part of these statistics.

You see, timing is everything in the market. Luckily there are technical tools that can make your trading a breeze. This is where the day trading patterns come in handy.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

Why Patterns Work In Day Trading?

Day trading patterns work perfectly for short-term analysis. While numerous analysis tools can overwhelm you, your reading results will improve significantly if you take the time to understand and perfect some of the trading patterns. Remember, there is no silver bullet or foolproof analytical tool. You only need to get tools that suit your trading strategy. In any case, profitable trading is about getting an edge. You don't have to know what will happen in the market all the time.

To use day trading patterns, you should acquaint yourself with other analytics concepts like Japanese candlestick, support, and resistance level. They form the basis of using day trade patterns. But don’t fret. We’ll cover everything, so let's get started.

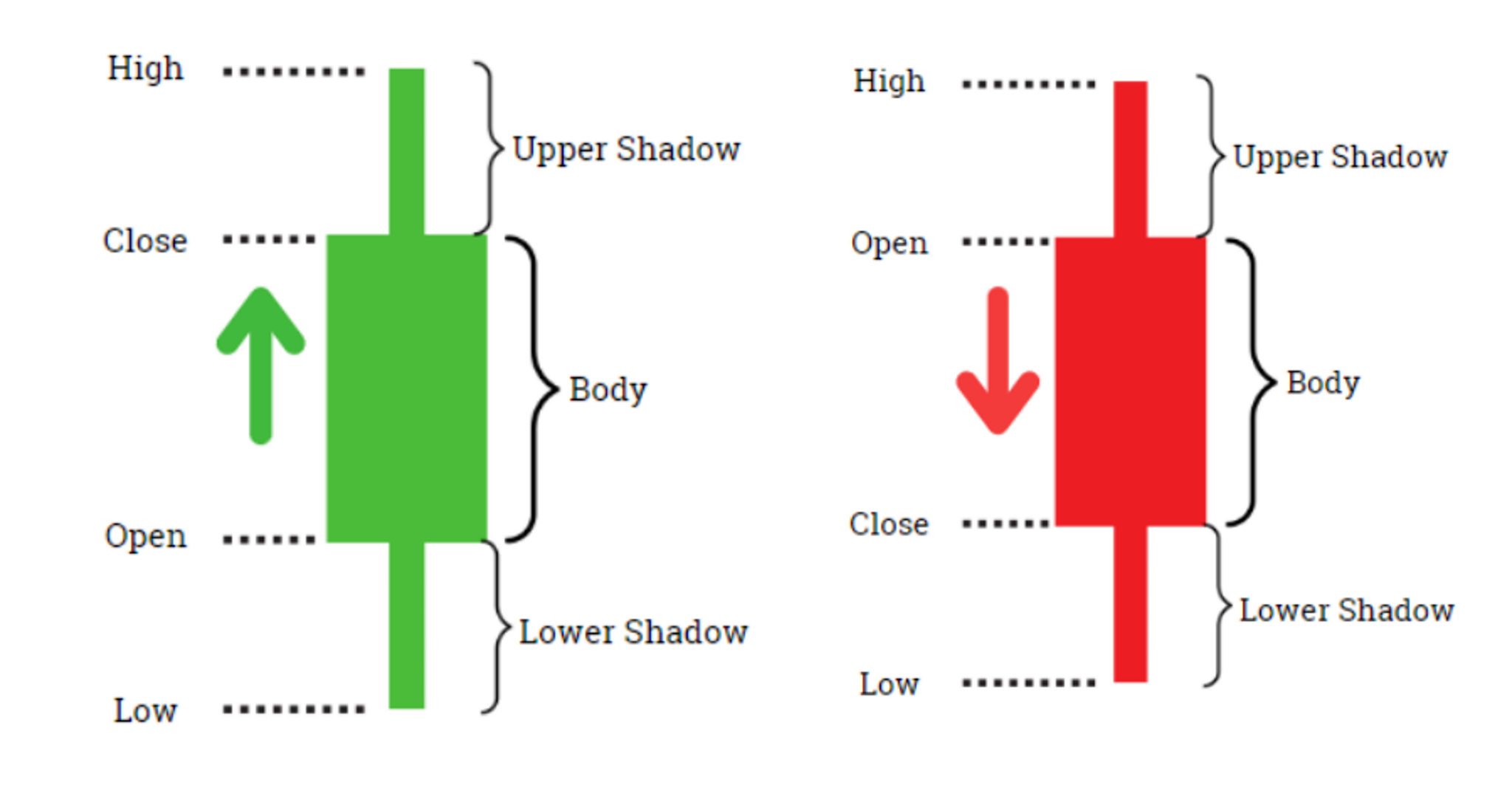

What is a Japanese Candlestick?

Traders have been using the Japanese candlestick since the 18th century. Unlike a bar chart, candlesticks show the price open, the high, the low, and the close. Therefore, you can identify the price direction within the session by determining if the opening was higher than the closing price.

A bullish green candlestick and a bearish red candlestick

Support and Resistance

The support is the lowest price level where the price hasn’t managed to break below within a certain period. Put differently, the instrument gets enough demand at this level to prevent it from falling lower. The resistance level is the exact opposite. The price hasn't surpassed this area for over a period of time. Once it hits this point, it reverses downwards. With this in mind, we can now explore the top patterns you should focus on. Let's delve right in.

1. Ascending Triangle

An ascending triangle is a continuation pattern that typically appears during an uptrend. It’s an indication that the current trend will continue. Simply put, it shows the uptrend will continue after the consolidation. The triangle forms when the price hits several highs around the same zone. When a line connects the highs, they form a resistance zone. However, when you join the lows, they form an ascending -diagonal- line.

You need to connect more than two price points when drawing the lines. The whole idea is to wait for the price to break out above the triangle, where you can prepare to enter a long (buy) trade.

NZDUSD on a 4-hour timeframe

The chart shows an ascending triangle forming midway through an uptrend. Notice how the market increases momentum after a breakout.

Descending triangle is the exact opposite of an ascending triangle. It forms during a downtrend and is a telltale sign that the price will continue to plummet. You should therefore be ready to enter a short trade.

Essentially, the price hits a certain level severally and fails to break below. When you connect the price points, it forms a support level. In addition, the resistance price points, on the other hand, form a line that slants downwards to the right. You should be ready to enter the market at the breakout.

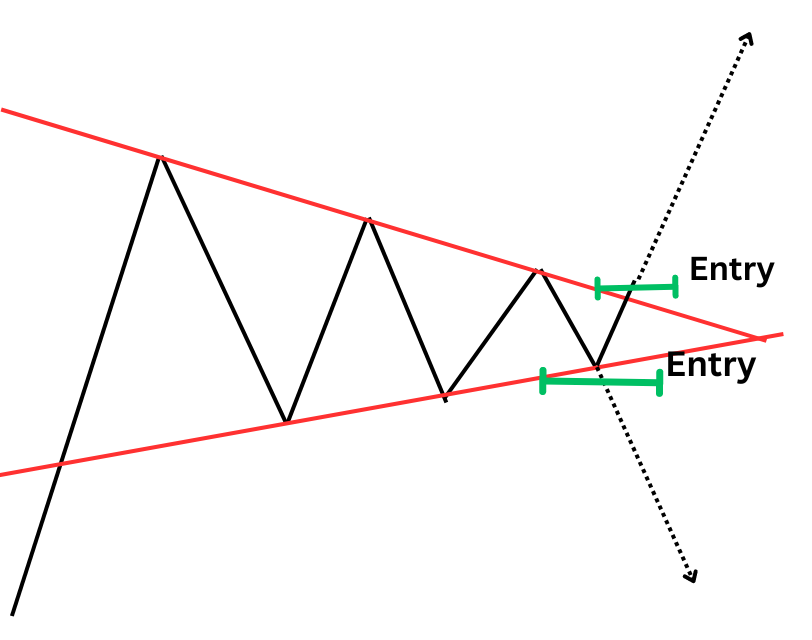

2. Symmetrical Triangle

Symmetrical triangles are part of the triangle pattern. But unlike bearish and bullish triangles, they don't have a flat resistance or support line. Instead, the two lines move toward each other and converge. You draw the line by connecting at least two resistance and two support price points.

The triangles can either be bullish or bearish. Ideally, a bullish symmetrical triangle forms during an uptrend, while a bearish symmetrical triangle forms during a bearish trend. However, you should wait for the price to break out in the direction of the overall trend. In some cases, the price may reverse after the triangle formation. Similarly, you should be cautious about fake breakouts. Set the price target at the same price distance as the triangle's height.

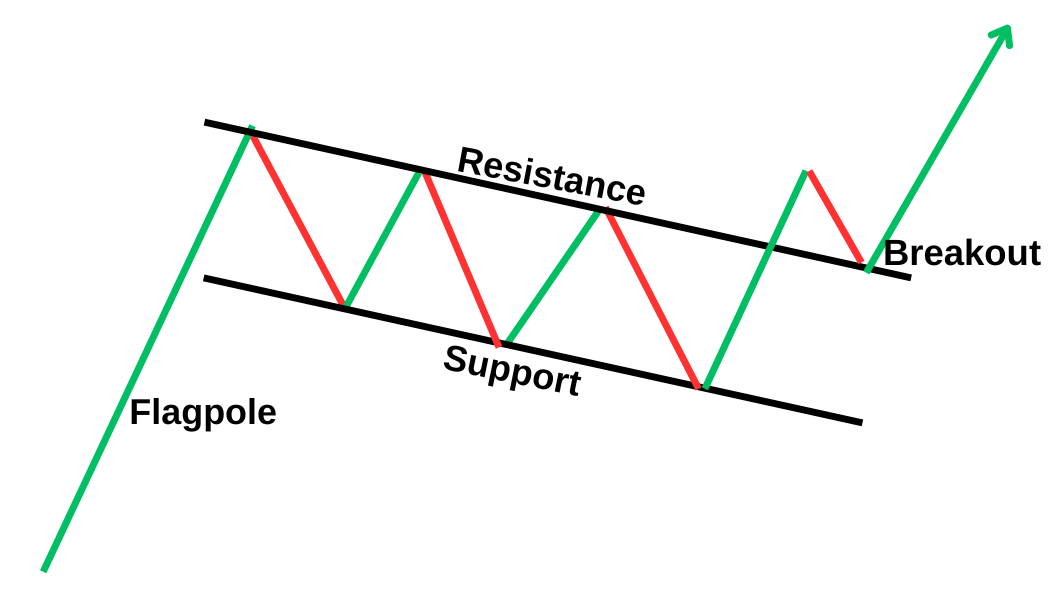

3. Flag Pattern

The flag pattern is a continuation pattern. As the name suggests, it resembles a flag. In essence, it has three attributes outlined below.

The pole - the initial trend forms the pole of the flag. The trend is quite strong.

Consolidation- Consolidation is a phase of market indecision characterized by price swings between two parallel lines. This consolidation phase slants upwards after a downtrend or downwards after an uptrend. The volume tends to decrease during consolidation.

Breakout - The breakout happens when the price closes above or below the flag. Ideally, you want to wait for a retouch before you enter the trade. The breakout provides an excellent time to enter the market and open a position in the direction of the overall trend.

Bullish Flag Pattern

In a bullish flag, the pole is usually on an uptrend. The consolidation phase slants downwards with parallel lines. The parallel lines are formed by connecting support and resistance zones. The price breaks above the flag, with increasing volume to continue the uptrend.

Bearish Flag Pattern

The bearish flag forms during a downtrend. During the consolidation phase, the flag slants upwards within parallel lines. After the consolidation, the price breaks out and continues to plummet. You should go short at the breakout level.

4. Head and Shoulder Pattern

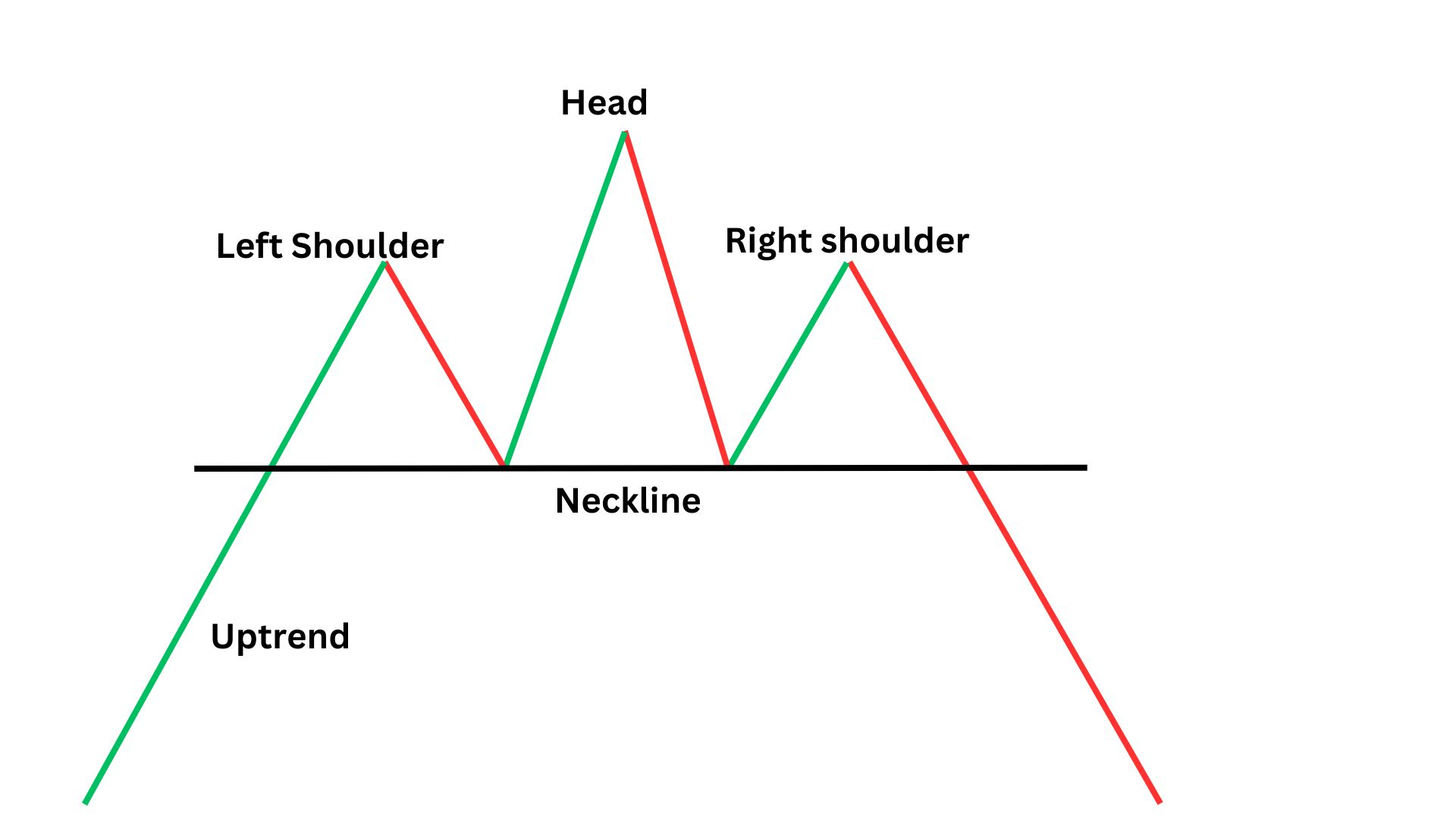

The head and shoulder pattern is among the most popular and reliable trading patterns. Perhaps it's the most reliable day trading pattern. It is easily recognizable and gives a reversal signal. This means that if it appears after a downtrend, the price will reverse and trend upwards. Essentially, a head and shoulder pattern has four components.

Left shoulder - The left shoulder forms after a bullish run. The price hits a peak and retraces forming a trough.

Head - After hitting a trough, the price rallies again, reaching a higher peak, and retraces after hitting resistance.

Right shoulder - again, the price rises, finding resistance at the same level, more or less, as the left shoulder

Neckline - the neckline is pretty much the lowest price point for the right and left shoulders. It is basically the support level.

How do you trade the pattern? Ideally, you should wait for the price to break below the support line. One way to set the profit target is to measure the distance between the neckline and the highest price point. The price is likely to fall approximately by the same distance.

Inverse Head and Shoulder Pattern

When the head and shoulder pattern forms after a downtrend, it’s referred to as the inverse head and shoulder pattern. Essentially, this pattern forms three troughs, with the middle one lower than the two. A buy signal occurs when the price breaks above the neckline.

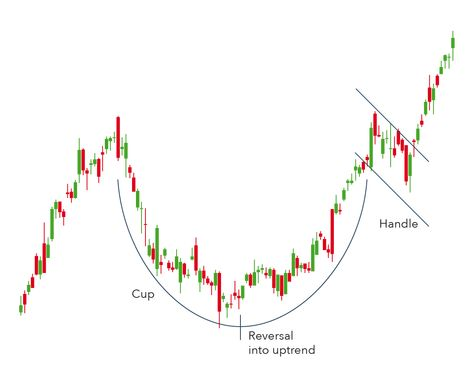

5. Cup and Handle Pattern

The cup and handle pattern is quite an interesting pattern. It resembles the usual cup. Picture the mug you use to drink tea. If this cup-like pattern appears, be ready to open long positions. It's a continuation pattern that forms during an uptrend.

The instrument experiences an increase in price and volume. However, the price and volume fall after the initial rally. The metrics rise again gradually, completing a cup-like structure. The currency pair experiences a small price drop forming a handle. Eventually, a breakout occurs and rises to reach new highs.

Here is something noteworthy. Not every cup and handle pattern is profitable. You might want to identify setups likely to work and eschew the others. For instance, you should avoid a cup that takes a V-shape and pattern whose handle exceeds a third of the cup. Keep note of the volume. It should decrease toward the bottom of the cup and increase as the price breaks out of the handle.

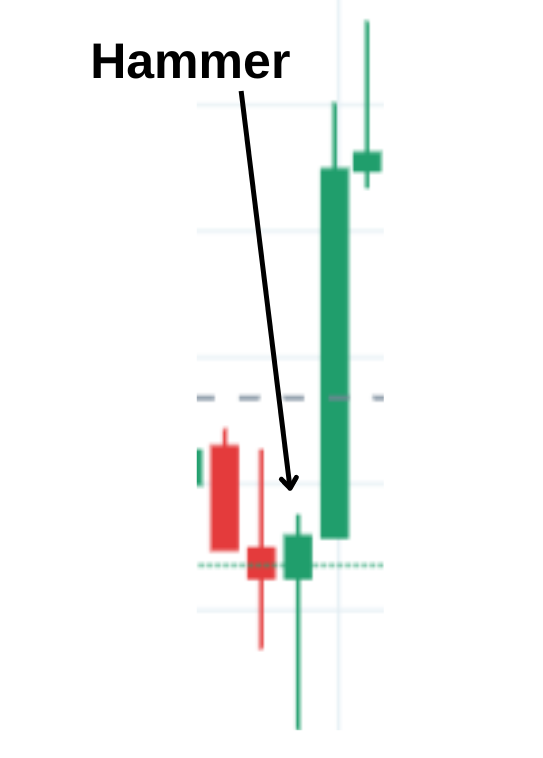

6. Hammer

Unlike other day trade patterns, the hammer is one candlestick pattern. However, it’s imperative that you consider the previous candlesticks and price action. The hammer appears during a downtrend. It’s characterized by a small body and long shadow. The wick is typically more than two times longer than the body. The longer the lower shadow, the more likely the pattern will succeed. The candlestick should not have an upper wick (the real body should be near the high of the candlestick). When it appears, it’s a signal of an impending reversal. Since no pattern is foolproof, you should use stop loss and place it below the candlestick's low.

7. Hanging man

As the name suggests, the hanging man is a cut-and-copy version of the hammer that forms at the top of the price action. The candlestick has a small body and a long shadow (wick). Similarly, the candle should have a small or no upper wick. Since it happens after an uptrend, should you wait for confirmation, you can aim to enter a short trade at the high or near high of the hanging man. Similarly, set stop loss necessarily.

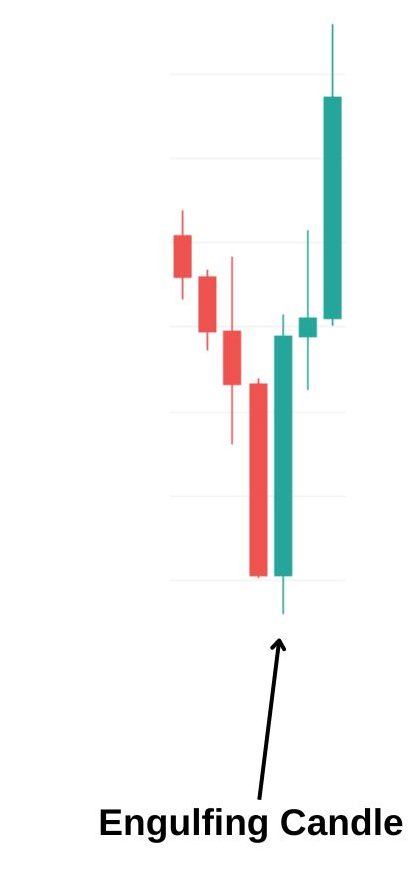

8. Engulfing Candle

Spotting an engulfing candle is a cakewalk. Unlike other complex patterns, it's one of the day trading candle patterns consisting of two candlesticks. It's one of the successful day trading reversal patterns. What sets the pattern apart is the length disparity of the two candlesticks. The first candle is relatively small, followed by a longer candle. To put this into perspective and enable you to understand how to use the pattern, let’s look at the bullish and bearish candles separately.

A bullish engulfing pattern appears after a bearish run. It's characterized by red(bearish) candles and longer bullish candles. The bullish candles open at the same price or lower than the previous candle close and then rise to tower above the previous candle.

Bullish engulfing

Typically, the engulfing candles’ wicks are small or absent. The bearish engulfing has a small bullish candle engulfed by a long bearish candle. Enter the trade after the close of the engulfing candles. Place stop loss above the recent high.

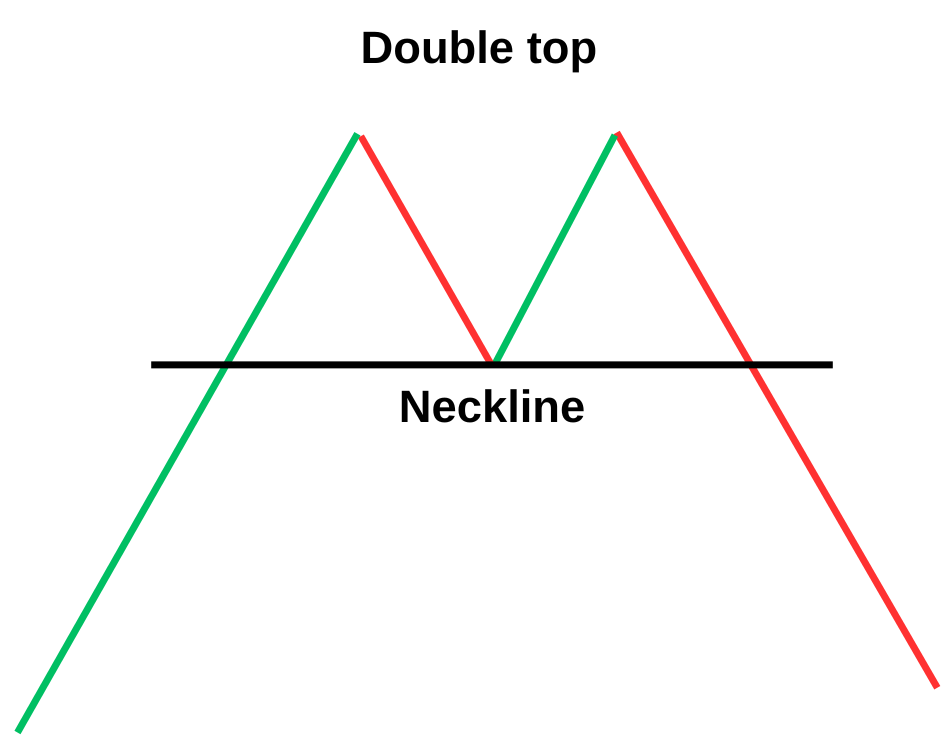

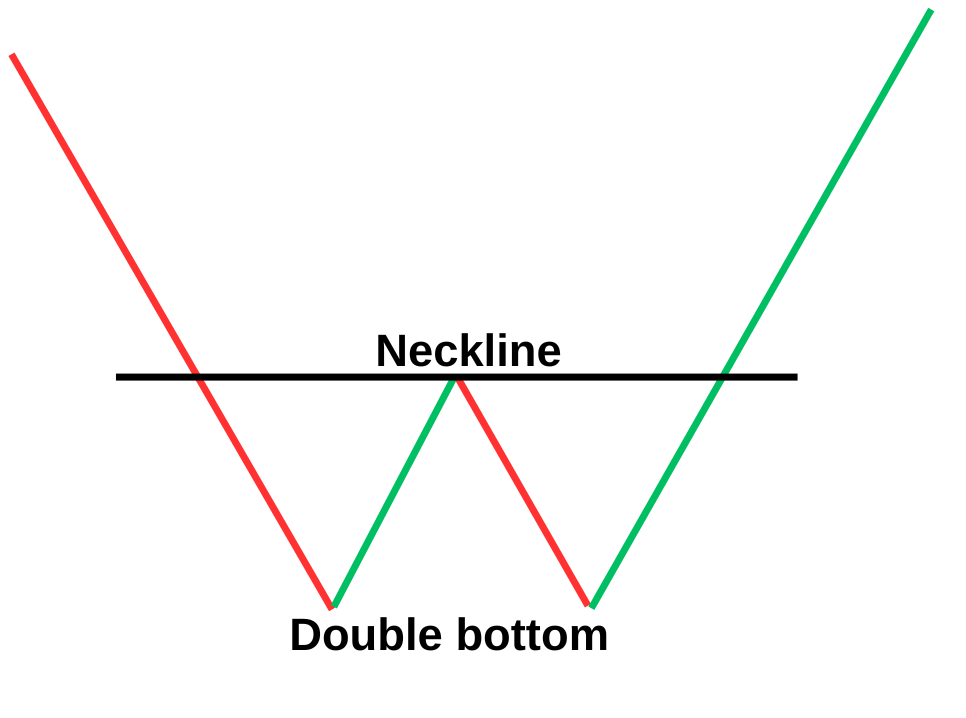

9. Double Top

The double top is a reversal signal that signals the start of a long-term bearish trend. But how do you recognize the pattern in the market? Recognizing the pattern is a breeze because it’s characterized by an M -shape.

The price touches an equal high twice, with a small price retracement between the two peaks. Ensure the two peaks are in close range, hit the exact price points, or differ slightly. You can confirm the legitimacy of the signal by checking the volume behavior. It reduces during the pattern formation and increases as the price plummets after the second peak.

Double Bottom

The double bottom is the exact opposite of the double top. Essentially, it is a telltale sign of an impending bullish reversal after a bearish run. The multi-candlestick timeframe forms two bottoms which are pretty much equal. After identifying the pattern, aim to enter a long position. You can set the stop loss several pips below the low of the double bottom.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

FAQs

What are the best day trading patterns to look for?

There are myriad of day trading patterns, including triangles, head and shoulder, and engulfing candlesticks. Choose one that suits your trading strategy.

Do patterns work in day trading?

Patterns work perfectly for day trading. You can find day trade patterns like flags, hammers, and double tops in lower timeframes like 15-minute timeframe.

Do pattern day traders make money?

Many day traders make money. However, you need analytical tools to enhance your trading strategy, especially if you are a technical analyst. Additionally, you should choose a reputable broker. Mitrade is an ASIC-regulated broker that offers a suite of tiptop trading features intuitive trading platform, commission-free trading, and extensive trading assets. It’s your go-to platform for day trading.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.