J.P. Morgan Research Says: 'Broken Logic' Is Driving This Software Stock Sell-Off

Key Points

J.P. Morgan research highlights a logical disconnect in how investors value AI stocks and software stocks.

The iShares Expanded Tech-Software Sector ETF is an easy way to buy the dip on software stocks.

- 10 stocks we like better than Microsoft ›

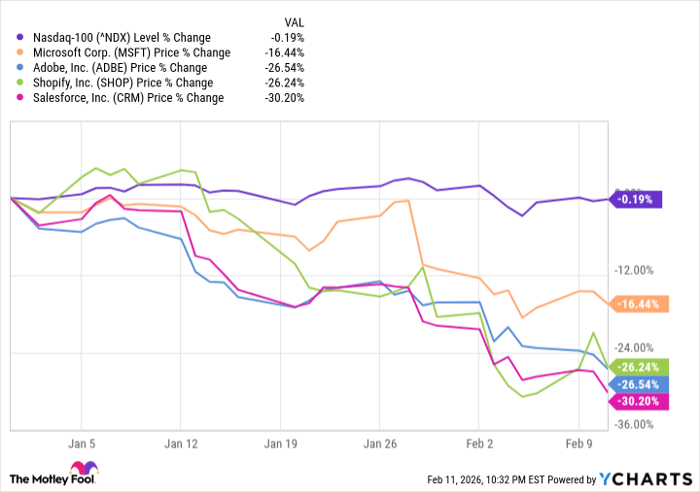

The slump in software stocks has become one of the biggest investment trends of 2026. The tech-heavy Nasdaq-100 index is down about 3% year to date, underperforming the S&P 500 index, which is little changed. But major software-as-a-service (SaaS) stocks are getting punished.

So far this year, Microsoft is down 16%, Shopify is down 26%, Adobe is down 27%, and Salesforce is down 30%. The reason: Investors are worried that artificial intelligence (AI) is about to upend the business model of selling enterprise software. If AI tools get good enough, fast enough, soon enough, to replace software, all these well-known software companies might be vulnerable.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

^NDX data by YCharts

But there's reason to believe that this AI-driven software stock bear market is based on unwarranted worries. Newly published research from J.P. Morgan suggests that the recent AI-driven software sell-off is overblown.

Let's look at what JP Morgan's research says about the AI-driven bear market in software -- and why now could be a buying opportunity for software stocks.

J.P. Morgan: AI-driven tech sell-off is based on 'broken logic'

Tech stock investors seem to be worried about two big things at once. First, investors fear that AI is going to disrupt the entire software industry. That's why stocks like Salesforce and Adobe are down. Second, investors fear that AI hyperscalers are spending too much money on AI infrastructure and that these capital expenditures won't generate the expected returns, and are thus their shares are overvalued. That's why stocks like Microsoft are down.

But both big AI concerns can't be true. Research published by J.P. Morgan Private Bank describes this disconnect as "broken logic" and says, "the market is selling indiscriminately." If AI companies are going to disrupt, destroy, and replace all software companies, those AI stocks should be more valuable. Or if AI is overvalued and those big capital expenditures are never going to pay off, software stock investors should be less worried about their companies getting wrecked by AI.

Image source: Getty Images.

Investors seem to be shying away from the entire tech sector without a sound reason.

How to invest in software stocks now

Another J.P. Morgan research team, according to Bloomberg, recently published research that describes the AI-driven software sell-off as an "overshoot at this time." It encourages investors to consider buying "AI-resilient" software stocks in companies that are most likely to benefit from AI enhancing their workflows.

Another logical argument for why the software stock sell-off is an overshoot: Software companies tend to offer specialized solutions that add value for specific industries and use cases, based on proprietary data stacks. AI companies can't replace all those competitive advantages -- for now.

If you believe that the AI-driven stock sell-off is an illogical overreaction, now could be a good time to invest in the iShares Expanded Tech-Software Sector ETF (NYSEMKT: IGV). This exchange-traded fund (ETF) is down 22% year to date, but it's delivered 18% average annual returns for the past 10 years. It charges a relatively low expense ratio of 0.39%, which includes a management fee. The fund gives you access to software majors, with top holdings including stocks like Microsoft, Palantir and Applovin.

This could be a buying opportunity for software stocks. This ETF makes it easy to own a broad mix of the entire sector.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 17, 2026.

JPMorgan Chase is an advertising partner of Motley Fool Money. Ben Gran has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, JPMorgan Chase, Microsoft, Palantir Technologies, Salesforce, and Shopify. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.