Is It Too Late to Buy AI Stocks in 2025? The Answer May Surprise You.

Key Points

Stocks like BigBear.AI are ones to avoid, no matter how low the price falls.

Palantir is a strong business, but it remains overvalued.

Reasonably priced stocks like Amazon are great AI companies to buy and hold for the long haul.

- 10 stocks we like better than Amazon ›

Anyone who bought stocks related to artificial intelligence (AI) a few years ago is sitting pretty today. Anyone who sat on the sidelines is likely experiencing the fear of missing out, otherwise known as FOMO. It can be difficult to sit still when it feels like everyone is getting rich, and you're not.

Many readers are likely looking at AI stocks as we near the end of 2025 and asking whether there are still gains to be had. Can you still buy AI stocks today? The answer may surprise you. It is more complicated than a simple yes or no answer, as most things are in the world of stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Skipping the nonsense

One piece of advice all investors should learn is to avoid nonsensical companies that simply use the hype around AI to promote their stocks. These are typically companies that put AI in their names or tickers but have flailing businesses.

For example, there is BigBear.AI. If you are confused about what that name means, you're not alone. It is a business that provides AI-powered decision-making software for organizations, similar to what Palantir Technologies does.

Last quarter, BigBear.AI's revenue declined 20% year over year to $33.1 million. Ask yourself how a company supposedly benefiting from the hundreds of billions of dollars spent on AI is experiencing a revenue decline. It is generating minimal sales, has poor margins, and has negative cash flow. This is a stock that is bound to disappoint any investor who buys today.

Image source: Getty Images.

Avoiding extreme valuations

If you should completely disregard the companies solely built on AI hype, then the next level of AI stocks are ones with viable businesses with less than magnanimous valuations.

Take the previously mentioned Palantir. It is a phenomenal business that dominates AI software for enterprise analytics. Its revenue is growing 63% year over year with a 33% operating margin. Total revenue is close to $4 billion, with U.S. commercial revenue growing over 100% year over year last quarter.

The problem? Palantir currently trades at a market cap of $433 billion. This makes the stock wildly overvalued versus its future potential, even if it maintains this impressive level of compounding revenue. Keep stocks like Palantir on your watch list for now. Strike if they crash in 2026.

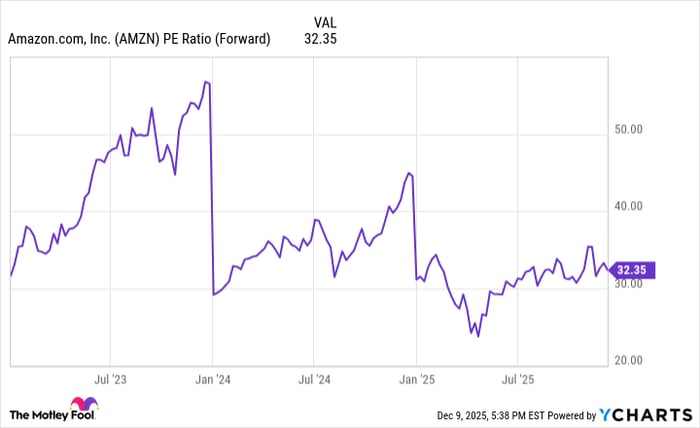

AMZN PE Ratio (Forward), data by YCharts; PE = price to earnings.

Buy quality at a reasonable price

When looking at AI stocks, don't ask whether the entire sector will go up in 2026. That is focusing on too broad a group of companies with too short a time horizon. Instead of asking whether AI stocks are a buy right now, you should look at specific stocks with strong growth prospects trading at a reasonable price that you can hold for a decade.

One that springs to mind is Amazon (NASDAQ: AMZN). Its stock is close to flat this year, even though it is delivering 20% year-over-year revenue growth for Amazon Web Services (AWS), its cloud computing division that is benefiting greatly from the AI revolution. Plus, its e-commerce segment is now doing $100 billion in quarterly revenue just in North America, and still growing in the double digits.

Amazon currently trades at a forward price-to-earnings ratio (P/E) of 32, and that is while it is still investing in many moonshot projects such as Kuiper satellite internet and Amazon Alexa. It has a slim operating margin of just 11.5%, which should begin to expand in the years to come. The company's cloud computing, advertising, and subscription services are growing fast and have fat margins.

With $691 billion in trailing revenue and a market cap of $2.4 trillion, Amazon looks like a solid bet as an AI beneficiary set to produce strong returns for shareholders over the next 10 years.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Palantir Technologies. The Motley Fool has a disclosure policy.