President Donald Trump's Policies Come With Unintended Consequences for Social Security

Key Points

President Trump has overseen several key changes to Social Security during the first year of his second nonconsecutive term.

Trump's tariff and trade policy has had a permanent impact on Social Security's cost-of-living adjustment (COLA).

Meanwhile, the president's flagship tax and spending law, the "big, beautiful bill," comes with an unsightly price tag for America's leading retirement program.

- The $23,760 Social Security bonus most retirees completely overlook ›

Year one of President Donald Trump's nonconsecutive second term is nearly in the books, and change has been a common theme -- especially when it comes to America's leading retirement program, Social Security.

For example, the Trump administration ended the overpayment and recovery rate of 10% that was set under the previous administration, led by President Joe Biden, during the COVID-19 pandemic. In its place, the Social Security Administration (SSA) installed a 50% clawback rate on the more than 1 million beneficiaries who owed a cumulative $23 billion in overpayments, as of the end of the federal government's fiscal 2023 (Sept. 30, 2023).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

President Trump also signed an executive order (EO) in late March ("Modernizing Payments To and From America's Bank Account") that set Sept. 30 as the compliance date to end the mailing of federal benefit checks. Although 99% of Social Security beneficiaries were already receiving electronic payments when Trump signed this EO, more than 500,000 beneficiaries were still required to set up direct deposit or a Direct Express Card to continue receiving their monthly payouts.

President Trump delivering remarks. Image source: Official White House Photo by Shealah Craighead, courtesy of the National Archives.

But there are more nuanced changes that have been made by Donald Trump's policies, which may not be as apparent. Two of the president's policies come with unintended consequences for Social Security.

Trump's tariff and trade policy has had a permanent impact on Social Security's COLA

Arguably, nothing Trump has done in his second term has received more attention than his tariff and trade policy.

On April 2, Trump unveiled a sweeping 10% global tariff, as well as higher "reciprocal tariffs" for dozens of countries deemed to have adverse trade imbalances with America. Between the extension of reciprocal tariff implementation dates and several announced trade deals, these reciprocal tariff rates have undergone significant changes over the last eight months.

While Donald Trump's intention with tariffs is to make American-made goods more price-competitive with those being imported into the country, as well as to protect U.S. jobs, his policy has come with an unintended (and permanent) consequence for Social Security.

In December 2024, four New York Federal Reserve economists writing for Liberty Street Economics published a report ("Do Import Tariffs Protect U.S. Firms?") that examined the effect of Trump's China tariffs in 2018-2019 on the U.S. economy and stock market. What these economists noted was a decisively negative effect caused by input tariffs.

An input tariff is a duty placed on an unfinished good (e.g., copper, steel, or an automotive component) imported into the country that's used to complete the manufacture of a product domestically. Input tariffs were found to have increased production costs for some domestic manufacturers, which in turn meant higher costs for consumers.

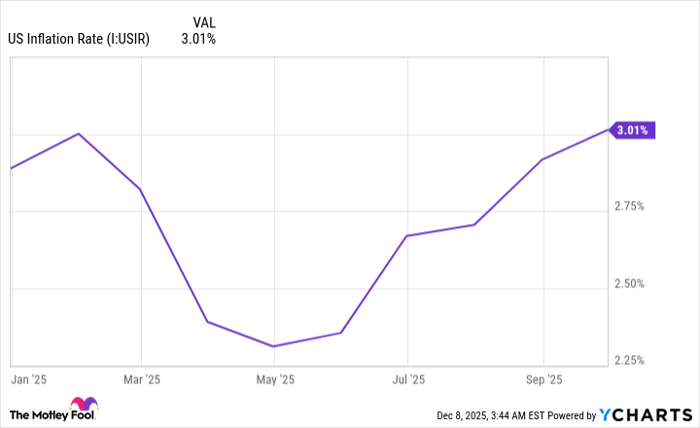

The inflation rate has been increasing following the implementation of President Trump's tariffs. US Inflation Rate data by YCharts.

Since the impact of President Trump's tariff and trade policy began showing up in monthly reported economic data, the U.S. inflation rate has moved modestly higher -- from 2.31% to 3.01%, based on the Consumer Price Index for All Urban Consumers.

But when the U.S. inflation rate increases, so does Social Security's cost-of-living adjustment (COLA). The program's COLA is the near-annual benefit increase passed along to recipients to help them offset the effects of inflation (rising prices). Since deflation (falling prices) can't result in Social Security benefits declining from one year to the next, the tariff-related "Trump bump" beneficiaries will receive in 2026 is a permanent part of the program's history, and their payout.

On Oct. 24, the SSA announced Social Security's 2026 COLA would be 2.8%, which is modestly above the 2.3% average annual raise since 2010. Next year will also mark the first time in close to three decades that benefits have risen by at least 2.5% for five consecutive years.

Image source: Getty Images.

Trump's "big, beautiful bill" comes with an unsightly price tag for Social Security

The other prominent policy change during the first year of Donald Trump's second term is the passage of the "big, beautiful bill."

This tax and spending law made the individual tax brackets that were temporarily set by the Tax Cuts and Jobs Act during President Trump's first term permanent. Moreover, it introduced several tax deductions that will be active from calendar years 2025 through 2028, including:

- A $6,000 increase to the standard deduction ($12,000 for couples filing jointly) for eligible seniors aged 65 and above.

- The ability for eligible workers to deduct a portion of their overtime pay from their federal income.

- The ability for eligible workers to deduct up to $25,000 in reported tips from their federal income.

While the seniors and workers to whom these tax breaks apply are potentially smiling, it's an entirely different story for future generations of retirees who expect to rely on Social Security as a meaningful source of income.

In late July, the highest-ranking Democrat on the Senate Finance Committee, Sen. Ron Wyden (D-OR), sent a letter to the SSA's Office of the Actuary (OACT) requesting a financial assessment of how Trump's "big, beautiful bill" will impact the program. A week later, the OACT sent a worrisome response.

According to the OACT, the tax breaks in Trump's flagship law are projected to reduce income collection for Social Security's Old-Age and Survivors Insurance trust fund (OASI) and Disability Insurance trust fund (DI). In turn, this is expected to increase costs for the combined OASI and DI by $168.6 billion from 2025 through 2034.

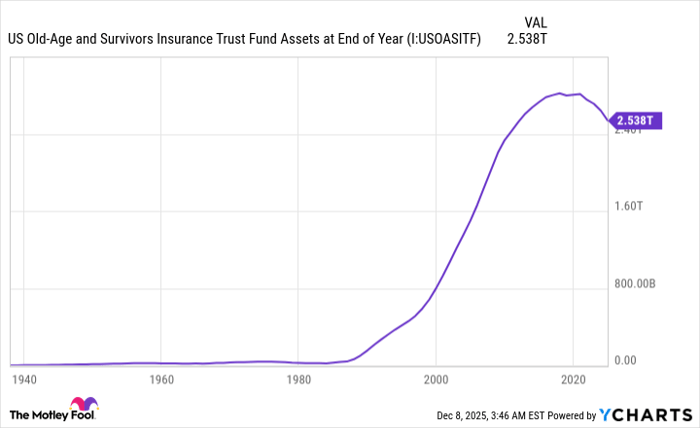

The OASI's asset reserves are expected to be exhausted in 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Furthermore, Trump's "big, beautiful bill" is forecast to speed up the timeline to potential benefit cuts for retired workers and survivor beneficiaries.

The 2025 Social Security Board of Trustees Annual Report estimated the OASI would completely exhaust its asset reserves (the excess cash collected since inception) by 2033. The OACT's newest analysis calls for the OASI's asset reserve depletion timeline to jump forward from the third quarter of 2033 to the fourth quarter of 2032. For context, the Board of Trustees believes that sweeping OASI benefit cuts of up to 23% may be necessary to avoid further reductions over the next 75 years.

Although things will look a bit rosier on the tax front for some folks through 2028, Trump's tax and spending law is expected to worsen Social Security's financial outlook.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.