Lululemon (LULU) Earnings Preview: Expectations are Low but still Plenty of Risks

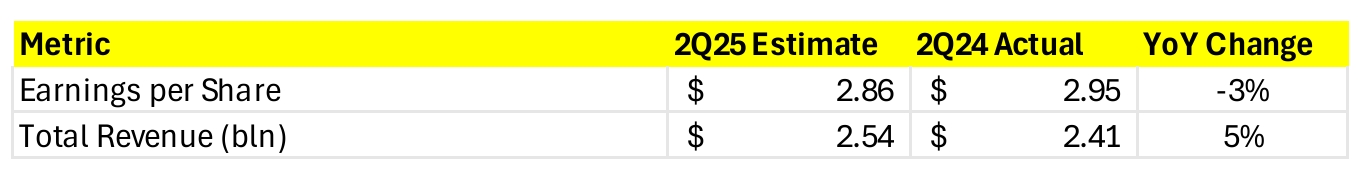

TradingKey - Lululemon Athletica will report earnings on Thursday after the market closes. A lot of negativity is revolving around LULU in 2025. The stock is not just down 46% this year, but it is also among the biggest underperformers among the S&P500 constituents. Expectations for the stock are low, which makes the threshold for a positive surprise low as well.

Apart from Q2 metrics, potential full-year guidance is just as important, with full-year revenue projected at $11.15–$11.30 billion and full-year EPS projected at $14.58–$14.78, any revision into the guidance will impact the share price.

Growth in the US and China

In the last few quarters, the revenue growth in North America (USA in particular) decelerated a lot, now being almost flat at around 3% year-over-year. As this is still the biggest market of the brand, the anemic growth makes investors worried, thus signs of US growth bottoming will turn the narrative in favor of LULU. On the other side China growth is perhaps the bright spot for the company recently with sales being up 21% there in Q1. However, even there we can see slowdown in growth compared to the recent quarters (30%+), thus as long as there is no material slowdown, things should be fine.

Margins

In Q1 2025, Lululemon’s gross margin increased by 60 basis points to 58.3%, however, the company still anticipates a 110-basis-point decline in gross margin for the full year due to tariffs and the removal of the de minimis rule. As we are already deep into the second half of the year, there probably be more clarity on how the company is managing the complex international trade environment.

Inventory is another aspect worth observing - as to whether the company is able to sell its product. Last quarter the inventory levels were up 23%, significantly higher than the revenue growth. If more inventory has been built up, this would mean a more aggressive discounting campaign which will hurt the overall profitability.

Brand Image and Competition

When it comes to its products, we would like to know more about the recent efforts of the firm to attract younger customers and respond to the quick rise of competitor brands like Alo, Vuori and Athleta. The current issue is young people may not find the skinny fit leggings cool anymore, compared to baggier pants, thus the recent Lululemon collections moved away from the traditional style. However, the efforts to rejuvenile the brand image may backfire and alienate the core millennial customer base.

Recently they also hired a Chief AI Officer, showing signs of ambitions towards that area, but we really want to see more details, as the market is yet to understand the long-term implications of such a move.

Get Started