SUI Price Forecast: SUI eyes further gains amid record high TVL, Open Interest

- Sui fluctuates indecisively at press time on Monday, consolidating the 4% gains from Sunday.

- The Total Value Locked on Sui hits a record high of $2.28 billion, indicating increased network activity.

- SUI Open Interest hits an all-time high of $2.66 billion, projecting heightened optimism among derivative traders.

Sui (SUI) edges lower by nearly 1% at press time on Monday, consolidating recent gains after reaching a six-month high of $4.44 earlier in the day, levels unseen since the Cetus hack in May. The bullish run backs the surge in Open Interest (OI) and Total Value Locked (TVL) on Sui to record high levels. The technical outlook reflects a battle against overhead supply pressure, as evidenced by the long wicks appearing on the daily candle.

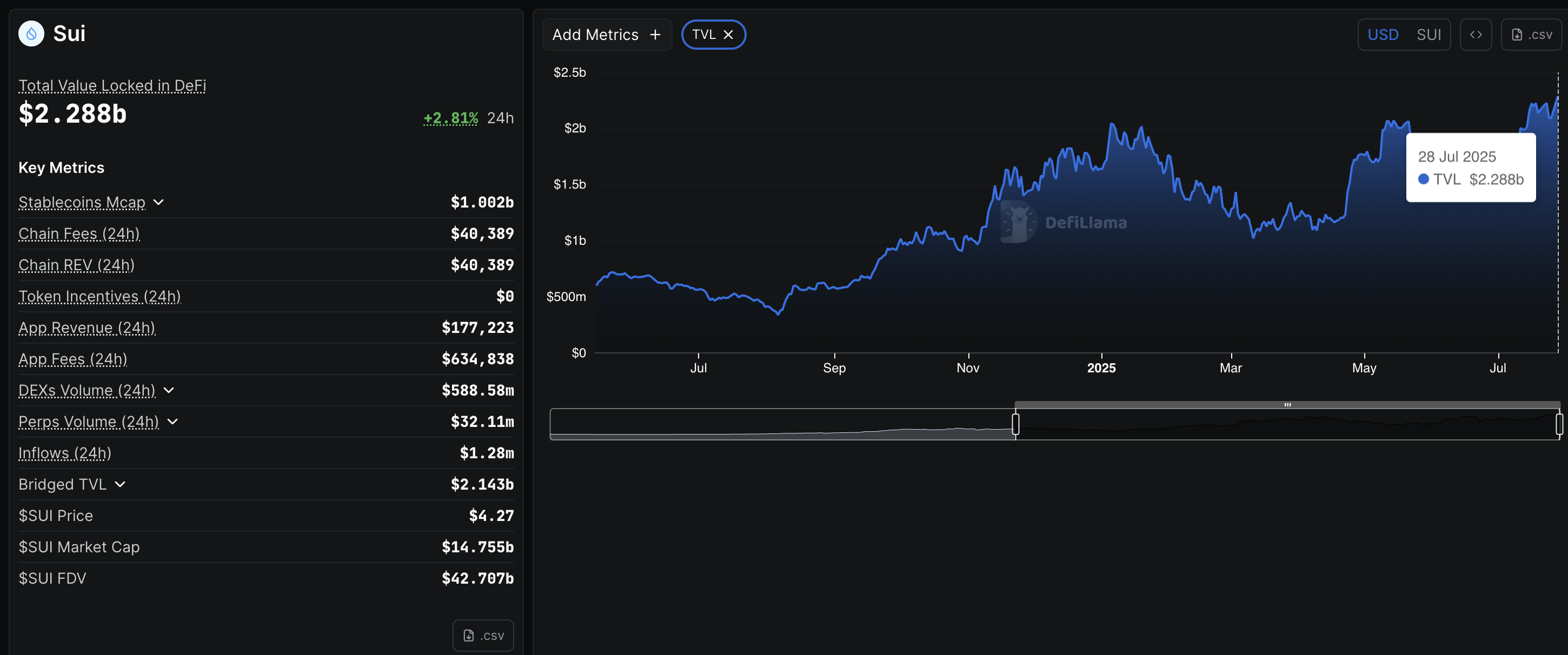

SUI TVL records a new all-time high of $2.28 billion

DeFiLlama data shows that the TVL on the Sui network has reached a record high of $2.28 billion, up from $2.19 billion last week. A $90 million increase reflects a rising influx of users on the network willing to trade, stake, or avail other decentralized finance (DeFi) services on the network.

SUI TVL. Source: DeFiLlama

It is worth noting that the Stablecoin market capitalization on the network has crossed $1 billion, indicating increased liquidity.

Open Interest hits record high of $2.66 billion

Coinglass’s data displays the SUI Open Interest (OI) rising to $2.66 billion, up from $2.36 billion on Sunday. The $30 billion surge in the last 24 hours indicates a significant capital inflow, likely driven by rising interest among traders.

SUI Open Interest. Source: Coinglass

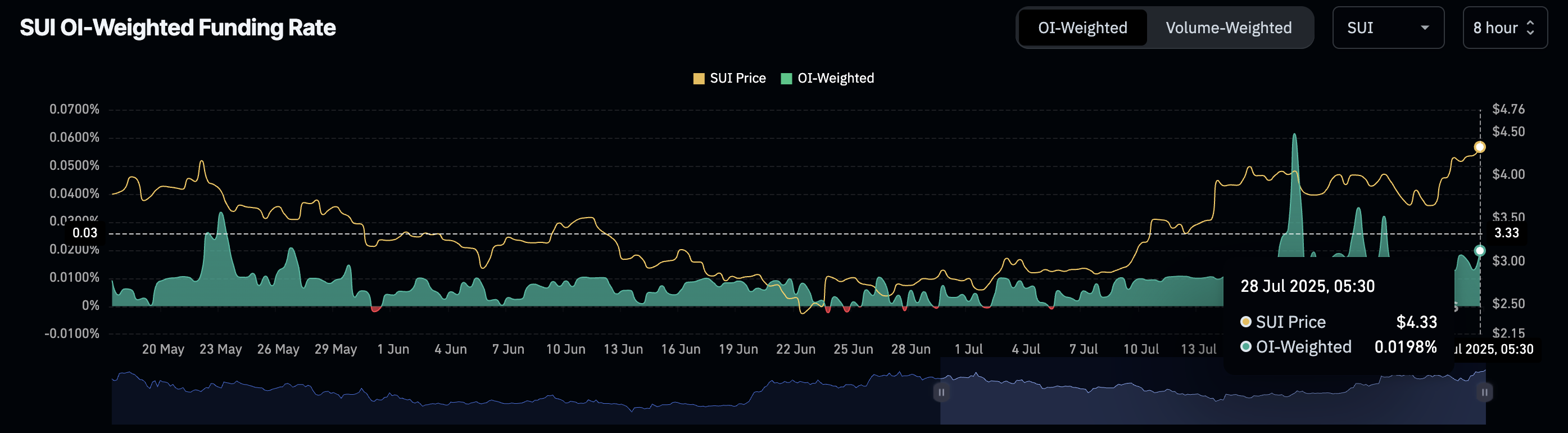

The OI-weighted funding rate stands at 0.0198%, up from 0.0129% on Sunday, indicating a greater boost in buying activity with the increased capital inflows. Typically, a spike in funding rate represents a surge in buying pressure as bulls pay the positive rates to keep the swap and spot prices aligned.

SUI funding rate. Source: Coinglass

SUI faces overhead selling pressure at six-month highs

SUI edges lower by nearly 1% so far on Monday after hitting $4.44 earlier in the day to mark a six-month high. The recent uptrend surpassing $4.29 marks a complete recovery from the Cetus hack in May.

However, the TVL and OI growth surpass the bullish run in spot prices, suggesting the boost in network activity and the derivative market’s optimism is yet to translate.

The intraday pullback could target the $4.00 round figure for a retest, potentially extending to the 50% Fibonacci retracement at $3.54, drawn from the $5.36 peak on January 6 to the $1.71 low on April 7.

The Relative Strength Index (RSI) reads 65 on the daily chart as it faces downside pressure. Notably, the RSI shifts lower, diverging from the rising SUI price trend, which indicates a potential hidden bearish divergence. Investors may want to temper their bullish expectations, as the said divergence often foreshadows a quick correction.

The Moving Average Convergence Divergence (MACD) bounces off its signal line with a surge in green histogram bars from the zero line, indicating the bulls are battling against a trend reversal.

SUI/USDT daily price chart.

If SUI upholds bullish momentum, it could extend the rally to the 78.6% Fibonacci level at $4.58. A potential close above this level would increase the chances of SUI reclaiming the $5 milestone.