Solana-based Jupiter posts hefty returns amidst meme coin rally

- Jupiter is proving to be one of Solana's most impressive DeFi projects as it processes higher volume than Uniswap V3.

- The recently introduced Value-Average (Beta) feature could be one of the main drivers behind JUP’s rally.

- Other Solana-based tokens have also shown significant price gains.

Jupiter (JUP) has risen rapidly since March 6, recording almost a 67% gain for investors. Although still down from its launch price of $2, Jupiter's on-chain metrics have been growing steadily.

JUP recovers from airdrop dump

Jupiter is a swap aggregator on the Solana blockchain that pools liquidity from various DeFi platforms to facilitate token swaps with minimal slippage and low transaction costs.

After Jupiter's token, JUP, went live on January 31, it faced a significant dump, a common occurrence with many airdropped tokens.

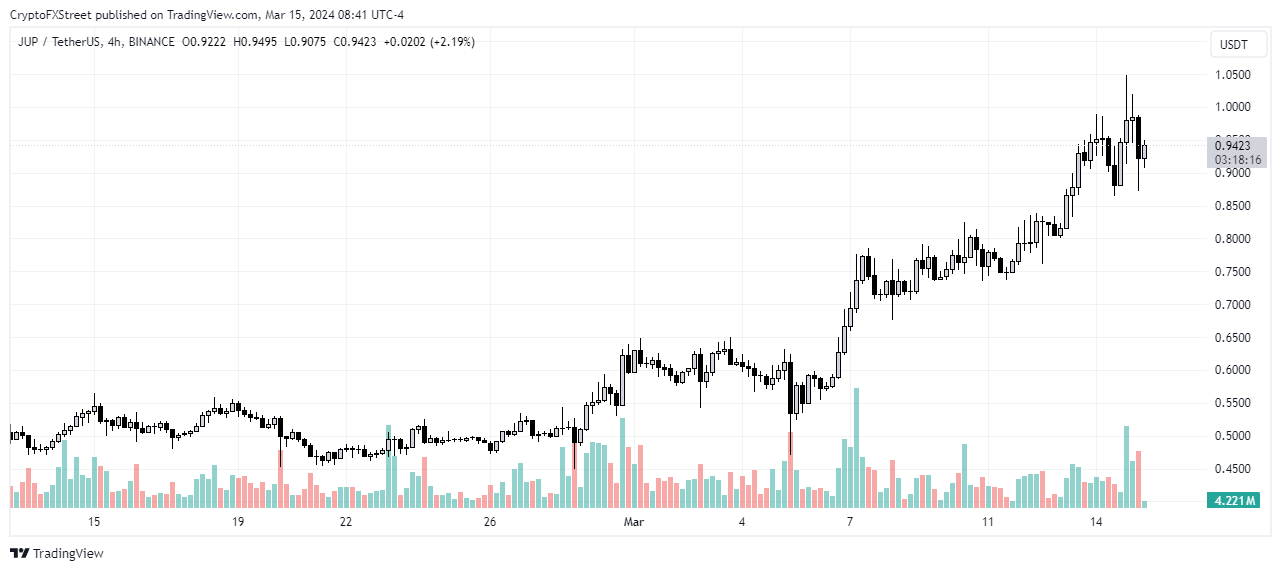

This led to its price plummeting to a low of $0.4 as investors seized the opportunity to take profits and explore other projects. Its price remained between $0.4 and $0.5 throughout February until it experienced a breakout on March 1. Since then, Jupiter has been on a steady upward trajectory, rising to $0.97 before experiencing a slight correction.

JUP/USDT 4-hour chart

Why JUP is rising

A key factor driving this price growth is the Jupiter team's commitment to enhancing and expanding the features of the Jupiter ecosystem. Notably, the recent introduction of the LFG Launchpad feature has been instrumental in the successful launch of highly traded memecoins like WEN.

Examining Jupiter's on-chain data provides further insights into its performance. The total value locked (TVL) has surged to approximately $300 million, indicating growing confidence and participation in the platform.

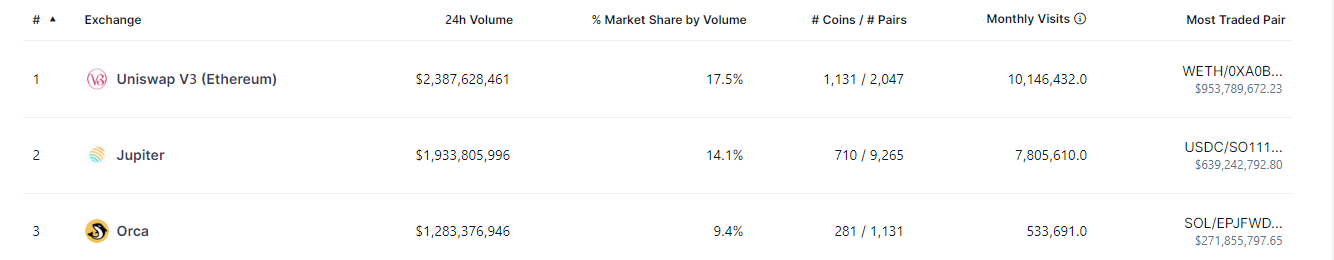

Moreover, Jupiter briefly surpassed Uniswap V3 on Thursday to become the largest DEX, before returning back to the number 2 position. According to Coingecko, Jupiter commands a dominance of 14.1%, compared to Uniswap V3's 17.5% as of the time of writing. Moreover, it has facilitated over 2.50 million transactions across 277.88 thousand unique wallet addresses in the same period, according to data from DappRadar.

Top DEX Trading Volume

The introduction of the value-average beta feature has also positively influenced Jupiter's price action. This dynamic investment strategy, as explained on its X (formerly Twitter) account, “prioritizes balanced portfolio growth by adjusting investments based on market movements”, purchasing more during price declines and less during upticks.

Other Solana-based tokens rise alongside JUP

Beyond Jupiter, the broader Solana ecosystem is experiencing rapid growth, with Solana-based memecoins such as Bonk (BONK) and Dogwifhat (WIF) witnessing significant gains and heightened social activity.

Jupiter may have benefitted from the overall growth of the Solana network, with JUP's market capitalization soaring to $1.27 billion at the time of writing. This reflects the confidence and interest surrounding Jupiter and its role within the burgeoning Solana ecosystem.