Aave Price Prediction: AAVE surges over 10% this week as on-chain metrics and bullish bets soar

- Aave price trades higher above $260 on Friday, having rallied over 10% so far this week.

- AAVE on-chain data presents a bullish outlook, with active loans and revenues reaching record highs.

- The technical outlook suggests a rally following a rebound from key support, with bullish bets reaching a monthly high.

Aave (AAVE) price is trading higher above $260 at the time of writing on Friday, following an over 10% rally so far this week. Three reasons why AAVE could extend its gains ahead are that its on-chain data shows that active loans and revenues have reached record levels. On the technical side, the price action indicates that it has rebounded from key support earlier this week. Lastly, the derivatives data shows that the bullish bets are rising among traders, all hinting at further upside moves.

AAVE on-chain metrics hint at further gains

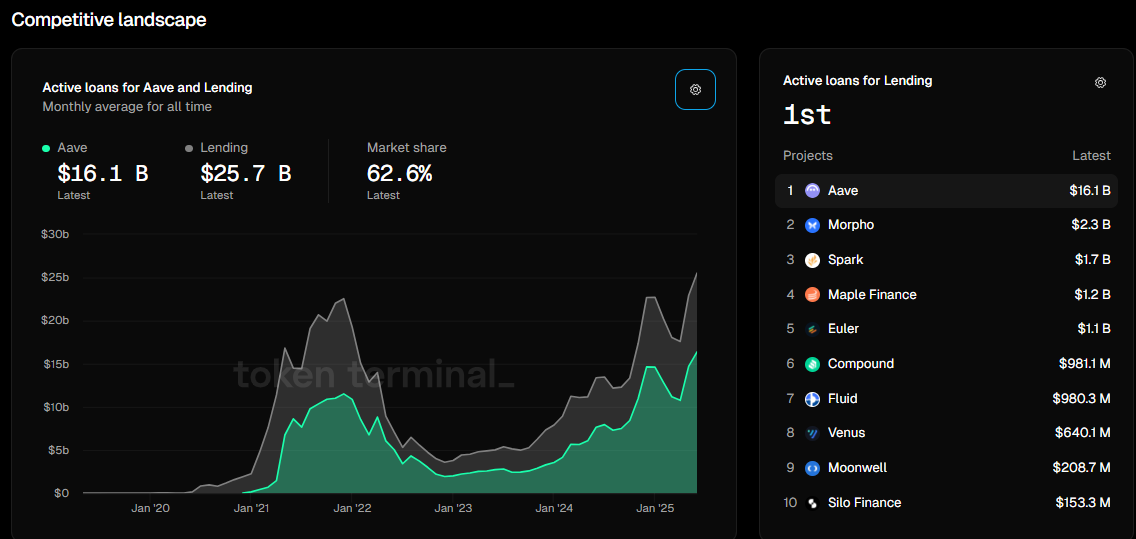

Token Terminal data shows that Aave’s active monthly loans as of June have reached a record high of $16.37 billion. The competitive landscape chart below shows that AAVE stands at the top, surpassing other lending platforms, such as Morpho (MORPHO) and Spark (SPK), with a market share of 62.6%. This suggests that Aave is currently the dominant player in the decentralized lending sector, indicating its widespread adoption and trust among users.

Aave active loans monthly chart. Source: Token Terminal

Competitive landscape chart. Source: Token Terminal

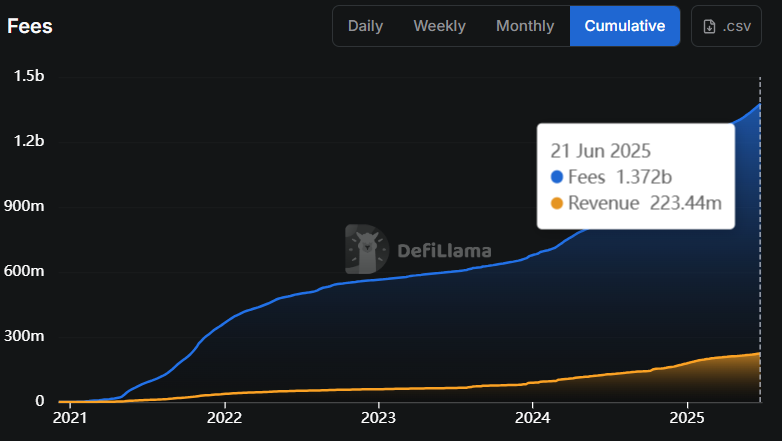

Another data supporting AAVE’s bullish outlook is the rising protocol fees and revenue. DeFiLama data shows that AAVE’s cumulative fees and revenue reached a record high of $1.37 billion and $ 223.44 million respectively, on June 21.

AAVE cumulative fees and revenue chart. Source: DefiLlama

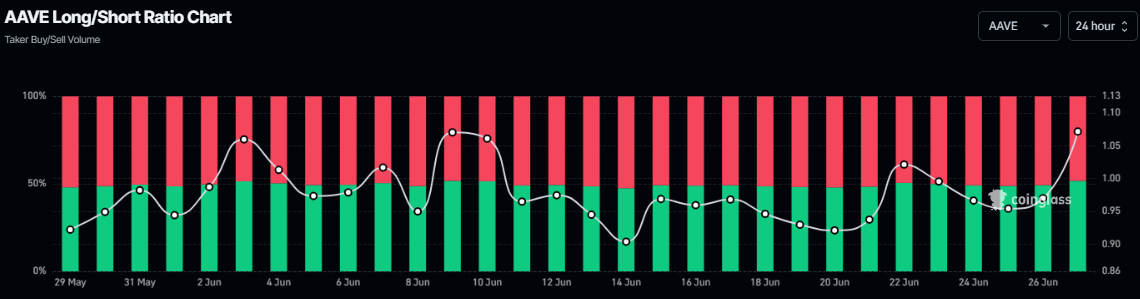

Apart from the positive on-chain metrics, Aave’s derivative data also suggests a potential price rally. Coinglass’s long-to-short ratio for AAVE reads 1.07, the highest level over a month. The ratio above one suggests that more traders are betting on AAVE’s price to rally.

AAVE long-to-short ratio chart. Source: Coinglass

AAVE Price Prediction: Rebound from key support

Aave’s price retested and found support around its key level at $219.69 on Monday and rallied by nearly 16% until the next day. This level aligns with the 200-day Exponential Moving Average (EMA), the 50% Fibonacci retracement level (derived from the April low of $114.05 to the June high of $325.40), and the ascending trendline formed by connecting multiple lows since early April, representing a key support zone. At the time of writing on Friday, it trades above $260.

If AAVE continues its upward trend, it could extend the rally toward its next daily resistance at $282.52. A successful close above this level would extend the gains to retest its June 11 high at $325.41.

The Relative Strength Index (RSI) on the daily chart hovers around its neutral level of 50, indicating a lack of momentum and indecision among traders. For the bullish momentum to be sustained, the RSI should continue to move above its neutral level.

AAVE/USDT daily chart

However, if AAVE faces a correction, it could extend the decline to retest its key support level at $219.69, its 200-day EMA.