Over $3.33 Billion Bitcoin and Ethereum Options Expire Today After US CPI and PPI

Over $3.3 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today. It comes after a lower-than-expected US CPI (Consumer Price Index) and cooler PPI (Producer Price Index) data.

How will today’s expiring options impact the prices of these digital assets and the broader crypto market volatility?

Over $3 Billion in Options Expiring – Crypto Market Reaction

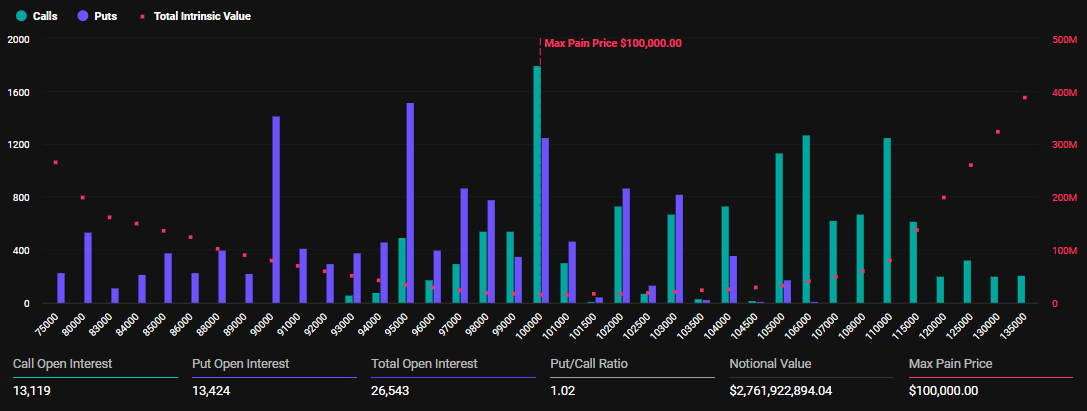

According to Deribit, more than $2.76 billion in Bitcoin options are set to expire, with a maximum pain point of $100,000. This batch of options includes 26,543 contracts, up from the previous week’s 25,925 open interest.

The put-to-call ratio is 1.02, meaning traders are buying more Puts (rights to sell) than Calls (rights to buy), reflecting a bearish market sentiment.

Expiring Bitcoin Options. Source: Deribit

Expiring Bitcoin Options. Source: Deribit

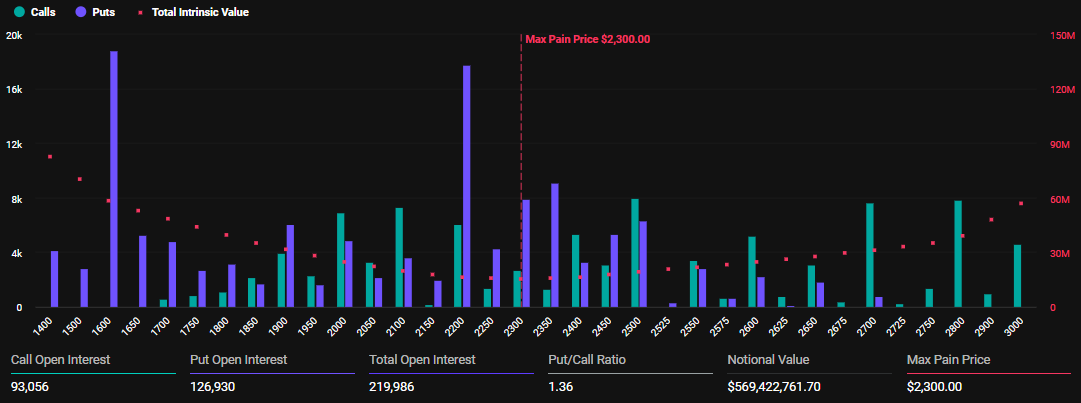

For Ethereum, $569.42 million in options are expiring, involving 219,986 contracts, a notable increase from last week’s 164,591 contracts. The maximum pain point is $2,300, with a put-to-call ratio of 1.36, suggesting a bearish market outlook for ETH.

Expiring Ethereum Options. Source: Deribit

Expiring Ethereum Options. Source: Deribit

The “maximum pain point” in crypto options is crucial. It represents the price level at which option holders experience the most significant financial discomfort.

As of this writing, Bitcoin traded for $103,912, whereas Ethereum exchanged hands for $2,572. This means both digital assets are above strike prices with a predominantly bearish market sentiment.

Notably, markets tend to gravitate toward the strike price or max pain level post-expiry to minimize payouts.

“BTC skew is neutral…price action could get interesting,” Deribit analysts wrote.

Greeks.live analysts note that Bitcoin’s rejection from the $105,000 threshold came amid an overextended market. The analysts also note caution in the market, with defensive strategies emerging, and traders preferring to sell rather than chase momentum.

“Several traders are taking profits on long calls and rotating into more defensive positions as they feel everybody rushed in,” Greeks.live notes.

How Does the Recent US CPI and PPI Affect the Crypto Options Market?

Meanwhile, these expiring options come after US CPI data for April showed inflation cooled to 2.3%, the smallest reading since February. 2021. Similarly, April PPI inflation fell to 2.4%, below expectations of 2.5%.

According to analysts, while the April data flipped the narrative, markets may be underreacting to this shift. Lower inflation and fading retail could pressure the Fed to cut rates sooner, despite earlier Fed signals of maintaining steady rates amid tariff uncertainties and a 2% inflation target.

“Rate cuts are back in play, markets aren’t ready for what’s coming,” wrote crypto analyst Merlijn the Trader.

This typically boosts risk assets like Bitcoin and Ethereum, increasing demand for crypto options as investors seek leveraged exposure. Lower inflation reduces pressure on monetary tightening, enhancing market liquidity, which drives up call option premiums.

However, crypto prices noted slight short-term volatility post CPI and PPI, with options traders seeing heightened activity, increased volumes, and tighter spreads.

While option expirations can cause sharp price movements, the impact is usually temporary. The market generally stabilizes the next day, offsetting initial fluctuations.

Nonetheless, traders should carefully analyze technical indicators and market sentiment before investing in this volatile environment.