Polymarket Faces Backlash After $7 Million Market Manipulation Scandal

Polymarket, a prediction market platform, is under fire following the most severe manipulation attack in its history.

A prediction market with a betting volume exceeding $7 million produced an erroneous outcome, leaving users with significant losses.

Inside Polymarket’s $7 Million Market Manipulation: What Went Wrong

The latest controversy concerns the market: “Ukraine agrees to Trump mineral deal before April?” The market was supposed to run from February 2 to March 31, 2025.

It would resolve as “Yes” if the United States and Ukraine reached an agreement involving Ukrainian rare earth elements by the specified deadline.

Ukraine agrees to Trump mineral deal before April. Source: Polymarket

Ukraine agrees to Trump mineral deal before April. Source: Polymarket

Rules on the Polymarket platform explicitly stated that the resolution would be based on “official information from the US and Ukrainian governments.” However, despite no official confirmation, the market was resolved as “Yes,” leading to widespread accusations of manipulation.

“Polymarket has scammed its users once more,” a user wrote on X.

He also noted that, in the past, two markets with identical conditions were classified as “No.” Notably, they had much smaller betting volumes of $91,860 and $360,976. In contrast, the manipulated market boasted a betting volume exceeding $7 million.

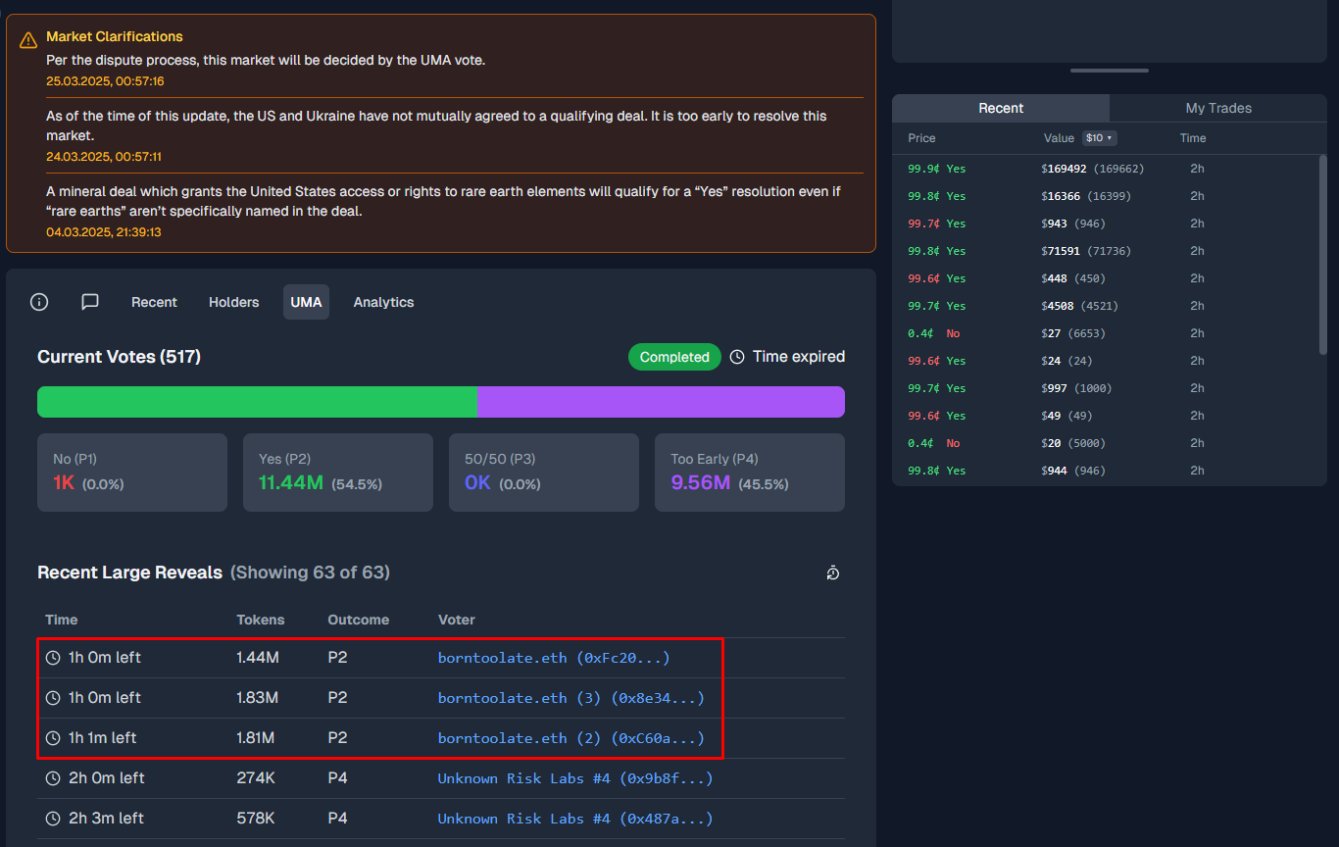

The user claimed that a group of influential users called UMA whales manipulated the outcome. He also revealed that a whale used multiple accounts to cast a large number of votes, totaling 5 million tokens, which accounted for 25% of the total votes.

UMA Whale Manipulation on Polymarket. Source: X/Marmont

UMA Whale Manipulation on Polymarket. Source: X/Marmont

Thus, the individual effectively concentrated a significant portion of the voting power in their hands, skewing the outcome in favor of the “Yes” option.

Polymarket’s response has done little to assuage user concerns. The team issued an announcement on their official Discord server, acknowledging the situation. However, they stated that they could not issue refunds to affected users because the situation was not a market failure.

“This is an unprecedented situation, and we have been in war rooms all day internally and with the UMA team to make sure this won’t happen again. This is not a part of the future we want to build: we will build up systems, monitoring, and more to make sure this doesn’t repeat itself,” the statement read.

Is Polymarket Rigged? A History of Insider Allegations

Meanwhile, this isn’t the first time Polymarket has been accused of manipulation. A detailed thread by an X user, Folke Hermansen, shed light on several similar instances.

“Polymarket is revealing itself to be revealing itself a totally fraudulent platform. Insiders write rules, place bets, and co-ordinate with verifiers to rig markets and scam their own customers for millions daily,” he posted.

Hermansen disclosed that, in early March, manipulators resolved the “Gold missing from Fort Knox” market as “No,” stealing $3.5 million. Furthermore, in another tariff-related market, he alleged that the dispute button disappeared during the 2-hour window for users to challenge the resolution. This allowed insiders to push the market to a “No” outcome.

Another example he gave was the “Will Trump say China during his crypto summit?” market. Polymarket issued a rule clarification after Trump mentioned China, retroactively declaring it didn’t count and resolving the market to “No.”

Hermansen elaborated that the manipulation of Polymarket markets happens due to a combination of factors related to UMA’s dispute resolution system and the influence of insiders.

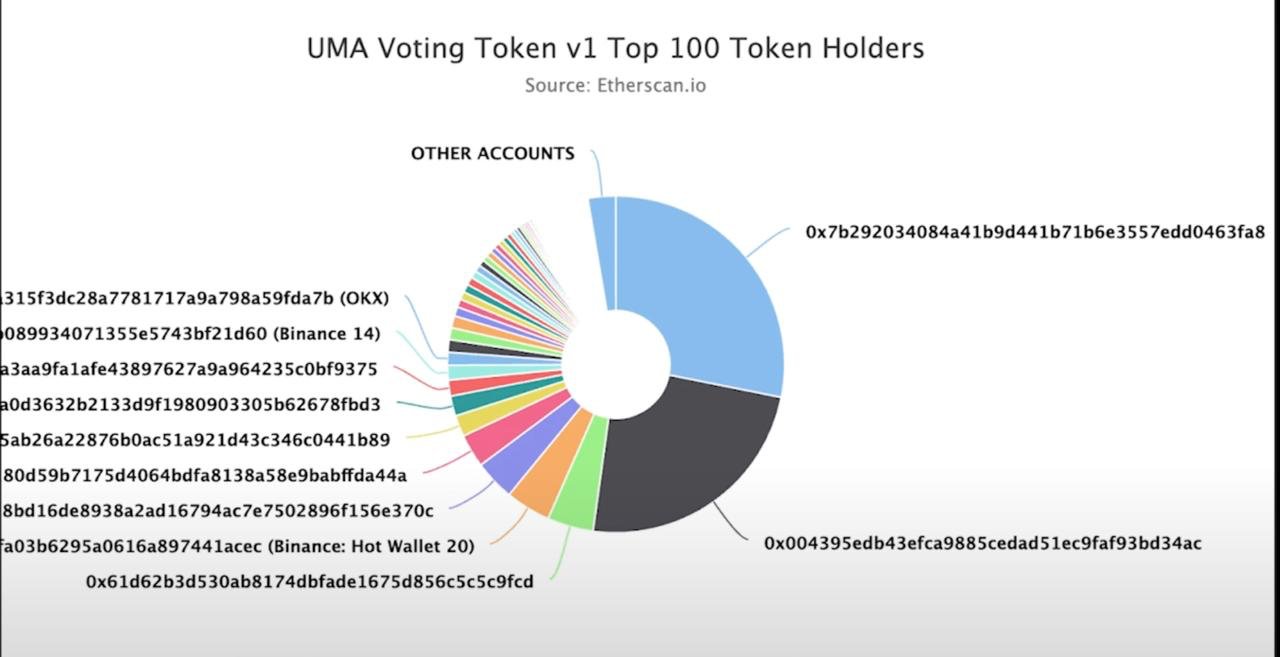

He added that UMA resolution votes are highly concentrated, with just two whales controlling over half of the voting power. Furthermore, an individual holds up to 7.5 million of the 20 million staked UMA tokens.

UMA Token Holders. Source: X/Folke Hermansen

UMA Token Holders. Source: X/Folke Hermansen

Hermansen stressed that these whales are also active participants in Polymarket, placing large bets on outcomes.

“UMA is, in theory, a neutral third-party blockchain protocol which incentivizes truth-seeking. In reality, it incentivizes crowding towards whatever other people are voting for,” he stated.

According to him, the UMA system incentivizes voters to follow the majority to avoid losing their staked tokens. Thus, large holders’ actions drive voting rather than an independent search for the truth.

Additionally, he detailed that to propose or dispute a market resolution on Polymarket, users must post a bond, which is usually $750 USDC. Insiders with significant holdings can afford to stake large amounts and post bonds. Meanwhile, fear of losing their stake discourages others from challenging them.

As a result, most disputes in UMA end up with near-unanimous resolutions, often 95% or more.

“It’s an open secret that UMA whales can arbitrarily decide how markets resolve,” Hermansen claimed.

He also emphasized that the system’s design anonymizes voting and disputes. Therefore, this makes it difficult to trace who is responsible for incorrect resolutions, further enabling insider manipulation.