Cardano Soars 60% Following Crypto Reserve Addition, What’s Next for ADA?

Cardano (ADA) has experienced a major price surge, rallying 60% after struggling for six weeks in a downtrend.

The recent announcement of US President Donald Trump’s Crypto Reserve, which includes Cardano, acted as a key catalyst for this price movement, pushing ADA back above the $1 level for the first time in over a month.

Cardano Investors Recover Their Losses

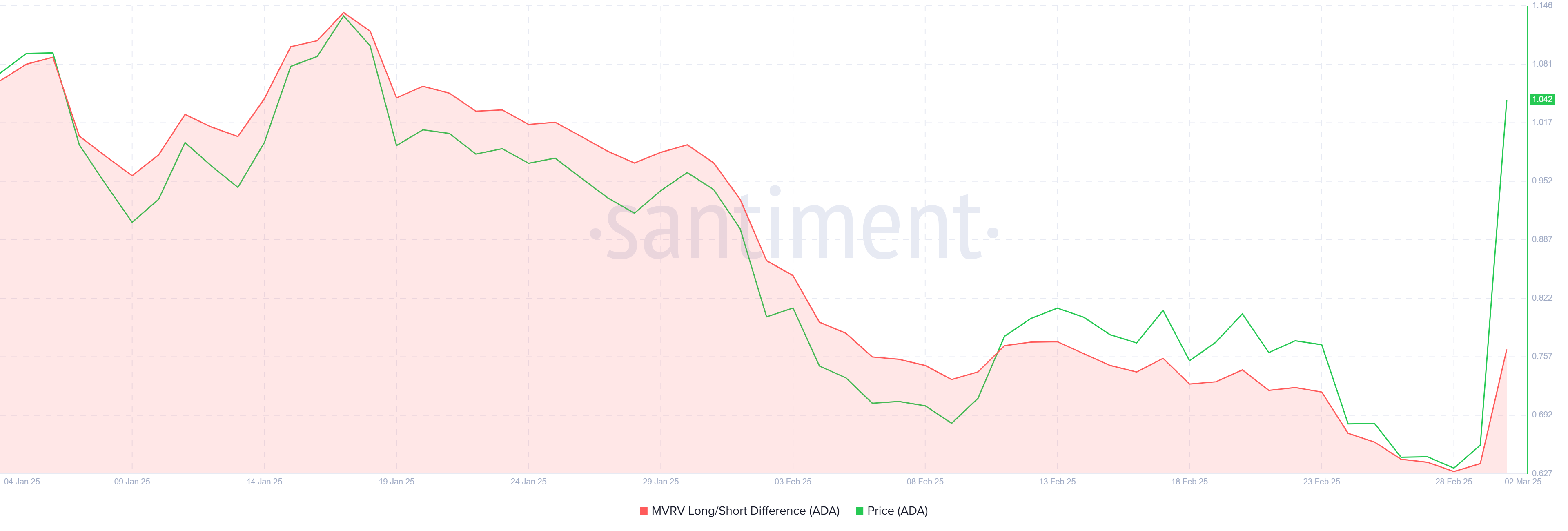

The MVRV Long/Short Difference indicator shows a significant uptick, suggesting that the profit margins of long-term holders (LTHs) have surged. LTHs typically act as the foundation for any cryptocurrency’s price stability. When LTHs are profiting and choosing to hold rather than sell, it prevents price drops and instead supports price increases.

This behavior aligns with the recent price surge, as long-term holders are choosing to hold ADA, reinforcing the bullish momentum.

The increased LTH profits signify strong investor confidence in the asset’s long-term prospects. This, in turn, suggests the rally may be more than just a short-term price movement but rather the beginning of a more sustained uptrend.

Cardano MVRV Long/Short Difference. Source: Santiment

Cardano MVRV Long/Short Difference. Source: Santiment

The Relative Strength Index (RSI) for Cardano has entered the overbought zone, which is traditionally a bearish sign indicating potential price reversals. However, historical data on ADA reveals that a rise into the overbought zone has often signaled the continuation of upward momentum, not a reversal. This suggests that despite the overbought indication, Cardano could still continue its rally.

Given that previous instances of RSI entering overbought territory have led to price increases for ADA, the current scenario indicates that Cardano may continue to rise. This momentum, if sustained, could drive ADA to further highs despite the typical bearish nature of overbought conditions.

Cardano RSI. Source: TradingView

Cardano RSI. Source: TradingView

ADA Price Is Rallying

At the time of writing, Cardano’s price is up 60%, trading at $1.06. This marks a significant recovery after the altcoin had struggled below the $1 mark for six weeks. The price increase is a direct result of the market’s reaction to Trump’s announcement, with ADA making a strong push above $1. This level is crucial as it marks a psychological threshold for both traders and investors.

The breakout above the $1 barrier is a sign that ADA may be gearing up for further rallies. For Cardano to maintain its upward momentum, it needs to secure $1.00 as a reliable support level. A failure to hold this level could lead to a loss of momentum and a return to lower price levels.

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingView

If Cardano fails to maintain support at $1.00, it could fall back toward the next key support level at $0.85. This would invalidate the current bullish outlook and set back the potential recovery. However, maintaining support at $1.00 would solidify the rally and pave the way for further price increases.