Argentinian President Javier Milei shares $LIBRA scam coin on X, $4.4 billion erased from the market

Earlier today, Argentinian President Javier Milei shared a meme coin called $LIBRA on his X account, stating that it’s a private project dedicated to the growth of the Argentine economy. Within 5 hours, the project erased $4.4 billion from the market.

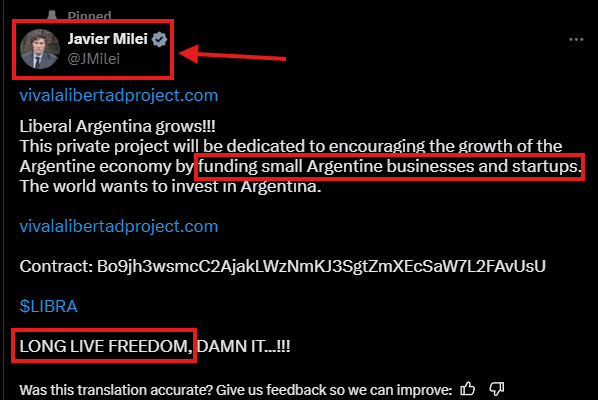

In a since-deleted X post, Javier Milei mentioned that the project aims to “fund small Argentine businesses and startups.”

Traders were concerned about the project’s authenticity during the first hour of its launch. However, The Kobeissi Letter mentioned on X that multiple Argentinian politicians posted the news of the launch, hence confirming that the president’s account is not hacked or compromised.

The project website, however, seemed off. It linked to a Google Form for funding applications, which is unusual for a project of such scale. The domain was apparently registered for one year only and created just hours before the project’s launch.

$LIBRA TEAM IS CASHING OUT

They already made $87M by removing USDC and SOL from liquidity pools https://t.co/hRGnRPTDiE pic.twitter.com/aiDmODKi6o

— Bubblemaps (@bubblemaps) February 15, 2025

Minutes into the launch, large holders of the coin started liquidating $LIBRA worth millions of dollars, resulting in gains of over $4 million as the coin topped $4.6 billion in market cap. It then dipped down in a straight line after marking a top at 5:40 PM ET.

The coin crashed within 3 hours of the launch. Bubblemaps data shows that within the first 3 hours, insiders cashed out $87.4 million of the project by removing the liquidity.

In a more recent X post, Javier Milei stated that he was not aware of the project’s details. He deleted his earlier post about the coin to avoid spreading the word.

At the time of this writing, $LIBRA sits at a market cap of $162.0 million after erasing $4.4 billion from the market. The effects of this scam coin were also seen in $TRUMP, which fell sharply and lost over $500 million in market cap.

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet