Ethereum Name Service (ENS) Soars to New Yearly High of $37.29, Leads Top 100 Gainers

ENS, the native token of Ethereum Name Service, a decentralized naming system, has seen a sharp price increase, surging by 37% in the past 24 hours. This performance makes it the top gainer among the top 100 cryptocurrencies.

During Thursday’s early Asian session, the altcoin reached a new year-to-date high of $37.29 before pulling back slightly. It is now trading at $34.17, accompanied by a notable rise in trading volume.

Ethereum Name Service Sees Spike in Trading Activity

A significant rise in trading volume has accompanied ENS’ double-digit surge. It has reached an all-time high of $2.35 billion, rocketing by more than 300% over the past 24 hours.

When an asset’s trading volume rallies with its price, it signals strong investor interest. Rising volume confirms that the price movement is supported by active participation, making the rally more sustainable. On the other hand, a price increase without volume growth may suggest a weaker uptrend that could be prone to reversal.

This means that actual demand for the token, rather than mere speculative trading activity, has driven ENS’ rally.

ENS Price and Trading Volume. Source: Santiment

ENS Price and Trading Volume. Source: Santiment

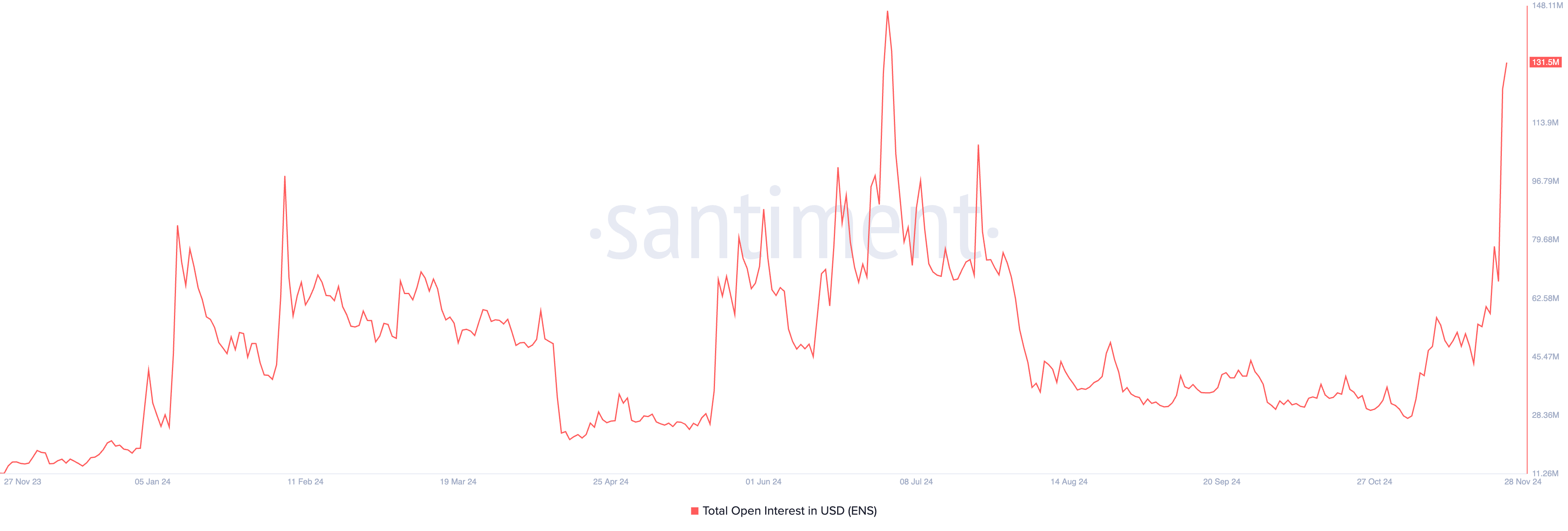

Moreover, the altcoin’s open interest has surged to a multi-month high of $132 million, confirming the rise in trading activity. Per Santiment, this has risen by 7% over the past 24 hours and is currently at its highest level since July.

Open interest measures the total number of outstanding contracts (such as futures or options) that have not yet been settled or closed. When it climbs during a price rally, it indicates that more traders are entering positions, suggesting strong market participation in the rally.

This signals the trend will continue, as increasing open interest reflects growing confidence in the price movement.

ENS Open Interest. Source: Santiment

ENS Open Interest. Source: Santiment

ENS Price Prediction: Buyers May Soon Witness Exhaustion

As of this writing, ENS trades slightly above support formed at $31.57. A successful retest of this support level will propel the token’s price to reclaim its year-to-date high of $37.29.

However, readings from ENS’ Relative Strength Index (RSI) indicate that the market is overheated, and buyers may soon experience exhaustion. At press time, the indicator’s value is at 79.27.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges from 0 to 100, with values above 70 suggesting the asset is overbought and potentially due for a correction. Conversely, RSI values below 30 signal the asset is oversold and may be primed for a rebound.

ENS Price Analysis. Source: TradingView

ENS Price Analysis. Source: TradingView

A potential correction will push the ENS token price below support at $31.57 and toward $28.27.