Fetch.ai (FET) Traders Turn Bullish as ASI Phase 2 Nears

Now regarded as Artificial Superintelligence Alliance (ASI), Fetch.ai (FET) completed the first phase of the merger with Ocean Protocol (OCEAN) and SingularityNET (AGIX) on July 22. The competition means that the project is 50% done with the integration that will see FET, OCEAN, and AGIX come under the same umbrella and ASI ticker.

However, before the alliance began on July 1, traders were bullish on the development. As time passed, the sentiment changed, especially as FET’s price dropped by 16.11% in the last seven days.

Fetch.ai Open Interest Rises Following Rise in Bullish Bets

At press time, the price performance has not improved, as the token dropped by 7.21% in the last 24 hours while trading at $1.27. But if something has alternated, it is the expectations traders have.

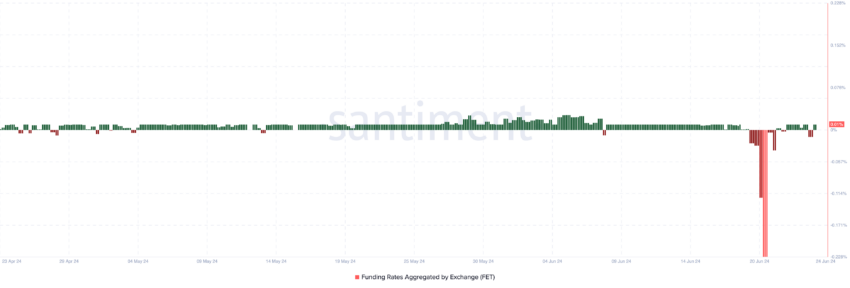

From the chart below, the Funding Rate shows that the rating dropped to negative territory between July 19 and 22.

In the early hours of July 24, funding was negative, suggesting that traders expect FET to produce negative returns. However, as of this writing, the reading has returned to the green zone and is at 0.01%.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Fetch.ai Funding Rate. Source: Santiment

Fetch.ai Funding Rate. Source: Santiment

By definition, the Funding Rate is the price gap between a cryptocurrency’s perpetual price and its spot value. If it is positive, longs (buyers) pay shorts (sellers) to keep their position open. If it is the other way around, shorts pay longs.

However, the perpetual price trading meaningfully above the spot price does not exactly mean FET’s price will increase. In most cases, as funding becomes more positive and the price moves lower, it means spot traders are selling.

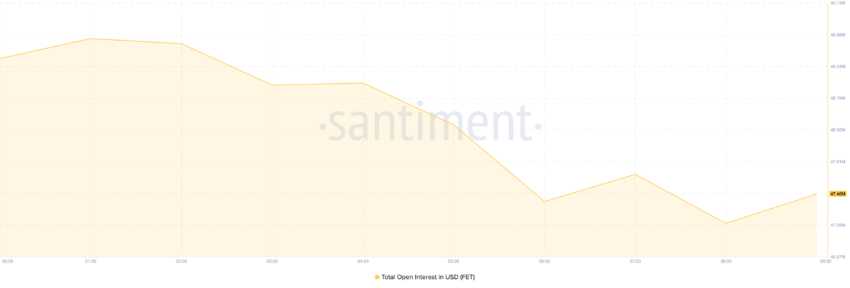

Should selling pressure intensify, Fetch.ai’s price could stay bearish. Interestingly, the token’s Open Interest (OI) increased around the same period the positive expectations appeared.

Open Interest refers to the value of all open contracts in the market. Previously, the OI hit a month-long low, but at press time, it had climbed to $47.46 million.

Fetch.ai Open Interest. Source: Santiment

Fetch.ai Open Interest. Source: Santiment

This increase indicates that traders are now opening more positions to profit from FET price action. If the increase continues, the crypto may shed some of its losses.

FET Price Prediction: Bearish Pressure Remains

Despite the change in perception, the technical perspective does not exactly paint FET in a bullish light. For a start, the Stochastic Relative Strength Index, commonly called the Stoch RSI, is down.

This indicator measures the strength or weakness of a cryptocurrency’s momentum. It also indicates overbought or oversold points with readings at 80.00 and 20.00, respectively. Therefore, the decline in the Stoch RSI reading suggests that the price might continue to slide.

Furthermore, strong support at $1.11 could prevent FET from decreasing below the region. Irrespective of that, a notable bounce looks unlikely, as the price may drop below $1.27.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

FET Daily Analysis. Source: TradingView

FET Daily Analysis. Source: TradingView

However, if bulls can keep defending this support and the bullish trader sentiment leads to increased demand, FET could reverse upwards. If this happens, the token could attempt to surpass the resistance at $1.55 and move toward $1.69.

Should this be the case, the second phase of the ASI merger could be better for Fetch.ai’s price than the underwhelming outlook shown in phase one.