Crypto Today: Bitcoin, Ethereum hold steady as XRP struggles ahead of Fed rate decision

- Bitcoin holds above $92,000, supported by ETF inflows and hopes of a potential Fed interest rate cut.

- Ethereum rises above the 50-day EMA as the MACD and RSI signal a bullish turnaround.

- XRP trades under pressure as sellers target $2.00 support despite mild ETF inflows.

Bitcoin (BTC) is trading above $92,000 at the time of writing on Wednesday as traders brace for volatility ahead of the upcoming US Federal Reserve (Fed) decision, which is widely expected to cut interest rates. An upswing from the previous day pushed BTC to $94,588, but headwinds amid macroeconomic uncertainty capped the rebound, leading to a minor correction.

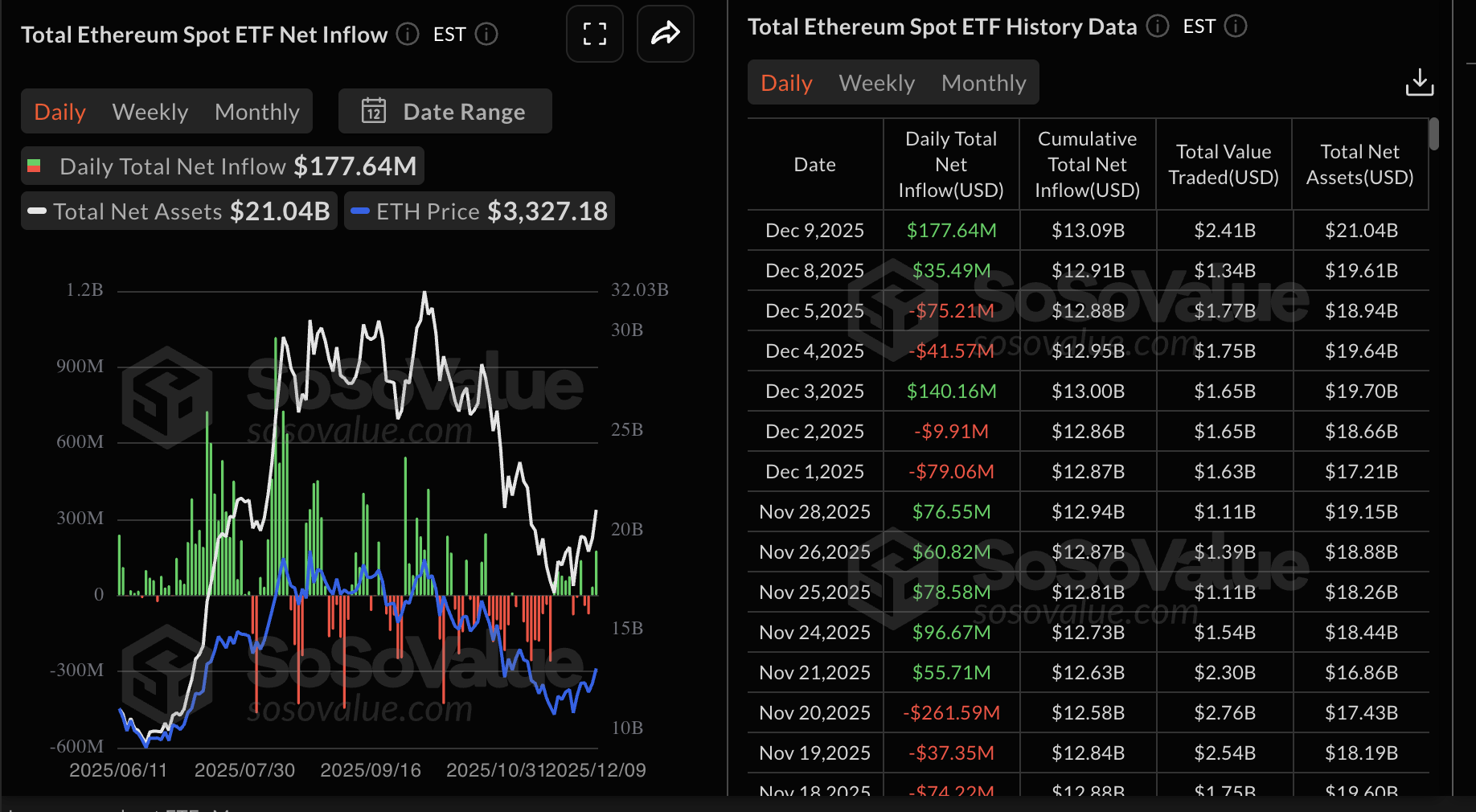

Ethereum (ETH) remains broadly stable above $3,300, buoyed by inflows into spot Exchange Traded Funds (ETFs). Ripple (XRP), on the other hand, is edging lower toward its short-term support $2.00 despite steady but mild ETF inflows.

Data spotlight: BTC, ETH, XRP ETF inflows build as markets await Fed rate call

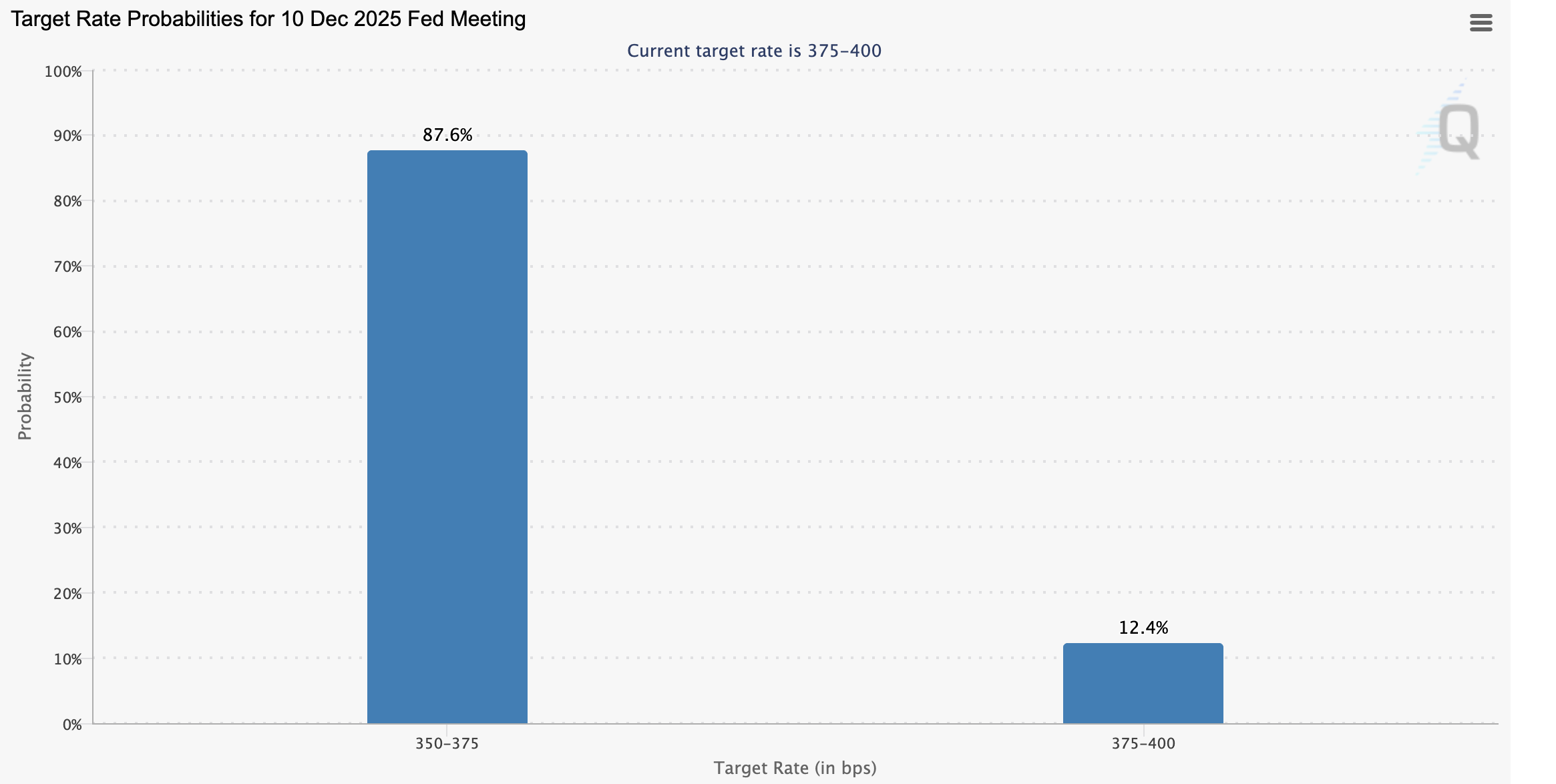

The Federal Reserve (Fed) is expected to announce its monetary policy decision later on Wednesday. Markets have almost fully priced in a 25-basis-point cut, with probabilities in favor standing at 87.6%, according to the FedWatch Tool.

If the Federal Open Market Committee (FOMC) follows through with the cut, it will take the benchmark interest rate down to a range of 3.50%-3.75%. Nonetheless, the weight of the matter lies with the post-meeting statement and Fed Chair Jerome Powell’s news conference. Here, investors will watch for clues about the central bank’s monetary policy direction, especially in the first quarter of 2026. This outlook will help shape sentiment, either bullish or bearish, over the next few weeks.

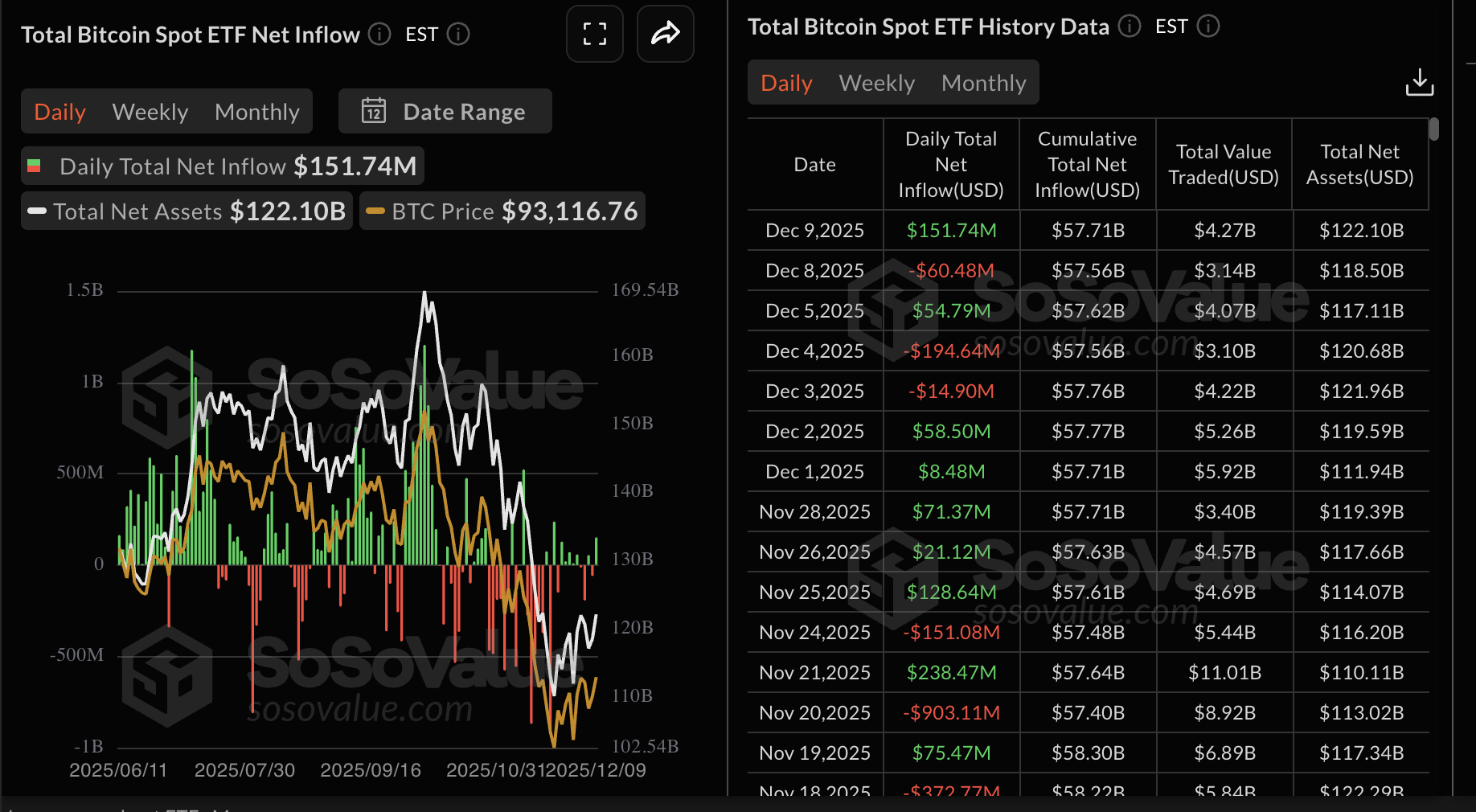

Bitcoin experienced a resurgence of inflows into US-listed spot ETFs, with nearly $152 million streaming in on Tuesday. BlackRock’s IBIT was the best-performing ETF with almost $199 million, followed by Grayscale’s BTC with $34 million and Grayscale’s GBTC with approximately $17 million.

Ethereum ETFs extended their inflow streak for the second consecutive day with nearly $178 million deposited on Tuesday. Fidelity’s FETH ETF led with approximately $51 million, followed by Grayscale’s ETH with $45 million.

Meanwhile, XRP spot ETFs recorded their 17th consecutive day of inflows, with almost $9 million flowing in on Tuesday. The cumulative inflow volume stands at $944 million, with net assets of $945 million. A break above $1 billion may affirm institutional interest in XRP ETFs.

Chart of the day: Bitcoin consolidates above short-term support

Bitcoin is trading above $92,000 at the time of writing on Wednesday, supported by an uptrending Moving Average Convergence Divergence (MACD) indicator on the daily chart.

The MACD histogram bars are rising above the mean line, indicating steady bullish momentum.

However, the Relative Strength Index (RSI) on the same chart hovers around the midline, signaling that momentum is cooling. A rejection at this level may accelerate bearish pressure, increasing the odds of a trend correction below $90,000.

Bitcoin also remains below the 50-day Exponential Moving Average (EMA) at $96,830, the 100-day EMA at $102,174 and the 200-day EMA at $103,714, which underpin the general bearish outlook.

A break above the 50-day EMA would likely reinforce the bullish outlook, with buyers targeting the second recovery phase above $100,000.

Altcoins update: Ethereum shows subtle recovery signs while XRP struggles

Ethereum is edging up above the 50-day EMA at $3,316 at the time of writing on Wednesday. The RSI on the daily chart has crossed above the 50 midline, increasing the probability of recovery toward the 100-day EMA at $3,513.

The MACD indicator on the same chart is almost crossing above the mean line, as green histogram bars expand, supporting the short-term bullish outlook.

Still, the 200-day EMA at $3,456 may cap rebounds. Moreover, a reversal below the 50-day EMA at $3,316 could push Ethereum toward the pivotal $3,000 support level.

As for XRP, the token is trading under pressure and below the 50-day EMA at $2.26, the 100-day EMA at $2.42 and the 200-day EMA at $2.47, which reinforces a short-term bearish outlook.

The RSI remains in the bearish region, at 44 and is pointing downwards, signaling a weakening of bullish momentum. Support at $2.00 is the short-term target, but if selling pressure increases, XRP may extend its down leg to the band support at $1.98-$1.82. Looking up, buyers should accelerate the price above the 50-day EMA at $2.26 to flip the trend upward toward the descending trendline.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.