Pi Network Price Forecast: Whale continues to buy as PI consolidates

- Pi Network has maintained a consolidation phase over the last couple of weeks.

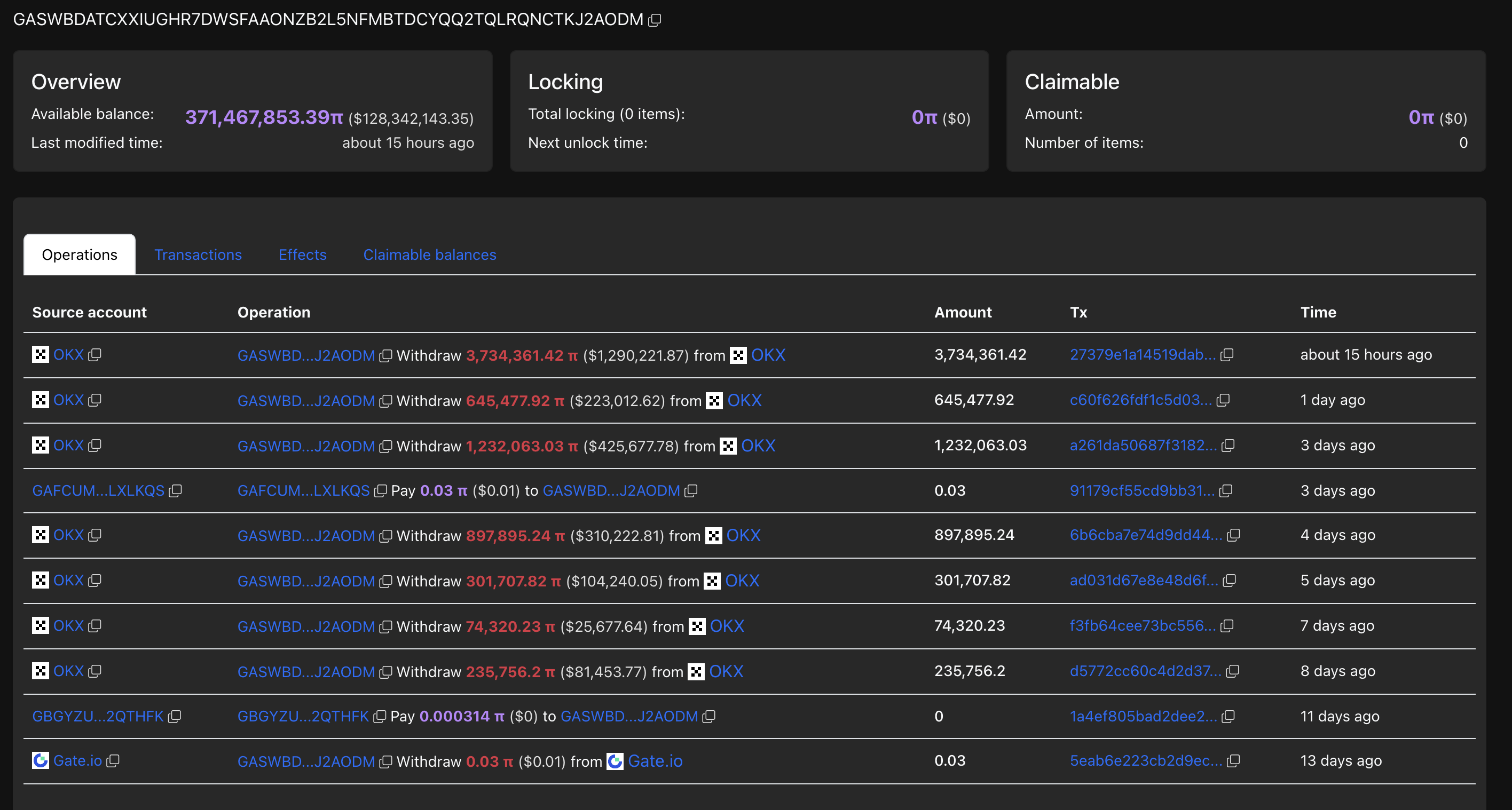

- The largest Pi token whale acquired 3.73 million coins on Monday, expanding the holding to 371 million PI.

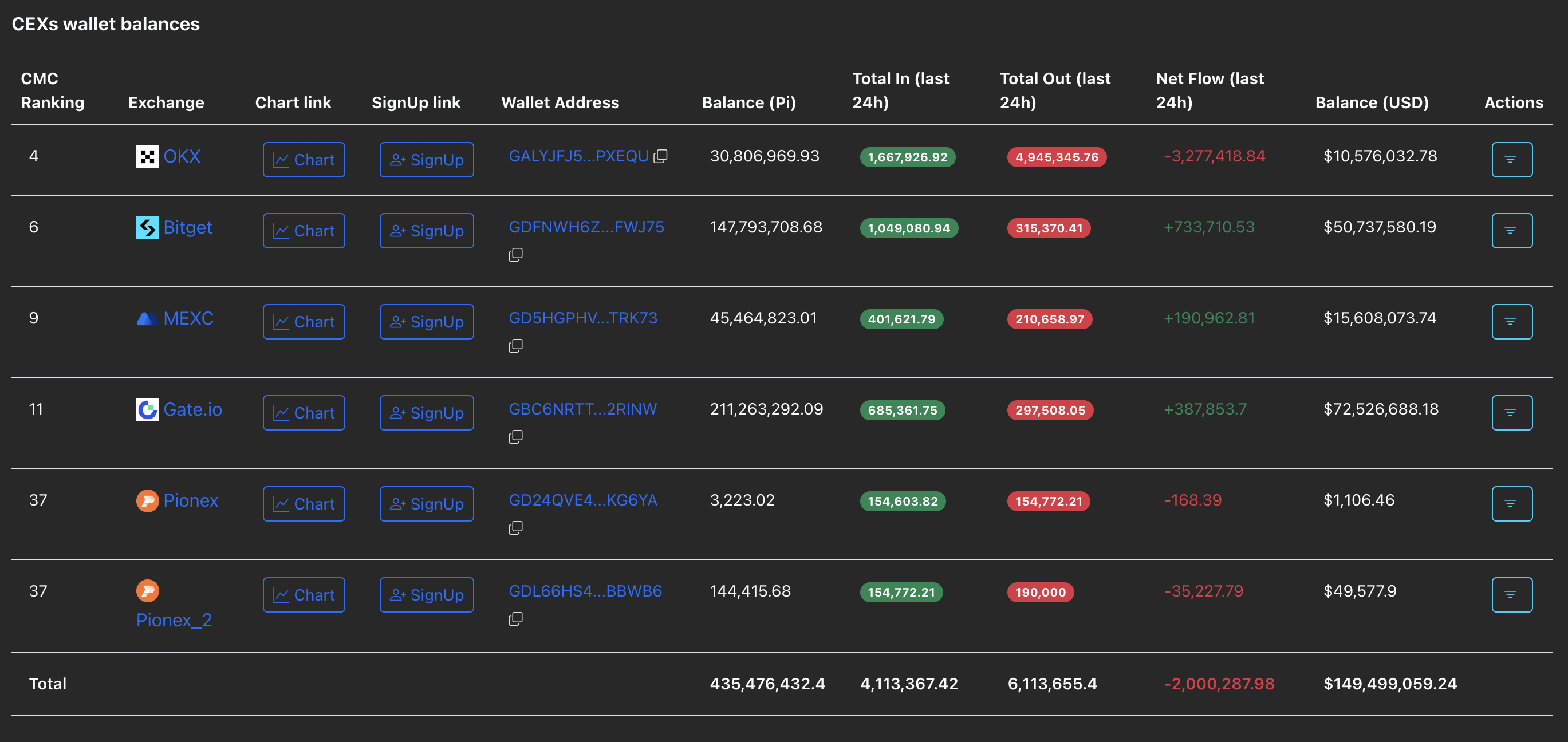

- The CEXs’ wallet reserves record a net outflow of 2 million PI tokens.

Pi Network (PI) trades above $0.34 at press time on Tuesday, extending the sideways trend. Capitalizing on low prices, the largest Pi token wallet address by holding acquired 3.73 million additional PI tokens on Monday.

Declining CEXs' reserve signals a demand surge

PiScan data shows that a large wallet investor, commonly referred to as a whale, withdrew 3.73 million PI tokens from OKX exchange on Monday, expanding the hodling to 371 million tokens.

Whale wallet address. Source: PiScan

Adding to the increased PI token demand, Centralized Exchanges (CEXs) wallet reserves have declined by 2 million tokens over the last 24 hours. Typically, an outflow from CEXs indicates an increase in retail demand.

CEXs wallet balances. Source: PiScan

Pi Network stands at a crucial crossroads

Pi Network edges higher by nearly 0.5% at press time on Tuesday, extending a sideways trend above $0.34. The mobile mining cryptocurrency flattens out within a larger falling channel pattern on the daily chart.

A potential bounce back in the PI token, underpinned by retail demand, could target the upper resistance trendline near $0.3700.

Momentum indicators flash mixed signals on the daily chart as PI stands at a crucial crossroads. The Relative Strength Index (RSI) at 44 moves flat below the halfway line, indicating muted buying pressure.

Additionally, the Moving Average Convergence Divergence (MACD) sustains an uptrend, hovering above its signal line, suggesting a bullish shift in trend momentum.

PI/USDT daily price chart.

Looking down, a potential drop below the August 1 trough of $0.3220 would mark a fresh record low, potentially targeting the $0.3000 round figure.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.