Should US Fed’s Slowing of Balance Sheet Runoff Concern Investors?

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

TradingKey - The US Federal Reserve has just concluded its regular Federal Open Market Committee (FOMC) meeting from 18-19 March. While there were no huge surprises on the interest rate front, and the stock market actually rose, there were some insights into specific concerns that investors had before the meeting.

For long-term investors, one of the concerns was surrounding so-called Quantitative Tightening or “QT”. Essentially the exact opposite of Quantitative Easing (QE), when the Fed printed money to push long-term rates down, QT is the Fed trying to shrink its balance sheet.

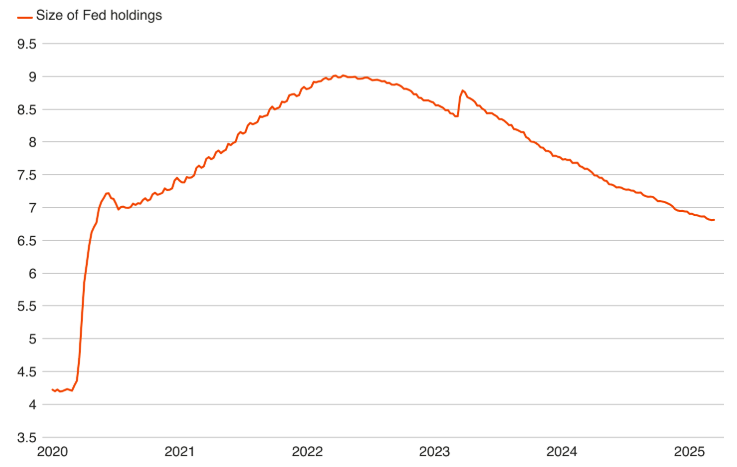

Given the central bank’s balance sheet ballooned to US$9 trillion in the wake of the Covid-19 stimulus, when the Fed bought trillions in assets to support financial markets, the Fed’s board governors have since tried to let these assets mature without replacing them.

Coming at the same time as the Fed rose interest rates at a fast and furious pace, this shocked the stock market in 2022. While it’s been out of the headlines in the past year or so, QT is actually still ongoing for the Fed.

So, for investors, here’s what the Fed said on Wednesday (19 March) in its post-FOMC press conference when it comes to the QT process and whether it should concern market participants.

Fed balance sheet continues to shrink

One of the big takeaways for investors from Wednesday’s post-FOMC statement was that the Fed will slow its pace of QT, starting in April.

While the central bank has been allowing up to US$25 billion in Treasuries to mature – and roll off its balance sheet – the Fed on Wednesday said that this pace would be reduced to just US$5 billion per month. However, they will leave the cap on mortgage-backed securities (MBS) that run off the balance sheet at US$35 billion.

With a net reduction in total QT of up to US$20 billion, it’s a sizable signal to the market that the Fed is willing to support it in other ways besides cutting interest rates in the short term. Why was this done?

Chairman Jerome Powell explained that Fed officials had observed some increased tightness in money markets and this was done to help increase liquidity in those markets, with that being a key consideration for the timing and path of QT.

He also did say that the decision to decrease the balance sheet runoff of Treasuries shouldn’t impact the size of the Fed’s balance sheet over the medium term.

Fed’s balance sheet holdings (US$ trillions)

Sources: US Federal Reserve, Reuters

Uncertainty from debt ceiling negotiations drives Fed decision

While there are data points that the Fed is concerned with longer term for the US economy, the reduction in QT was likely taken because US lawmakers are looking to strike a deal on the debt ceiling.

This is a statutory limit for outstanding Treasury debt and the US hit that limit in January. For Fed officials, this was made clear in minutes from their January meeting as it revealed the central bank’s policymakers had discussed pausing or slowing the process of QT until a deal over the government’s debt ceiling could be agreed on.

A similar tick up in the Fed’s balance sheet holdings occurred in 2023 – the last time there was a debt ceiling showdown in the US. Last week, the US government averted a shutdown as a spending bill to keep the government funded for the next six months passed.

Either way, the debt ceiling has been breached and the US lawmakers have around three to six months to come to an agreement on raising it in order to avoid defaulting on its debts.

Good for markets short term but one lone Fed dissenter

Overall, investors should be much more concerned with how the US debt ceiling negotiations pan out versus what the Fed decides on its balance sheet runoff. Regardless, out of all the Fed governors, only Christopher Waller objected to the Fed’s decision to reduce its pace of QT.

The Fed said in its statement that he “preferred to continue the current pace of decline in securities holdings”. It will be positive for markets short term, though. Why? Well any reduction in QT generally results in lower long-term Treasury bond yields and that could help boost demand for consumer/business loans as well as drive higher economic activity.

Yet the reasons for carrying out the QT reduction are not ideal for the long-term health of the US economy. That’s mainly because the Fed has no influence over fiscal policy. That’s left up to US politicians and lawmakers to decide. Raising the debt ceiling and ensuring the US is credible in debt markets will be of the utmost importance in the next few months.

Remember that the US Treasuries market is around US$29 trillion, making it one of the most liquid and available debt markets in the world. Investors worldwide will be monitoring these negotiations to ensure that a lifting of the debt ceiling can be agreed upon sooner rather than later.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.