Here is what you need to know on Friday, June 20:

The US Dollar (USD) struggles to find demand early Friday as market focus shifts back to geopolitics following this week's central bank meetings. In the second half of the day, May Retail Sales from Canada and preliminary June Consumer Confidence data from the Eurozone will be featured in the economic calendar.

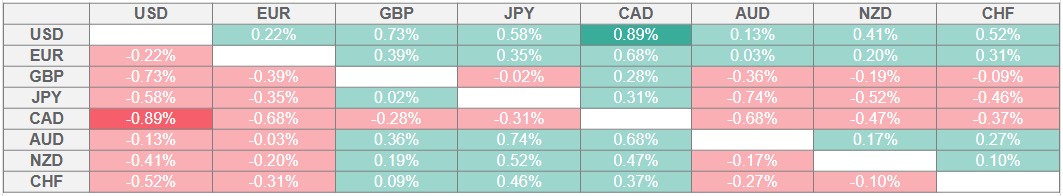

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Federal Reserve's (Fed) cautious stance on policy-easing and the risk-averse market atmosphere helped the USD outperform its rivals early Thursday. After reaching its highest level in a week above 99.00, however, the USD Index lost its traction and was last seen fluctuating at around 98.60.

Markets turned risk-averse on Thursday on reports hinting at a direct involvement of the United States (US) in the Iran-Israel conflict. Later in the day, US Senate Intelligence Committee Chair noted that US President Donald Trump said that he will give Iran the last chance to make a deal to end its nuclear program. Trump reportedly decided that he would delay his final decision on launching strikes for up to two weeks. Although Israel and Iran continue to exchange strikes, this development seems to be helping markets breathe a sigh of relief.

During the Asian trading hours, the People’s Bank of China (PBOC), China's central bank, announced that it left the one-year and five-year Loan Prime Rates (LPRs) unchanged at 3.00% and 3.50%, respectively.

The data from Japan showed early Friday that the National Consumer Price Index rose by 3.5% on a yearly basis in May, following the 3.6% increase recorded in April. Meanwhile, commenting on trade talks with the US, Japan's top trade negotiator Ryosei Akazawa said on Friday that Japan will not fixate on the looming date for so-called reciprocal tariffs to go back to higher levels. "We're looking for the possibility of a deal in ministerial-level negotiations but the outlook remains in a fog," Akazawa added. After closing in positive territory on Thursday, USD/JPY fluctuates in a tight channel slightly below 145.50 on Friday.

The UK's Office for National Statistics reported on Friday that Retail Sales declined by 2.7% on a monthly basis in May, compared to the market expectation of -0.5%. On Thursday, the Bank of England (BoE) announced that it left the policy rate unchanged at 4.25%, as expected. After posting small gains on Thursday, GBP/USD struggles to gather bullish momentum and trades below 1.3500 early Friday.

Following Thursday's indecisive action, Gold stays under bearish pressure in the European morning on Friday and trades at its lowest level in a week below $3,350.

EUR/USD holds steady above 1.1500 in the early European session on Friday after rebounding from the weekly low it set below 1.1450 on Thursday.

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.