US Dollar Index hits a fresh one-month low below 99.00 as risk appetite improves

DXY extends losses to a fresh one-month low at 98.70.

Trump's decision to pause 50% tariffs on EU imports has boosted risk appetite.

The highlights of the week will be the Fed meeting and the PCE Price Index release.

The US Dollar Index (DXY) has opened the week in the same weak tone seen during the last one. An improved market sentiment, after US President Donald Trump backtracked on his threat to impose 50% levies on EU imports, has boosted the Euro and risk-sensitive currencies, to the detriment of the US Dollar.

The DXY, which measures the value of the Greenback against the six most traded currencies, reached a fresh one-month low of 98.70 during Monday’s Asian Trading session. It is nearing the multi-year low of 97.95, hit in late April.

Donald Trump announced a pause on the 50% tariffs plan from June 1st after a phone call with EU Commission president Von der Leyen in which both leaders agreed to give some time to reach a good deal.

Tariffs' pause boosts risk appetite

The market has welcomed the news, amid easing concerns of a severe blow to global economic growth. The combined trade between the US and the EU accounts for 30% of the global GDP, and reciprocal tariffs between the two, combined with the 30% tariffs on China, would pose a significant weigh on global growth.

Beyond that, President Trump affirmed that his sweeping Tax Bill will go through significant changes in the Senate, which has contributed to soothing investors, wary about the bill’s impact on the US fiscal stability, and has provided an additional boost to risk appetite.

With the USD losing ground against riskier assets, but also against safe havens like the Yen and the Swiss Franc, the DXY depreciated 0.3% on the day and nearly 3% from early May highs. Trading volumes are likely to remain light with US markets closed on a bank holiday.

Later this week, the minutes of the latest Fed meeting and the Personal Consumption Expenditures (PCE) Price Index data will provide further fundamental background for US Dollar traders.

US Dollar PRICE Today

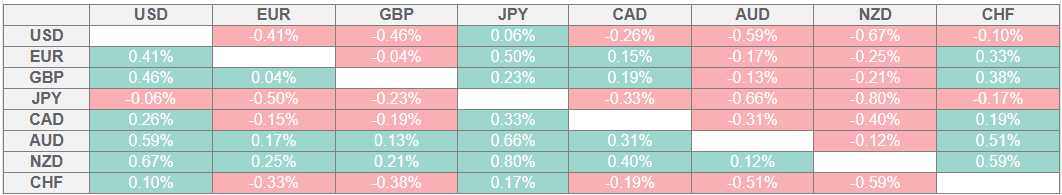

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.