BOE's Rate Cut: Hawkish or Dovish? What’s Next for GBP/USD and GBP/EUR?

- 270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

- Gold Price Forecast: XAU/USD gains momentum to near $5,050 amid geopolitical risks, Fed uncertainty

- Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

TradingKey - At its February monetary policy meeting, the Bank of England (BoE) cut interest rates by 25 bps as expected but warned of a strong inflation rebound in 2025 while lowering its economic growth forecasts. Analysts are divided on whether this rate cut signals a hawkish or dovish stance.

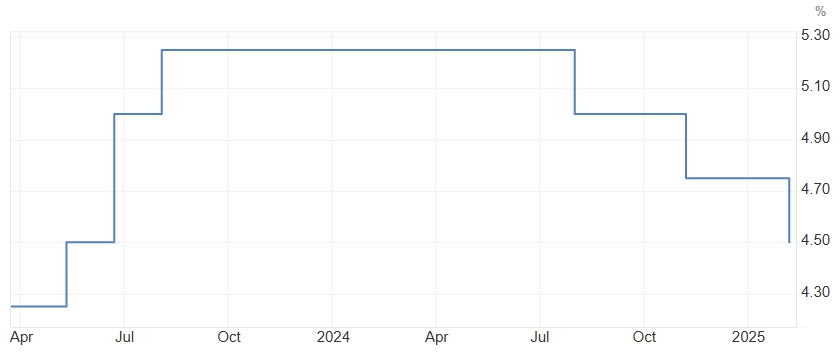

On Thursday, February 6, the BoE announced a 25 bps reduction in its benchmark interest rate to 4.5%, the lowest since June 2023, in line with expectations. This marks the third rate cut in the current easing cycle, following a reduction in November last year.

[BoE Policy Rate Chart, Source: Trading Economics]

Looking ahead, the BoE significantly raised its inflation forecast while slashing its growth outlook. It now expects inflation to rebound to around 3.7% in Q3 2024—far above the previous estimate of 2.8%—and does not anticipate inflation returning to the 2% target until 2027.

Meanwhile, the 2024 GDP growth forecast has been halved to 0.75%.

Hawkish or Dovish Cut?

The voting outcome suggests a dovish tilt: seven members voted for a 25 bps cut, while two supported a 50 bps reduction. The larger cut was driven by concerns over slowing economic growth.

Philip Shaw, Chief Economist at Investec, described the meeting statement as dovish overall, projecting three additional 25 bps cuts this year, bringing the rate down to 3.75%.

KPMG economists noted that rising energy prices pushed the BoE to raise its inflation forecast, while weak economic activity led to a downgrade in growth projections. The tone of the statement indicated a dovish bias among all members, though domestic uncertainties remain due to upcoming tax hikes and wage increases.

BoE Governor Andrew Bailey stated that the rate cut is good news for many and emphasized a "gradual and cautious" approach to further easing. Notably, the addition of "cautious" marks a shift from December's language.

Following the decision, markets increased bets on three more rate cuts this year.

TradingKey analyst Jason Tang expects the BoE to cut rates by 100–125 bps by the end of 2025, citing weak economic conditions and gradually declining inflation. However, JPMorgan cautioned that while markets are confident in further cuts, risks remain. The bank warned that failing to curb inflation now could lead to higher costs in the future.

What’s Next for the Pound?

The GBP/USD exchange rate initially fell by about 1% post-announcement before recovering to 1.2434. Similarly, GBP/EUR dipped before rebounding to 1.1976.

Tang predicts that the BoE's aggressive rate cuts, combined with delayed rate cuts by the Federal Reserve, will widen the US-UK interest rate differential, further weakening GBP/USD.

Additionally, the UK's economic resilience lags behind that of the US, and the absence of a significant fiscal stimulus plan—akin to the Trump-era tax cuts—adds downward pressure on the pound.

However, the UK faces fewer political risks, economic stagnation, and US tariff threats compared to the Eurozone, which could provide support for GBP/EUR.

Overall, the pound is expected to maintain a balance: weakening against the dollar while strengthening against the euro.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.