Here is what you need to know on Tuesday, July 8:

The Australian Dollar gathers strength early Tuesday as markets react to the Reserve Bank of Australia's (RBA) unexpected decision to keep the policy rate unchanged at 3.85%. NFIB Business Optimism Index for June will be the only data featured in the US economic calendar, while investors will remain focused on headlines surrounding US tariffs.

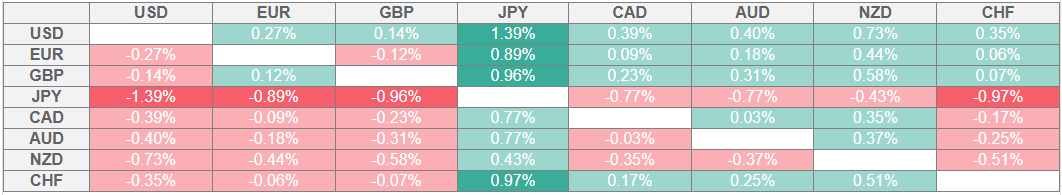

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The RBA announced early Tuesday that it left the Official Cash Rate (OCR) unchanged at 3.85% after concluding its July monetary policy meeting, going against the market expectation for a 25 basis points rate cut. In its policy statement, the RBA noted that it could wait for a little more information to confirm that inflation remains on track to reach 2.5% on a sustainable basis. In the post-meeting press conference, RBA Governor Michele Bullock said that it is appropriate to have a cautious and a gradual stance on policy easing but added that they can expect rates to continue to decline if inflation slows in line with their projections. After losing nearly 1% on Monday, AUD/USD reversed its direction on the hawkish RBA surprise. At the time of press, the pair was up nearly 0.7% on the day at 0.6535.

The White House announced late Monday that US President Donald Trump signed an executive order to push the deadline for the implementation of tariffs to August 1. However, US President Donald Trump said that they will be imposing 25% tariffs on Japan and South Korea. "If, for any reason, you decide to raise your tariffs, then, whatever the number you choose to raise them by, will be added on to the 25% that we charge," Trump reportedly said in letters sent to Japan and South Korea. Wall Street's main indexes closed deep in negative territory on Monday and the US Dollar Index climbed to its highest level in nearly two weeks, rising more than 0.5% on a daily basis. Early Tuesday, the USD Index corrects lower and fluctuates below 97.50, while US stock index futures trade marginally higher.

EUR/USD stages a rebound and trades near 1.1750 after losing about 0.6% on Monday.

Japanese Prime Minister Shigeru Ishiba said early Tuesday that Japan hasn’t been able to reach an agreement with the US because the country kept defending what needs to be defended. He added that they will continue the dialogue and seek a chance of agreeing on a deal that benefits both countries. After gaining more than 1% on Monday, USD/JPY fluctuates in a narrow channel above 146.00 early Tuesday.

GBP/USD gains traction and rebounds toward 1.3650 in the European morning following Monday's decline.

Gold started the week on a bearish note and declined below $3,300 before erasing its losses late Monday. XAU/USD stays in a consolidation phase at around $3,330 early Tuesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.