Australian Dollar rises as upbeat jobs data support momentum, Fed dovish tone

The Australian Dollar rises as US Dollar steadies due to dovish sentiment surrounding the Fed outlook.

The AUD finds support as upbeat Australian jobs data reduces the urgency for an RBA rate cut in September.

The US Dollar may extend losses as recent economic data strengthen the case for a Federal Reserve rate cut next month.

The Australian Dollar (AUD) extends its gains for the second consecutive session on Monday. The AUD/USD pair holds gains as the US Dollar (USD) could face challenges amid the prevailing dovish tone surrounding the US Federal Reserve’s (Fed) policy outlook for September.

The AUD also received support as an upbeat Australian jobs data for July eased concerns about a weakening labor market, lessening the urgency for the Reserve Bank of Australia (RBA) to continue with another rate cut in September.

RBA Governor Michele Bullock stated last week that current forecasts suggest the cash rate may need to be reduced to ensure price stability. However, Bullock emphasized the Board’s meeting-by-meeting approach and refrained from making any commitments on rate moves should financial markets experience a bout of volatility.

Australian Dollar advances as US Dollar steadies amid dovish Fed outlook

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground after registering losses in the previous session and trading around 97.90 at the time of writing. The Greenback may further lose ground as recent US economic data support the case for a Federal Reserve (Fed) rate cut in September.

The Trump administration has broadened its 50% tariffs on steel and aluminum imports, taking effect on August 18. Friday’s notification has included 407 new product codes in the US Harmonized Tariff Schedule. US President Donald Trump also told reporters he intends to issue further announcements on steel tariffs, along with new levies aimed at semiconductor imports.

President Trump said on Saturday that Ukraine should seek a deal to end the war with Russia, arguing that “Russia is a very big power, and they’re not.” His remarks followed reports from a recent summit in Alaska that Russian President Vladimir Putin had demanded additional Ukrainian territory, per Reuters.

The preliminary Michigan Consumer Sentiment Index fell to 58.6 in August from 61.7 in July, falling short of the expected 62.0 reading. Meanwhile, the US Retail Sales grew by 0.5% month-over-month in July, as expected, against a rise of 0.9% seen in June. Retail Sales Control Group rose by 0.5%, compared to the 0.8% increase prior.

US Treasury Secretary Scott Bessent said in an interview on Wednesday that short-term Fed interest rates should be 1.5-1.75% lower than the current benchmark rate at an effective 4.33%. Bessent added that there is a good chance the central bank could opt for a 50-basis-point rate cut in September.

US President Donald Trump shared his "paper calculation" that Fed interest rates should be at or near 1%. Trump also noted interest rates should be three or four points lower. Interest rates are just a paper calculation, he added.

US Treasury Secretary Scott Bessent said on Wednesday that US and Chinese trade officials will meet again within the next two to three months to discuss the future of their economic ties. “The US would need to see sustained progress on curbing fentanyl flows from China, potentially over months or even a year, before considering tariff reductions,” Bessent said.

China’s Retail Sales rose 3.7% year-over-year in July, falling short of 4.6% expected and 4.8% in June. Meanwhile, Industrial Production increased 5.7% YoY, compared to the 5.9% forecast and 6.8% seen previously.

Australia’s Employment Change arrived at 24.5K in July from 1K in June (revised from 2K), against the consensus forecast of 25K. Meanwhile, the Unemployment Rate fell to 4.2%, as expected, from 4.3% in June.

The Reserve Bank of Australia (RBA) delivered a 25 basis points (bps) interest rate cut on Tuesday, as widely expected, bringing the Official Cash Rate (OCR) to 3.6% from 3.85% at the August policy meeting.

Australian Dollar rebounds toward ascending channel after breaking above nine-day EMA

The AUD/USD pair is trading around 0.6510 on Monday, with technical analysis on the daily chart suggesting a potential for a bullish recovery. The pair has rebounded and is attempting to return to the ascending channel pattern. The pair has moved above the nine-day Exponential Moving Average (EMA), signaling that short-term momentum is strengthening. Moreover, the 14-day Relative Strength Index (RSI) is positioned on the 50 level, suggesting that market bias is neutral. Further movements will offer a clear directional trend.

The successful return to the ascending channel would reinforce the bullish bias and support the AUD/USD pair to target the monthly high at 0.6568, reached on August 14. A break above this level may prompt the pair to approach the channel’s upper boundary around 0.6610, followed by the nine-month high of 0.6625, which was recorded on July 24.

On the downside, the nine-day EMA at 0.6512 is acting as the immediate support, followed by the 50-day EMA at 0.6503 and a psychological level of 0.6500. A break below this crucial support zone would weaken the short- and medium-term price momentum and put downward pressure on the AUD/USD pair to navigate the region around the two-month low of 0.6419, recorded on August 1.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

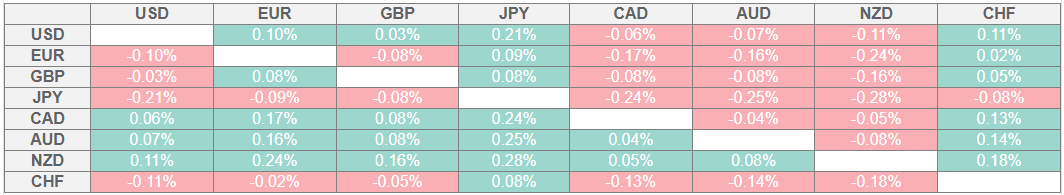

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.